Tiaa Forms F11379

Understanding the Tiaa Forms F11379

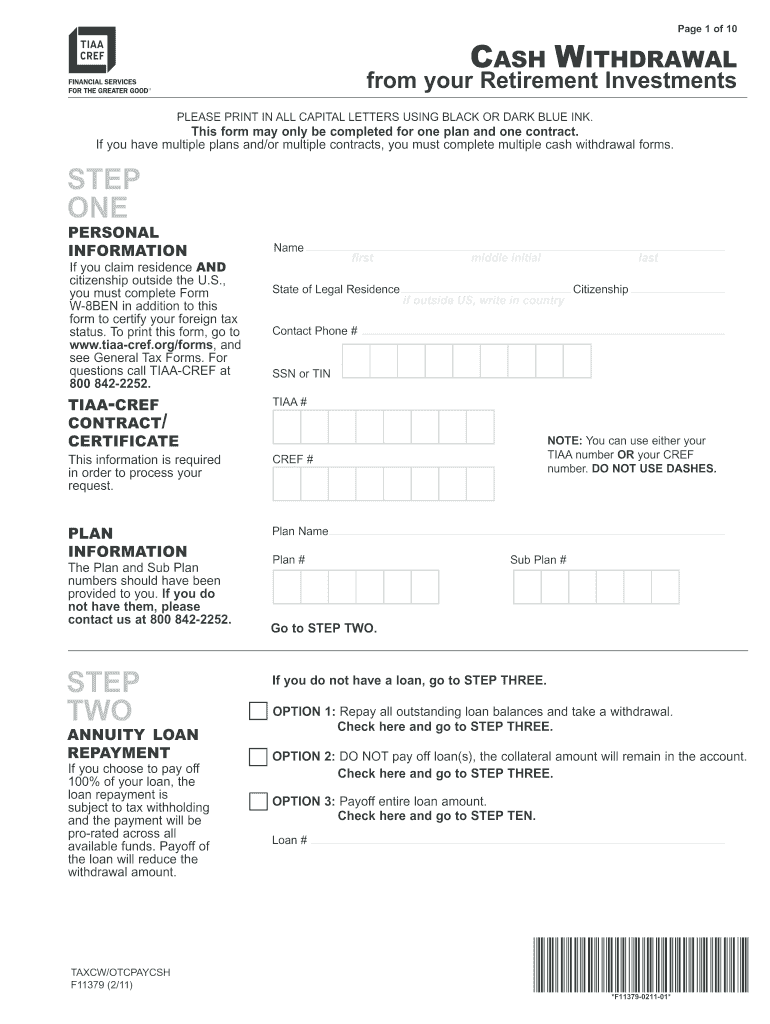

The Tiaa Forms F11379 is a crucial document used for various transactions related to retirement accounts and investment plans. This form is primarily utilized by individuals who are looking to withdraw funds from their TIAA accounts, whether for hardship reasons or regular withdrawals. Understanding the specific purpose of this form is essential for ensuring compliance with TIAA's requirements and for facilitating a smooth transaction process.

How to Use the Tiaa Forms F11379

Using the Tiaa Forms F11379 involves a few straightforward steps. First, gather all necessary personal information, including your TIAA account number and any relevant identification. Next, fill out the form accurately, ensuring that all sections are completed to avoid delays. After completing the form, review it for any errors before submitting it. This careful approach helps to ensure that your request is processed efficiently.

Steps to Complete the Tiaa Forms F11379

Completing the Tiaa Forms F11379 requires attention to detail. Follow these steps:

- Begin by entering your personal information, including your full name, address, and contact details.

- Indicate the type of withdrawal you are requesting, whether it is a hardship withdrawal or a standard withdrawal.

- Provide any required documentation that supports your withdrawal request, such as proof of hardship if applicable.

- Carefully review all information for accuracy before signing the form.

- Submit the completed form as instructed, either online or via mail.

