Corporation Partnership State Zip Tax Ok Form

What is the Corporation Partnership State Zip Tax Ok

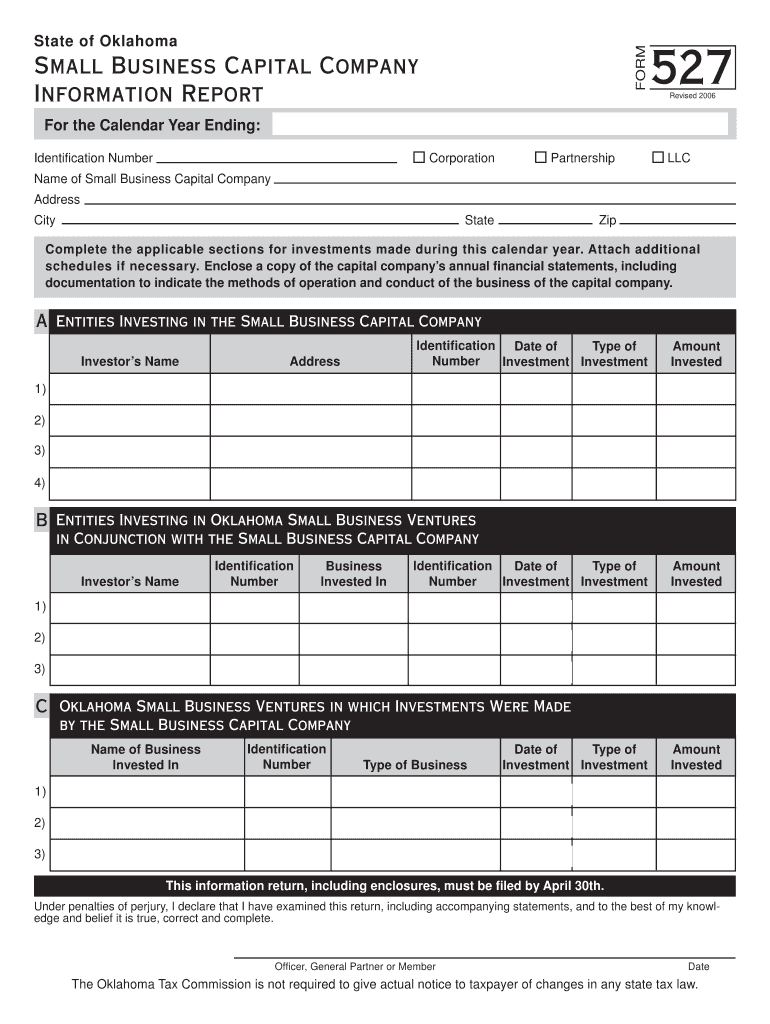

The Corporation Partnership State Zip Tax Ok form is a crucial document used in the United States for tax reporting purposes. It is specifically designed for partnerships and corporations to report their income and expenses to state tax authorities. This form helps ensure compliance with state tax regulations and provides a clear overview of the financial activities of the business entity.

This form typically includes essential information such as the business name, address, and tax identification number. Additionally, it outlines the income generated, deductions claimed, and any taxes owed. Understanding this form is vital for accurate tax filing and avoiding potential penalties.

Steps to complete the Corporation Partnership State Zip Tax Ok

Completing the Corporation Partnership State Zip Tax Ok form involves several key steps:

- Gather necessary documentation, including financial statements, income records, and previous tax returns.

- Fill out the form with accurate information regarding the business name, address, and tax identification number.

- Report all sources of income and applicable deductions, ensuring that each entry is supported by documentation.

- Review the completed form for accuracy, checking all calculations and entries.

- Submit the form to the appropriate state tax authority by the specified deadline.

Legal use of the Corporation Partnership State Zip Tax Ok

The legal use of the Corporation Partnership State Zip Tax Ok form is essential for maintaining compliance with state tax laws. Businesses are required to file this form annually, and failure to do so can result in penalties or legal repercussions. It is important for entities to understand their obligations under state tax regulations and to ensure that the information provided is truthful and complete.

In addition to tax compliance, this form may also be used in legal contexts, such as when applying for loans or grants, where proof of tax compliance is necessary. Accurate completion of the form reflects the entity's financial responsibility and can positively influence business relationships.

State-specific rules for the Corporation Partnership State Zip Tax Ok

Each state in the U.S. may have unique rules and regulations regarding the Corporation Partnership State Zip Tax Ok form. It is crucial for businesses to familiarize themselves with the specific requirements of their state, as these can vary significantly. Some states may require additional documentation or have different filing deadlines.

