Partnership Zip Tax Ok Form

Understanding the Partnership Zip Tax Ok

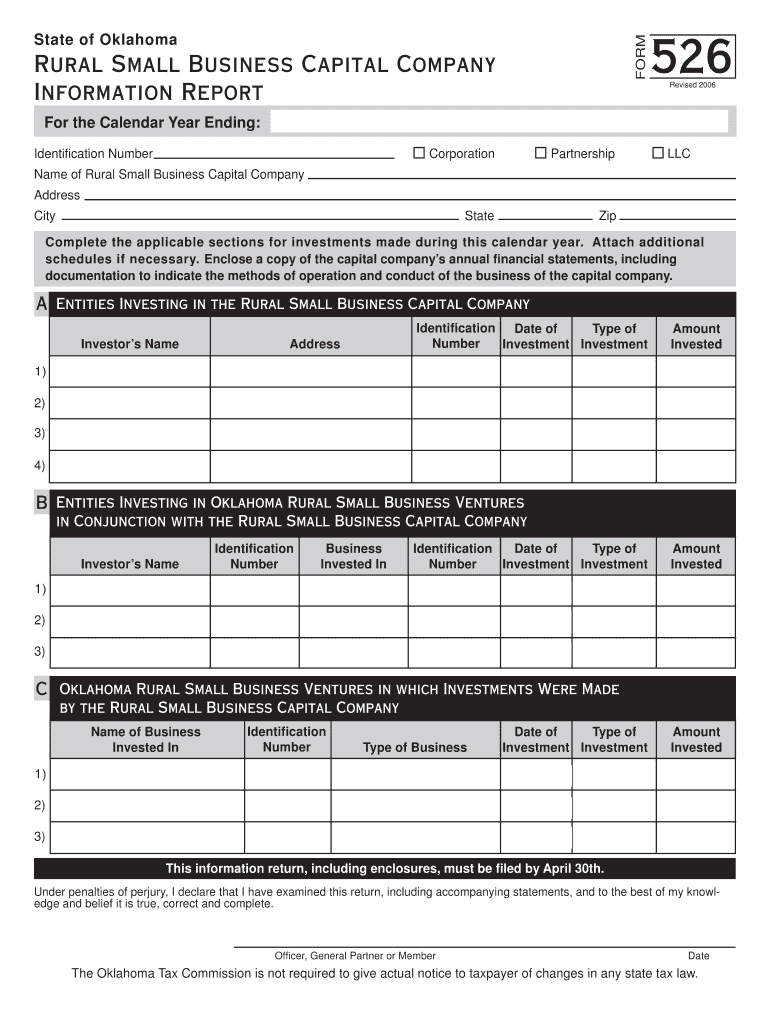

The Partnership Zip Tax Ok is a specific tax form utilized by partnerships in the United States to report income, deductions, gains, and losses. This form is essential for ensuring compliance with federal tax regulations and provides the IRS with a comprehensive overview of a partnership's financial activities. It is designed to facilitate accurate tax reporting and help partnerships maintain transparency in their financial dealings.

Steps to Complete the Partnership Zip Tax Ok

Completing the Partnership Zip Tax Ok involves several key steps:

- Gather all necessary financial documents, including income statements, expense reports, and previous tax returns.

- Fill out the form accurately, ensuring that all income and deductions are reported correctly.

- Review the completed form for any errors or omissions before submission.

- Submit the form to the IRS by the designated deadline, which is typically the fifteenth day of the third month following the end of the partnership’s tax year.

Legal Use of the Partnership Zip Tax Ok

The Partnership Zip Tax Ok is legally required for partnerships to report their financial activities to the IRS. Failure to file this form can result in penalties and interest on unpaid taxes. It is crucial for partnerships to understand their legal obligations and ensure that they are compliant with all relevant tax laws. This form not only serves as a record of financial transactions but also helps in determining the tax liabilities of each partner.

