Form ND 2 Optional Method Nd

What is the Form ND 2 Optional Method Nd

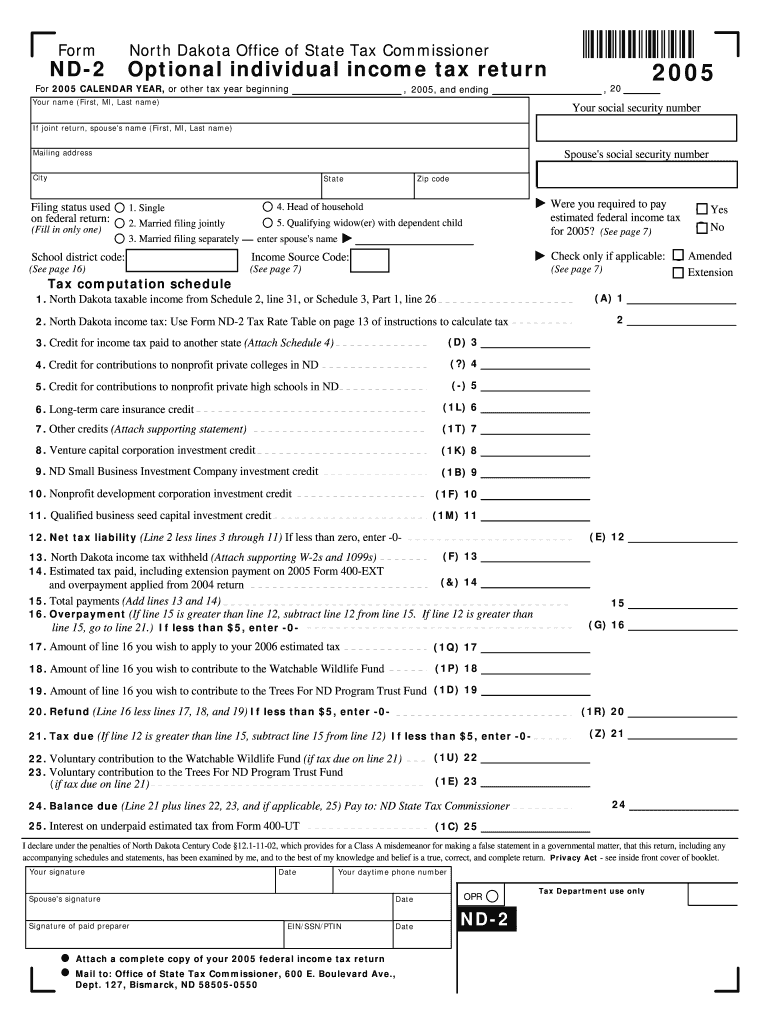

The Form ND 2 Optional Method Nd is a tax form utilized by individuals and businesses in the United States to report specific financial information. This form is particularly relevant for taxpayers who wish to elect the optional method of reporting income or expenses. It allows for a simplified approach to calculating tax obligations, making it easier for eligible filers to comply with IRS regulations.

How to use the Form ND 2 Optional Method Nd

Using the Form ND 2 Optional Method Nd involves several straightforward steps. First, ensure that you meet the eligibility criteria for using this form. Next, gather all necessary financial documents and information required to complete the form accurately. Once you have the required data, fill out the form, ensuring that all sections are completed thoroughly. Finally, submit the form according to the specified submission methods, which may include online filing, mailing, or in-person delivery.

Steps to complete the Form ND 2 Optional Method Nd

Completing the Form ND 2 Optional Method Nd requires careful attention to detail. Here are the steps to follow:

- Review the eligibility criteria to confirm that you can use this form.

- Collect all relevant financial records, including income statements and expense receipts.

- Fill out the form, ensuring that each section is addressed accurately.

- Double-check your entries for any errors or omissions.

- Submit the completed form through your chosen method, ensuring it is sent before the deadline.

Legal use of the Form ND 2 Optional Method Nd

The legal use of the Form ND 2 Optional Method Nd is governed by IRS regulations. Taxpayers must ensure they are compliant with all applicable laws when using this form. It is essential to understand the implications of choosing the optional method, as it may affect your overall tax liability. Consulting a tax professional can provide clarity on how to use the form legally and effectively.

Filing Deadlines / Important Dates

Filing deadlines for the Form ND 2 Optional Method Nd are critical to avoid penalties. Generally, this form must be submitted by the tax filing deadline, which is typically April fifteenth for most taxpayers. However, specific circumstances, such as extensions or special situations, may alter these dates. It is advisable to stay informed about any changes to the filing calendar each tax year.

Required Documents

To complete the Form ND 2 Optional Method Nd, several documents are required. These typically include:

- Income statements, such as W-2s or 1099s.

- Records of deductible expenses.

- Previous tax returns, if applicable.

- Any additional documentation that supports your claims on the form.

Form Submission Methods

The Form ND 2 Optional Method Nd can be submitted through various methods. Taxpayers may choose to file online using authorized e-filing services, mail a physical copy of the form to the appropriate IRS address, or deliver it in person at designated IRS offices. Each method has its own advantages, and selecting the right one can depend on your specific needs and circumstances.

Quick guide on how to complete form nd 2 optional method nd

Effortlessly complete [SKS] on any device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the correct document and securely store it online. airSlate SignNow provides you with all the resources necessary to create, edit, and eSign your documents quickly without any delays. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related operation today.

The simplest way to edit and eSign [SKS] without hassle

- Locate [SKS] and then select Get Form to initiate the process.

- Make use of the tools we supply to fill out your form.

- Mark important sections of the documents or conceal sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, SMS, invite link, or download it directly to your computer.

Eliminate worries about lost or misplaced documents, cumbersome form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign [SKS] while ensuring outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form ND 2 Optional Method Nd

Create this form in 5 minutes!

How to create an eSignature for the form nd 2 optional method nd

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form ND 2 Optional Method Nd?

The Form ND 2 Optional Method Nd is a specific form that allows businesses to choose an alternative method for submitting their documents. This method is designed to streamline the process of electronic signatures, making it easier and more efficient for users. By utilizing airSlate SignNow, you can effortlessly manage your Form ND 2 submissions.

-

How does airSlate SignNow support the Form ND 2 Optional Method Nd?

airSlate SignNow offers robust features that facilitate the completion and signing of the Form ND 2 Optional Method Nd. Our platform provides templates, easy integration options, and a user-friendly interface, ensuring that your document management process is smooth and efficient. This allows businesses to stay compliant while saving time and resources.

-

Is airSlate SignNow cost-effective for using the Form ND 2 Optional Method Nd?

Yes, airSlate SignNow is a cost-effective solution for managing the Form ND 2 Optional Method Nd. We offer competitive pricing plans that cater to businesses of all sizes, ensuring that you get the best value for your electronic signature needs. Our transparent pricing model means you won't encounter hidden fees.

-

What are the benefits of using airSlate SignNow for Form ND 2 Optional Method Nd?

Using airSlate SignNow for the Form ND 2 Optional Method Nd offers several advantages, such as increased efficiency and reduced turnaround times for document signing. Our platform enables secure storage and easy access to important documents, ensuring you always have what you need at your fingertips. Additionally, you can track the status of your documents in real-time.

-

Can I integrate airSlate SignNow with other applications for Form ND 2 Optional Method Nd?

Absolutely! airSlate SignNow seamlessly integrates with a variety of applications, making the handling of the Form ND 2 Optional Method Nd easier. This enables you to connect your existing workflows and enhance productivity by automating processes, ensuring a smooth operation across your business systems.

-

How secure is the signing process for Form ND 2 Optional Method Nd on airSlate SignNow?

The signing process for the Form ND 2 Optional Method Nd on airSlate SignNow is highly secure. We implement advanced encryption protocols to protect your data and ensure that all signatures are legally binding. Our platform complies with industry standards for electronic signatures, giving you peace of mind.

-

What types of documents can be signed using the Form ND 2 Optional Method Nd on airSlate SignNow?

With airSlate SignNow, you can sign a variety of documents using the Form ND 2 Optional Method Nd, including contracts, agreements, and regulatory forms. This flexibility allows businesses to use the platform for diverse signing needs, ensuring that all documentation remains compliant and processed efficiently.

Get more for Form ND 2 Optional Method Nd

Find out other Form ND 2 Optional Method Nd

- Sign West Virginia Standard residential lease agreement Safe

- Sign Wyoming Standard residential lease agreement Online

- Sign Vermont Apartment lease contract Online

- Sign Rhode Island Tenant lease agreement Myself

- Sign Wyoming Tenant lease agreement Now

- Sign Florida Contract Safe

- Sign Nebraska Contract Safe

- How To Sign North Carolina Contract

- How Can I Sign Alabama Personal loan contract template

- Can I Sign Arizona Personal loan contract template

- How To Sign Arkansas Personal loan contract template

- Sign Colorado Personal loan contract template Mobile

- How Do I Sign Florida Personal loan contract template

- Sign Hawaii Personal loan contract template Safe

- Sign Montana Personal loan contract template Free

- Sign New Mexico Personal loan contract template Myself

- Sign Vermont Real estate contracts Safe

- Can I Sign West Virginia Personal loan contract template

- How Do I Sign Hawaii Real estate sales contract template

- Sign Kentucky New hire forms Myself