For example, certain states may impose additional taxes or fees on partnerships and corporations, which must be reported on the form. Understanding these state-specific rules can help businesses avoid costly mistakes and ensure compliance with local tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the Corporation Partnership State Zip Tax Ok form can vary by state. Typically, partnerships and corporations must submit their forms by the fifteenth day of the fourth month following the end of their fiscal year. It is essential for businesses to be aware of these deadlines to avoid late filing penalties.

Additionally, some states may have different deadlines for estimated tax payments, which should also be tracked carefully. Keeping a calendar of important dates can help ensure timely compliance with all tax obligations.

Required Documents

To accurately complete the Corporation Partnership State Zip Tax Ok form, several documents are typically required. These may include:

- Financial statements, including profit and loss statements and balance sheets.

- Records of all income sources, such as sales receipts and investment income.

- Documentation for any deductions claimed, including receipts and invoices.

- Previous tax returns for reference and consistency.

Having these documents organized and readily available can streamline the completion process and help ensure accuracy in reporting.

Quick guide on how to complete corporation partnership state zip tax ok

Manage [SKS] effortlessly on any platform

Web-based document administration has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the right template and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without any hold-ups. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and streamline your document-centric processes today.

The easiest way to edit and electronically sign [SKS] smoothly

- Find [SKS] and select Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Highlight important sections of your documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Review the details and click the Done button to retain your modifications.

- Select your preferred method of sending your form, whether by email, SMS, or invitation link, or download it directly to your computer.

Eliminate the hassle of lost or misplaced documents, monotonous form searching, or errors that require printing additional document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and electronically sign [SKS] and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Corporation Partnership State Zip Tax Ok

Create this form in 5 minutes!

How to create an eSignature for the corporation partnership state zip tax ok

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What fees are associated with the Corporation Partnership State Zip Tax Ok service?

The Corporation Partnership State Zip Tax Ok service offers transparent pricing with no hidden fees. Customers can choose from various pricing plans that cater to different business needs, ensuring that you only pay for the features you utilize. Additionally, we provide a free trial to allow potential customers to explore the platform before committing.

-

How does airSlate SignNow support Corporation Partnership State Zip Tax Ok integration?

airSlate SignNow seamlessly integrates with various accounting and financial software that handle Corporation Partnership State Zip Tax Ok. This ensures that businesses can streamline their document management and eSignature processes within their existing workflows. Our integration capabilities help users efficiently manage tax documents while minimizing errors and enhancing productivity.

-

What features does airSlate SignNow offer for managing Corporation Partnership State Zip Tax Ok documents?

Our platform offers advanced features specifically designed for Corporation Partnership State Zip Tax Ok documents, including customizable templates, secure eSignature options, and real-time tracking. Users can easily manage their documents, ensuring compliance with local regulations while enhancing collaboration among team members. These tools provide peace of mind and efficiency when handling vital tax-related paperwork.

-

Is airSlate SignNow suitable for small businesses focused on Corporation Partnership State Zip Tax Ok?

Absolutely! airSlate SignNow is tailored to meet the needs of small businesses managing Corporation Partnership State Zip Tax Ok. Our cost-effective pricing and user-friendly interface make it easy for small teams to create, send, and sign documents without requiring extensive technical knowledge. This empowers businesses to focus on growth without the burden of complex document management.

-

Can I use airSlate SignNow for remote teams working on Corporation Partnership State Zip Tax Ok?

Yes, airSlate SignNow is designed to support remote teams through cloud-based functionality, making it an ideal solution for businesses working with Corporation Partnership State Zip Tax Ok documents. Team members can access, edit, and sign documents from anywhere, ensuring that tax-related tasks are completed promptly and efficiently. This flexibility enhances collaboration and ensures that everyone stays informed.

-

How secure is the handling of Corporation Partnership State Zip Tax Ok documents on airSlate SignNow?

Security is a top priority at airSlate SignNow. We implement industry-leading encryption protocols to protect your Corporation Partnership State Zip Tax Ok documents from unauthorized access. Additionally, we comply with various regulatory standards, ensuring that your sensitive tax information is managed with the highest level of security throughout its lifecycle.

-

Can I track the status of my Corporation Partnership State Zip Tax Ok documents?

Yes, airSlate SignNow provides real-time tracking for all documents, including those related to Corporation Partnership State Zip Tax Ok. Users can easily see when documents are sent, viewed, and signed, allowing for greater accountability and transparency in the process. This feature ensures you are always updated on the status of important tax documents.

Get more for Corporation Partnership State Zip Tax Ok

- Texas unemployment benefits application form

- Rule 129 of the records manual 1917 form

- Parent student teacher contract download pdf form

- Cooking contest score sheet template form

- Idromar watermaker manual pdf form

- Iowa home inspection checklist form

- Selective mutism checklist pdf form

- Cis305 15308647 form

Find out other Corporation Partnership State Zip Tax Ok

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors