Individual Extension Payment 400 EXT Form

What is the Individual Extension Payment 400 EXT

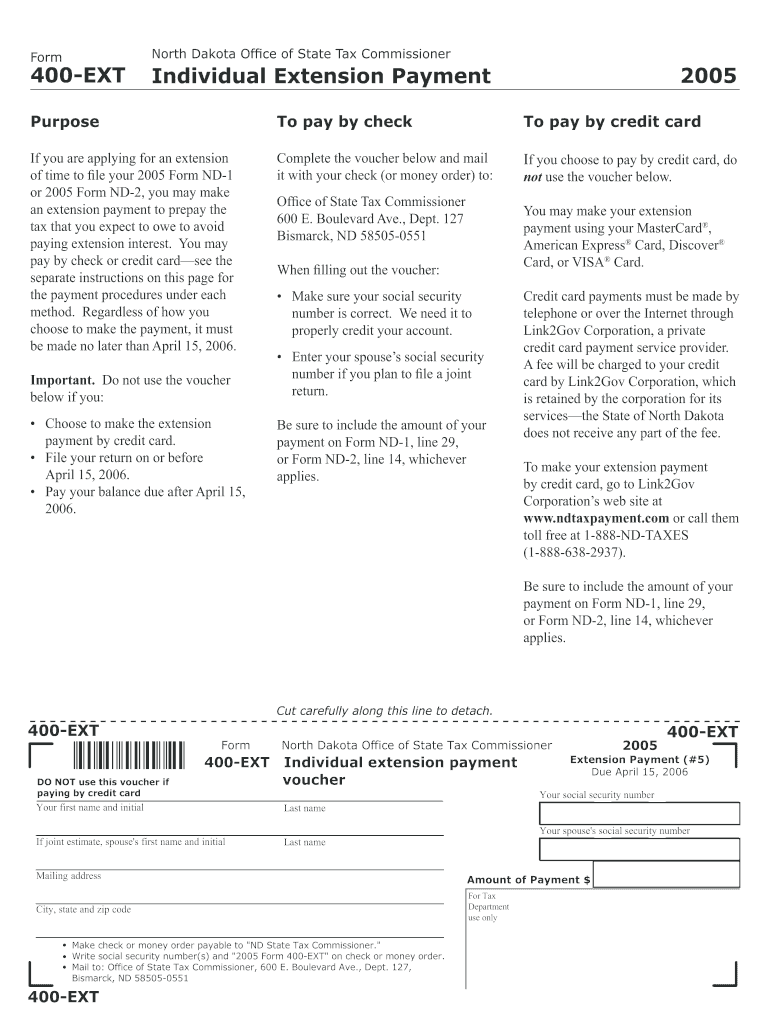

The Individual Extension Payment 400 EXT is a specific form used by taxpayers in the United States to request an extension for filing their individual income tax returns. This form allows individuals to extend their filing deadline, providing additional time to prepare and submit their tax documents without incurring penalties for late filing. It is important to note that while this extension allows for more time to file, it does not extend the time to pay any taxes owed.

How to use the Individual Extension Payment 400 EXT

To effectively use the Individual Extension Payment 400 EXT, taxpayers must complete the form accurately, providing necessary personal information such as name, address, and Social Security number. After filling out the form, individuals should submit it to the appropriate IRS address or electronically, depending on their preference. It is crucial to ensure that the payment for any estimated taxes owed is included with the submission to avoid penalties.

Steps to complete the Individual Extension Payment 400 EXT

Completing the Individual Extension Payment 400 EXT involves several key steps:

- Gather necessary documentation, including your previous year's tax return and any income statements.

- Fill out the form with accurate personal information and any required financial details.

- Calculate the estimated tax payment you owe, if applicable.

- Submit the completed form either electronically or by mail, along with any payment due.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the Individual Extension Payment 400 EXT. Generally, the form must be submitted by the original due date of the tax return, which is typically April fifteenth. If the deadline falls on a weekend or holiday, it may be extended to the next business day. It is essential to mark these dates on your calendar to ensure timely submission.

Eligibility Criteria

Eligibility for the Individual Extension Payment 400 EXT is generally open to all individual taxpayers who need more time to file their income tax returns. This includes self-employed individuals, retirees, and students. However, it is important to note that the extension does not apply to those who have already filed their tax returns or who do not owe any taxes. Understanding these criteria can help ensure that you qualify for the extension.

Required Documents

When preparing to submit the Individual Extension Payment 400 EXT, certain documents are typically required. These may include:

- Your previous year’s tax return for reference.

- W-2 forms or 1099 forms to report income.

- Any documentation supporting deductions or credits you plan to claim.

Having these documents on hand can facilitate a smoother completion of the form and ensure accuracy in your tax filing.

IRS Guidelines

The IRS provides specific guidelines for using the Individual Extension Payment 400 EXT. Taxpayers are encouraged to review these guidelines to understand the rules surrounding extensions, including how to calculate estimated payments and the implications of failing to file on time. Adhering to IRS guidelines can help prevent potential issues and ensure compliance with tax regulations.

Quick guide on how to complete individual extension payment 400 ext

Complete [SKS] seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It delivers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

How to alter and eSign [SKS] effortlessly

- Find [SKS] and click Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Highlight important sections of the documents or obscure sensitive information using the tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a traditional ink signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate creating new document copies. airSlate SignNow meets your document management needs with just a few clicks from your chosen device. Alter and eSign [SKS] and guarantee effective communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Individual Extension Payment 400 EXT

Create this form in 5 minutes!

How to create an eSignature for the individual extension payment 400 ext

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Individual Extension Payment 400 EXT?

The Individual Extension Payment 400 EXT allows users to extend their contract or service period conveniently. This option is ideal for businesses looking for flexibility in their document signing needs without a long-term commitment.

-

How much does the Individual Extension Payment 400 EXT cost?

The cost of the Individual Extension Payment 400 EXT is competitive and designed to provide value for ongoing services. Please visit our pricing page for detailed information and any current promotions to help you save further.

-

What features are included with the Individual Extension Payment 400 EXT?

With the Individual Extension Payment 400 EXT, users gain access to advanced features such as document templates, automated workflows, and real-time collaboration. This empowers businesses to streamline their document signing processes efficiently.

-

How can the Individual Extension Payment 400 EXT benefit my business?

The Individual Extension Payment 400 EXT can signNowly enhance your business operations by providing a seamless way to manage eSigning. It ensures that all documents are signed quickly, which accelerates deal closures and improves customer satisfaction.

-

Can I integrate the Individual Extension Payment 400 EXT with other software?

Yes, the Individual Extension Payment 400 EXT seamlessly integrates with various third-party applications such as CRMs and cloud storage services. This ensures that your workflow remains uninterrupted and efficient across platforms.

-

Is there a limit to how many documents I can send with the Individual Extension Payment 400 EXT?

The Individual Extension Payment 400 EXT does not impose strict limits on the number of documents you can send. However, please review our usage policies to ensure compliance with fair usage standards, allowing for optimal service delivery.

-

How do I upgrade to the Individual Extension Payment 400 EXT?

Upgrading to the Individual Extension Payment 400 EXT is easy. Simply log into your account and select the upgrade option from the billing settings. Follow the prompts to complete the upgrade process and enjoy the extended benefits.

Get more for Individual Extension Payment 400 EXT

Find out other Individual Extension Payment 400 EXT

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now