Required Documents for the Partnership Zip Tax Ok

To successfully complete the Partnership Zip Tax Ok, several documents are required:

- Financial statements detailing income and expenses.

- Records of any deductions claimed.

- Previous tax returns for reference.

- Partnership agreement outlining the roles and responsibilities of each partner.

Filing Deadlines for the Partnership Zip Tax Ok

Partnerships must be aware of the filing deadlines associated with the Partnership Zip Tax Ok. The form is typically due on the fifteenth day of the third month after the end of the partnership's tax year. For partnerships operating on a calendar year, this means the form is due by March 15. Timely submission is essential to avoid penalties and ensure compliance with IRS regulations.

Examples of Using the Partnership Zip Tax Ok

Partnerships in various industries utilize the Partnership Zip Tax Ok to report their earnings. For example:

- A law firm structured as a partnership would report its income from client fees and any associated expenses.

- A real estate partnership would detail rental income, property management costs, and depreciation on properties owned.

These examples illustrate the form's versatility in accommodating different types of partnerships while ensuring accurate tax reporting.

Quick guide on how to complete partnership zip tax ok

Complete [SKS] effortlessly on any device

Web-based document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to easily locate the correct template and securely store it online. airSlate SignNow equips you with all the essential tools to generate, edit, and eSign your documents swiftly and without delays. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and enhance any document-driven workflow today.

The easiest way to modify and eSign [SKS] with minimal effort

- Locate [SKS] and click Get Form to begin.

- Utilize the features we offer to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign feature, which takes just seconds and holds the same legal validity as a traditional ink signature.

- Review the details and hit the Done button to save your changes.

- Choose your preferred method to send your form, whether via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form navigation, or mistakes that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your preference. Edit and eSign [SKS] and maintain exceptional communication at every step of your form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Partnership Zip Tax Ok

Create this form in 5 minutes!

How to create an eSignature for the partnership zip tax ok

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Partnership Zip Tax Ok?

Partnership Zip Tax Ok is a streamlined solution allowing businesses to manage their tax-related documents efficiently. It simplifies the process of signing and sending essential tax forms, ensuring compliance and timely submission.

-

How does airSlate SignNow improve my experience with Partnership Zip Tax Ok?

airSlate SignNow enhances your Partnership Zip Tax Ok experience by providing a user-friendly interface that simplifies document eSigning and sharing. This tool helps you save time and reduce errors, making tax management much more efficient.

-

What pricing plans are available for Partnership Zip Tax Ok?

airSlate SignNow offers competitive pricing plans for Partnership Zip Tax Ok, allowing businesses of all sizes to choose an option that fits their budget. These plans include various features tailored to meet the specific needs of users handling tax documents.

-

Can I integrate Partnership Zip Tax Ok with other platforms?

Yes, Partnership Zip Tax Ok easily integrates with various platforms such as CRM systems and accounting software. This ensures seamless workflow and improved productivity when managing your tax documents within the airSlate SignNow framework.

-

What security measures does airSlate SignNow implement for Partnership Zip Tax Ok?

airSlate SignNow prioritizes the security of your documents with advanced encryption and authentication protocols under Partnership Zip Tax Ok. This guarantees that your sensitive tax information is protected during the signing and sharing process.

-

What benefits can I expect from using Partnership Zip Tax Ok?

Using Partnership Zip Tax Ok with airSlate SignNow introduces numerous benefits, including reduced turnaround time for document processing and improved accuracy. It allows users to focus on their core business operations while ensuring compliance with tax regulations.

-

Is there a free trial available for Partnership Zip Tax Ok?

Yes, airSlate SignNow offers a free trial for Partnership Zip Tax Ok, allowing prospective customers to explore its features before committing to a paid plan. This trial provides an opportunity to experience the ease of eSigning tax documents firsthand.

Get more for Partnership Zip Tax Ok

Find out other Partnership Zip Tax Ok

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History