Legal Use of the Tiaa Forms F11379

The Tiaa Forms F11379 must be used in accordance with specific legal guidelines to ensure its validity. Compliance with federal regulations regarding retirement account withdrawals is essential. The form should be filled out truthfully and accurately, as any discrepancies may lead to legal complications or delays in processing your request. TIAA adheres to regulations set forth by the IRS and other governing bodies, ensuring that all transactions are conducted legally.

Required Documents for the Tiaa Forms F11379

When submitting the Tiaa Forms F11379, certain documents are typically required to support your request. These may include:

- A government-issued identification card to verify your identity.

- Proof of any hardship circumstances, if applicable, such as medical bills or financial statements.

- Any additional forms or documentation requested by TIAA to process your withdrawal.

Having these documents ready can expedite the processing of your form and help avoid unnecessary delays.

Form Submission Methods

The Tiaa Forms F11379 can be submitted through various methods, providing flexibility for users. The available submission options typically include:

- Online submission through the TIAA website, which offers a quick and efficient way to process your request.

- Mailing the completed form to the designated TIAA address, ensuring that you send it with sufficient postage.

- In-person submission at a TIAA office, if preferred, allowing for direct interaction with TIAA representatives.

Choosing the right submission method can enhance the speed and efficiency of your withdrawal process.

Quick guide on how to complete tiaa forms f11379

Effortlessly Prepare Tiaa Forms F11379 on Any Device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to find the correct form and securely save it online. airSlate SignNow provides all the tools necessary to swiftly create, modify, and eSign your documents without any delays. Manage Tiaa Forms F11379 on any platform using the airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

How to Modify and eSign Tiaa Forms F11379 with Ease

- Find Tiaa Forms F11379 and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you would like to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Tiaa Forms F11379 to ensure outstanding communication at any point in your form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tiaa forms f11379

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is taxcw otcpaycsh and how does it relate to eSigning documents?

Taxcw otcpaycsh is a secure electronic payment method that can be integrated with eSigning solutions like airSlate SignNow. By utilizing taxcw otcpaycsh, businesses can ensure that their document transactions are not only efficient but also compliant with financial regulations. This increases trust and security for all parties involved.

-

How can airSlate SignNow enhance my business's taxcw otcpaycsh transactions?

airSlate SignNow optimizes taxcw otcpaycsh transactions by streamlining the signing process with easy-to-use features. This allows businesses to obtain signatures quickly while handling sensitive tax documents securely. The automation of workflows reduces time and boosts productivity in managing financial documents.

-

What pricing plans are available for airSlate SignNow users interested in taxcw otcpaycsh?

airSlate SignNow offers flexible pricing plans that cater to various business needs while integrating taxcw otcpaycsh. Whether you're a small startup or a large enterprise, you can find a plan that suits your budget and requirements. Each plan includes essential features for effective document management and secure payments.

-

Are there any specific features of airSlate SignNow that support taxcw otcpaycsh?

Yes, airSlate SignNow provides features designed to enhance taxcw otcpaycsh transactions, such as customizable templates and automated reminders for signatures. These features ensure that your tax-related documents are always up to date and signed promptly, fostering smoother transactions in your business operations.

-

Can I integrate taxcw otcpaycsh with other applications using airSlate SignNow?

Absolutely! airSlate SignNow supports integrations with various applications that enhance the taxcw otcpaycsh experience. You can connect your eSigning processes with popular tools like CRM and accounting software, allowing for seamless workflows and improved efficiency in handling transactions.

-

What are the benefits of using airSlate SignNow for taxcw otcpaycsh?

Using airSlate SignNow for taxcw otcpaycsh offers numerous benefits, such as increased efficiency, security, and compliance. The platform simplifies the signing process, which reduces turnaround times and enhances customer satisfaction. With built-in protection features, your sensitive transactions are kept secure.

-

Is airSlate SignNow mobile-friendly for users managing taxcw otcpaycsh?

Yes, airSlate SignNow is mobile-friendly, allowing users to manage their taxcw otcpaycsh transactions on the go. The mobile app provides full access to eSigning capabilities and document tracking features, ensuring that you can handle your signing needs anytime, anywhere without compromising security.

Get more for Tiaa Forms F11379

Find out other Tiaa Forms F11379

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple