400 ES and Instructions Fill in Form

What is the 400 ES And Instructions Fill in

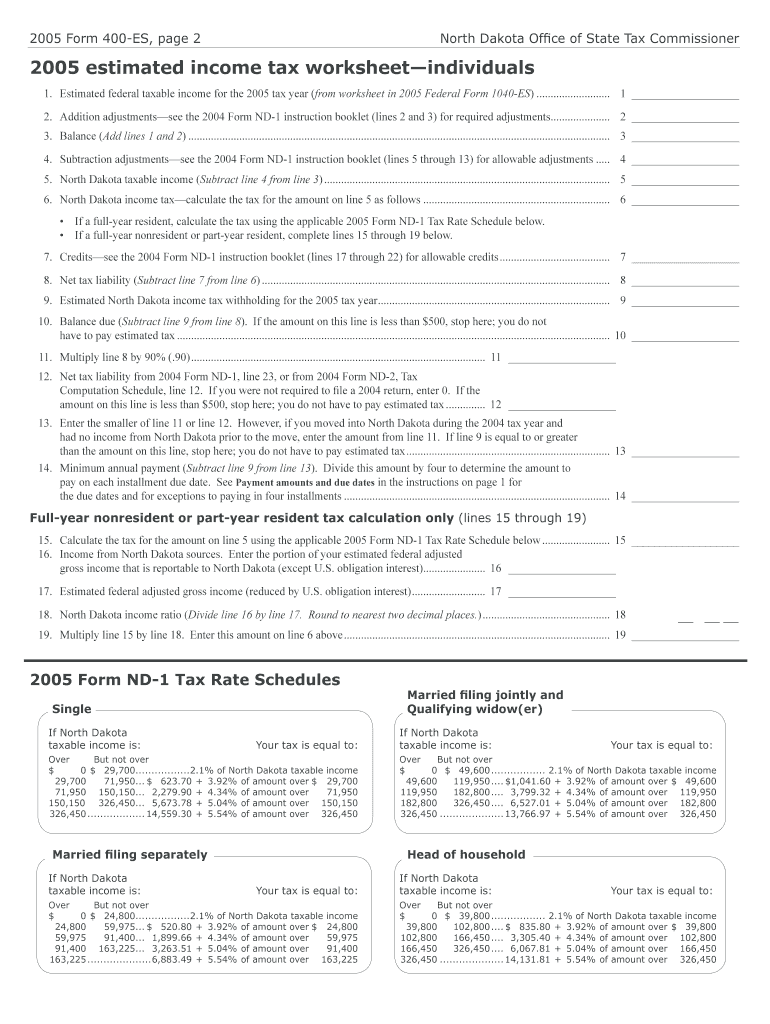

The 400 ES form, also known as the Estimated Tax for Individuals, is a crucial document for taxpayers in the United States who need to pay estimated taxes. This form is primarily used by individuals who expect to owe tax of one thousand dollars or more when they file their return. It allows taxpayers to calculate and submit their estimated tax payments for the year, ensuring they meet their tax obligations and avoid penalties. The accompanying instructions provide detailed guidance on how to complete the form accurately.

How to use the 400 ES And Instructions Fill in

Using the 400 ES form involves several key steps. First, taxpayers should gather their financial information, including income sources and deductions. Next, they need to estimate their total income for the year, taking into account any adjustments. The form includes a worksheet to help calculate the estimated tax due based on expected income, deductions, and credits. Once the calculations are complete, individuals can fill out the form and submit it along with their payment. It is essential to follow the instructions carefully to ensure accuracy and compliance with IRS requirements.

Steps to complete the 400 ES And Instructions Fill in

Completing the 400 ES form involves a systematic approach:

- Gather necessary documents, such as previous tax returns and income statements.

- Estimate your total income for the current year, considering all sources.

- Calculate your expected deductions and credits.

- Use the worksheet provided in the instructions to determine your estimated tax liability.

- Fill out the 400 ES form with your calculated figures.

- Submit the form along with your estimated tax payment by the due date.

Filing Deadlines / Important Dates

Filing deadlines for the 400 ES form are critical for avoiding penalties. Generally, estimated tax payments are due quarterly. The deadlines typically fall on:

- April 15 for the first quarter

- June 15 for the second quarter

- September 15 for the third quarter

- January 15 of the following year for the fourth quarter

Taxpayers should mark these dates on their calendars to ensure timely submissions.

Legal use of the 400 ES And Instructions Fill in

The 400 ES form is legally required for individuals who expect to owe tax and do not have enough withholding from their income. Using this form helps taxpayers comply with federal tax laws and avoid underpayment penalties. It is important to ensure that all information provided on the form is accurate and complete, as discrepancies can lead to audits or additional penalties from the IRS.

Who Issues the Form

The 400 ES form is issued by the Internal Revenue Service (IRS), the federal agency responsible for tax collection and enforcement in the United States. Taxpayers can obtain the form directly from the IRS website or through authorized tax preparation services. It is essential to use the most current version of the form to ensure compliance with the latest tax laws and regulations.

Quick guide on how to complete 400 es and instructions fill in

Easily Prepare [SKS] on Any Device

Digital document management has gained traction among companies and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow supplies all the tools you require to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any platform using airSlate SignNow apps for Android or iOS and simplify any document-related procedure today.

Edit and eSign [SKS] Effortlessly

- Find [SKS] and click Get Form to begin.

- Use the tools we offer to complete your form.

- Select important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes only seconds and has the same legal standing as a handwritten signature.

- Review all details and click the Done button to save your changes.

- Decide how you’d like to send your form—via email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form hunting, or mistakes that require printing new copies. airSlate SignNow satisfies all your document management needs with just a few clicks from any device you prefer. Edit and eSign [SKS] to ensure effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to 400 ES And Instructions Fill in

Create this form in 5 minutes!

How to create an eSignature for the 400 es and instructions fill in

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 400 ES And Instructions Fill in process offered by airSlate SignNow?

The 400 ES And Instructions Fill in process in airSlate SignNow allows users to efficiently complete and sign essential tax documents. With our streamlined interface, filling in the 400 ES form is quick and user-friendly, ensuring compliance and accuracy for all users.

-

How much does it cost to use the 400 ES And Instructions Fill in feature on airSlate SignNow?

airSlate SignNow offers competitive pricing for its 400 ES And Instructions Fill in feature, providing various subscription plans to fit different business needs. You can choose from monthly or annual billing options, making it a cost-effective solution for your document signing requirements.

-

What are the key benefits of using 400 ES And Instructions Fill in with airSlate SignNow?

Using the 400 ES And Instructions Fill in feature, businesses can save time and reduce errors associated with manual documentation. The service also offers secure eSignature functionality, enhanced tracking, and the ability to store and retrieve documents easily.

-

Can I integrate airSlate SignNow's 400 ES And Instructions Fill in with other software?

Yes, airSlate SignNow allows seamless integrations with various tools that businesses already use. You can integrate with customer relationship management (CRM) systems, cloud storage services, and other applications to enhance your workflow when filling in the 400 ES.

-

Is it easy to eSign documents related to the 400 ES And Instructions Fill in?

Absolutely! airSlate SignNow provides a straightforward eSignature process for the 400 ES And Instructions Fill in documents. Users can sign electronically with just a few clicks, which simplifies document management and speeds up the approval process.

-

What support options are available for users of the 400 ES And Instructions Fill in feature?

airSlate SignNow offers various support options for users of the 400 ES And Instructions Fill in feature, including a comprehensive knowledge base, live chat, and email support. Our team is dedicated to ensuring that you can effectively utilize our service for all your document needs.

-

Can multiple users collaborate on the 400 ES And Instructions Fill in documents?

Yes, airSlate SignNow allows multiple users to collaborate on the 400 ES And Instructions Fill in documents effortlessly. This feature fosters teamwork, enabling users to fill in and sign documents collectively in real-time, enhancing productivity.

Get more for 400 ES And Instructions Fill in

Find out other 400 ES And Instructions Fill in

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF