000 0500109 ITE Oklahoma Individual Estimated Tax First Quarter OW 8 ES Revised 10 a for Tax Year B Quarter C Taxpayer's SS Form

Understanding the109 ITE Oklahoma Individual Estimated Tax Form

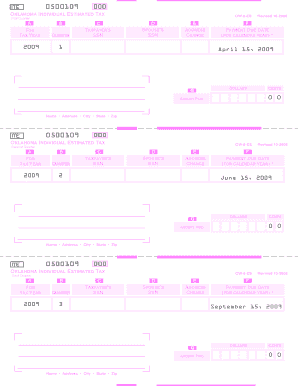

The109 ITE Oklahoma Individual Estimated Tax First Quarter form is essential for taxpayers in Oklahoma who need to report their estimated tax payments for the first quarter of the tax year. This form is designed for individuals who expect to owe tax of one thousand dollars or more when they file their annual tax return. It allows taxpayers to prepay their estimated tax liability, helping to avoid penalties and interest charges associated with underpayment.

Steps to Complete the109 ITE Oklahoma Individual Estimated Tax Form

Completing the109 ITE form involves several key steps. First, gather your financial information, including your expected income for the year, deductions, and credits. Next, accurately fill out the taxpayer's Social Security Number (SSN) and, if applicable, the spouse's SSN. Indicate any address changes and ensure the payment due date is clearly noted, typically April 15. Finally, calculate the amount you intend to pay and submit the form by the due date to avoid penalties.

Key Elements of the109 ITE Oklahoma Individual Estimated Tax Form

This form includes several critical components. The taxpayer's and spouse's SSNs are required for identification purposes. The address change section ensures that the tax authorities have your current information. The payment due date is crucial for compliance, and the amount paid section allows you to document your prepayment accurately. Each of these elements plays a vital role in ensuring your estimated tax is processed correctly.

Filing Deadlines and Important Dates for the109 ITE Form

It is important to adhere to filing deadlines to avoid penalties. For the109 ITE form, the payment due date for the first quarter is typically April 15 of the tax year. Taxpayers should mark their calendars to ensure timely submission. Missing this deadline may result in interest and penalties on the unpaid tax amount.

Legal Use of the109 ITE Oklahoma Individual Estimated Tax Form

The109 ITE form is legally binding when submitted. It represents your commitment to pay the estimated taxes owed for the year. Accurate completion and timely submission are essential to maintain compliance with Oklahoma tax laws. Failure to submit this form can lead to penalties and affect your overall tax standing.

Examples of Using the109 ITE Oklahoma Individual Estimated Tax Form

Consider a self-employed individual who expects to owe taxes at the end of the year. By using the109 ITE form, they can estimate their tax liability based on projected earnings and make quarterly payments. This proactive approach helps manage cash flow and avoids a large tax bill at year-end. Another example includes a retiree who continues to earn income from investments; they can use this form to prepay taxes on that income, ensuring they remain compliant with tax obligations.

Quick guide on how to complete 000 0500109 ite oklahoma individual estimated tax first quarter ow 8 es revised 10 a for tax year b quarter c taxpayers ssn d

Easily prepare 000 0500109 ITE Oklahoma Individual Estimated Tax First Quarter OW 8 ES Revised 10 A For Tax Year B Quarter C Taxpayer's SS on any device

Online document management has gained popularity among businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, enabling efficient access to the correct forms and safe online storage. airSlate SignNow provides all the resources necessary to swiftly create, modify, and electronically sign your documents without delays. Manage 000 0500109 ITE Oklahoma Individual Estimated Tax First Quarter OW 8 ES Revised 10 A For Tax Year B Quarter C Taxpayer's SS on any device using the airSlate SignNow applications for Android or iOS, and enhance your document-related processes today.

The simplest method to edit and electronically sign 000 0500109 ITE Oklahoma Individual Estimated Tax First Quarter OW 8 ES Revised 10 A For Tax Year B Quarter C Taxpayer's SS with ease

- Locate 000 0500109 ITE Oklahoma Individual Estimated Tax First Quarter OW 8 ES Revised 10 A For Tax Year B Quarter C Taxpayer's SS and click Get Form to begin.

- Make use of the tools available to finalize your document.

- Emphasize notable sections of the documents or obscure sensitive information using the specific tools provided by airSlate SignNow for that purpose.

- Generate your signature with the Sign tool, which takes only seconds and holds the same legal validity as a traditional handwritten signature.

- Review all details and click on the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious searches for forms, or mistakes that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks, from any device of your preference. Edit and electronically sign 000 0500109 ITE Oklahoma Individual Estimated Tax First Quarter OW 8 ES Revised 10 A For Tax Year B Quarter C Taxpayer's SS to ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 000 0500109 ite oklahoma individual estimated tax first quarter ow 8 es revised 10 a for tax year b quarter c taxpayers ssn d

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 000 0500109 ITE Oklahoma Individual Estimated Tax First Quarter OW 8 ES Revised 10 A for Tax Year B?

The 000 0500109 ITE Oklahoma Individual Estimated Tax First Quarter OW 8 ES Revised 10 A is a form used by taxpayers to report and pay their estimated state income tax for the first quarter of the specified tax year. This form helps ensure that individuals meet their tax obligations and avoid penalties for underpayment.

-

What information is required on the 000 0500109 ITE form?

When filling out the 000 0500109 ITE Oklahoma Individual Estimated Tax First Quarter OW 8 ES Revised 10 A form, you will need to provide the Taxpayer's SSN, Spouse's SSN, Address Change, and the Payment Due Date for Calendar Year, which is typically April 15. Accurate information is crucial to ensure compliance with state tax laws.

-

What is the payment due date for the 000 0500109 ITE form?

The payment due date for the 000 0500109 ITE Oklahoma Individual Estimated Tax First Quarter OW 8 ES Revised 10 A is April 15 each year. Paying on or before this date helps to avoid penalties and interest on unpaid taxes, ensuring that your tax obligations are met.

-

How can airSlate SignNow assist with filing the 000 0500109 ITE form?

airSlate SignNow offers a streamlined platform that allows users to easily create, send, and eSign the 000 0500109 ITE Oklahoma Individual Estimated Tax First Quarter OW 8 ES Revised 10 A form. Our intuitive solution simplifies the paperwork process and keeps your tax documents safe and organized.

-

Are there any fees associated with using airSlate SignNow for the 000 0500109 ITE form?

Yes, airSlate SignNow operates on a subscription-based pricing model, making it a cost-effective solution for managing documents including the 000 0500109 ITE Oklahoma Individual Estimated Tax First Quarter OW 8 ES Revised 10 A. Our plans are designed to cater to different user needs, ensuring flexibility and affordability.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow provides various features such as document templates, eSigning, real-time tracking, and integration with other applications, which are beneficial for managing the 000 0500109 ITE Oklahoma Individual Estimated Tax First Quarter OW 8 ES Revised 10 A form. These features help you complete your tax documents efficiently and securely.

-

Can I store and retrieve my completed 000 0500109 ITE forms using airSlate SignNow?

Absolutely! airSlate SignNow allows you to store and retrieve your completed 000 0500109 ITE Oklahoma Individual Estimated Tax First Quarter OW 8 ES Revised 10 A forms, ensuring they are easily accessible when needed. This feature promotes organization and helps you keep track of your financial documents.

Get more for 000 0500109 ITE Oklahoma Individual Estimated Tax First Quarter OW 8 ES Revised 10 A For Tax Year B Quarter C Taxpayer's SS

- City of greenville hospitality tax form

- Oral conscious sedation informed consent form

- L 1 rewrite equations in y mx b form

- Jamaica the companies act articles of incorporation company limited by shares pursuant to sections 8 ampamp form

- Double good popcorn images form

- Residency verification form volusia

- The main event special event liability arlington roe amp co form

- Grn 6 form

Find out other 000 0500109 ITE Oklahoma Individual Estimated Tax First Quarter OW 8 ES Revised 10 A For Tax Year B Quarter C Taxpayer's SS

- Can I eSignature Nevada Non-disclosure agreement PDF

- eSignature New Mexico Non-disclosure agreement PDF Online

- Can I eSignature Utah Non-disclosure agreement PDF

- eSignature Rhode Island Rental agreement lease Easy

- eSignature New Hampshire Rental lease agreement Simple

- eSignature Nebraska Rental lease agreement forms Fast

- eSignature Delaware Rental lease agreement template Fast

- eSignature West Virginia Rental lease agreement forms Myself

- eSignature Michigan Rental property lease agreement Online

- Can I eSignature North Carolina Rental lease contract

- eSignature Vermont Rental lease agreement template Online

- eSignature Vermont Rental lease agreement template Now

- eSignature Vermont Rental lease agreement template Free

- eSignature Nebraska Rental property lease agreement Later

- eSignature Tennessee Residential lease agreement Easy

- Can I eSignature Washington Residential lease agreement

- How To eSignature Vermont Residential lease agreement form

- How To eSignature Rhode Island Standard residential lease agreement

- eSignature Mississippi Commercial real estate contract Fast

- eSignature Arizona Contract of employment Online