Included Form 512

What is the Included Form 512

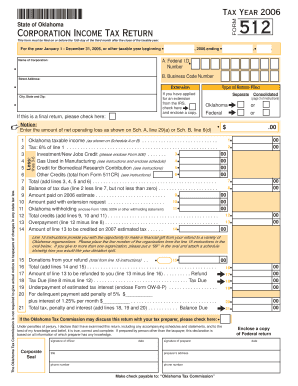

The Included Form 512 is a tax form used primarily for reporting specific financial information to the Internal Revenue Service (IRS). This form is essential for certain taxpayers, including individuals and businesses, who need to disclose income, deductions, and credits accurately. Understanding the purpose of Form 512 is crucial for compliance with federal tax regulations and for ensuring that all financial information is reported correctly.

How to use the Included Form 512

Using the Included Form 512 involves several steps to ensure accurate completion. First, gather all necessary financial documents, such as income statements and receipts for deductions. Next, carefully fill out the form, ensuring that all sections are completed according to the instructions provided. It is important to double-check all entries for accuracy before submission. Finally, submit the form to the IRS through the appropriate method, which can vary based on individual circumstances.

Steps to complete the Included Form 512

Completing the Included Form 512 requires a systematic approach. Start by downloading the form from the IRS website or obtaining a physical copy. Follow these steps:

- Read the instructions carefully to understand the requirements.

- Fill in personal information, including name, address, and Social Security number.

- Report all sources of income accurately.

- Detail any deductions or credits applicable to your situation.

- Review the completed form for any errors or omissions.

- Sign and date the form before submission.

Key elements of the Included Form 512

The Included Form 512 contains several key elements that are vital for accurate reporting. These include:

- Identification Information: This section requires personal details, such as your name and taxpayer identification number.

- Income Reporting: All income sources must be reported, including wages, dividends, and interest.

- Deductions and Credits: Taxpayers can claim various deductions and credits, which can significantly affect their tax liability.

- Signature Section: A signature is required to validate the information provided on the form.

Filing Deadlines / Important Dates

Filing deadlines for the Included Form 512 are critical to avoid penalties. Typically, the form must be submitted by April fifteenth of the following tax year. However, extensions may be available under certain circumstances. It is important to stay informed about any changes to deadlines, especially in light of special circumstances that may arise, such as natural disasters or legislative changes.

Who Issues the Form

The Included Form 512 is issued by the Internal Revenue Service (IRS), the federal agency responsible for tax administration in the United States. The IRS provides detailed instructions and guidelines for completing the form, ensuring that taxpayers can comply with federal tax laws. It is advisable to refer to the IRS website for the most current version of the form and any updates related to its use.

Quick guide on how to complete included form 512

Complete [SKS] effortlessly on any device

Online document management has gained popularity among organizations and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your paperwork promptly without delays. Handle [SKS] on any device using the airSlate SignNow Android or iOS applications and enhance any document-based process today.

The easiest way to edit and eSign [SKS] without any hassle

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools provided to complete your document.

- Highlight essential sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your PC.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and eSign [SKS] and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Included Form 512

Create this form in 5 minutes!

How to create an eSignature for the included form 512

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Included Form 512 in airSlate SignNow?

The Included Form 512 is a customizable template in airSlate SignNow designed for ease of use in eSigning and document management. This form streamlines your workflow, allowing you to collect necessary signatures efficiently while ensuring compliance with relevant regulations. With this template, you can signNowly decrease the time spent on paperwork.

-

How does Using the Included Form 512 benefit my business?

Using the Included Form 512 can enhance your business's productivity by simplifying the signature process. By having a pre-designed format, it minimizes errors and speeds up the approval cycle. Furthermore, it enables you to maintain a professional appearance and ensure that all legal requirements are met.

-

Is the Included Form 512 customizable?

Yes, the Included Form 512 is fully customizable to meet your specific needs. You can adjust fields, add personalized branding, and modify content to align with your business requirements. This flexibility ensures that your document captures all the essential information relevant to your processes.

-

What are the pricing options for accessing the Included Form 512?

airSlate SignNow offers competitive pricing options that include access to the Included Form 512 across various subscription plans. These plans are tailored to meet the needs of businesses of any size, ensuring you get the features you require without overspending. Visit our pricing page for more details and to select the best plan for your business.

-

Can I integrate the Included Form 512 with other software?

Absolutely! The Included Form 512 can be seamlessly integrated with various popular applications, enhancing your workflow. Whether you use CRM systems, document storage platforms, or project management tools, airSlate SignNow connects smoothly with them to streamline your operations.

-

How does airSlate SignNow ensure the security of the Included Form 512?

Security is a top priority for airSlate SignNow, which is why the Included Form 512 is protected with advanced encryption protocols. Your data and signed documents are stored securely and are compliant with industry standards. This level of security gives you peace of mind when handling sensitive information.

-

What types of documents can I create with the Included Form 512?

The Included Form 512 can be utilized for a variety of document types including contracts, agreements, and invoices that require signatures. This versatility makes it an ideal choice for different industries. By using airSlate SignNow, you can adapt the form to fit any document needs in your organization.

Get more for Included Form 512

Find out other Included Form 512

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document