Fill in Format 1040n Nebraska State Income Tax Forms 2022

What is the Fill In Format 1040n Nebraska State Income Tax Forms

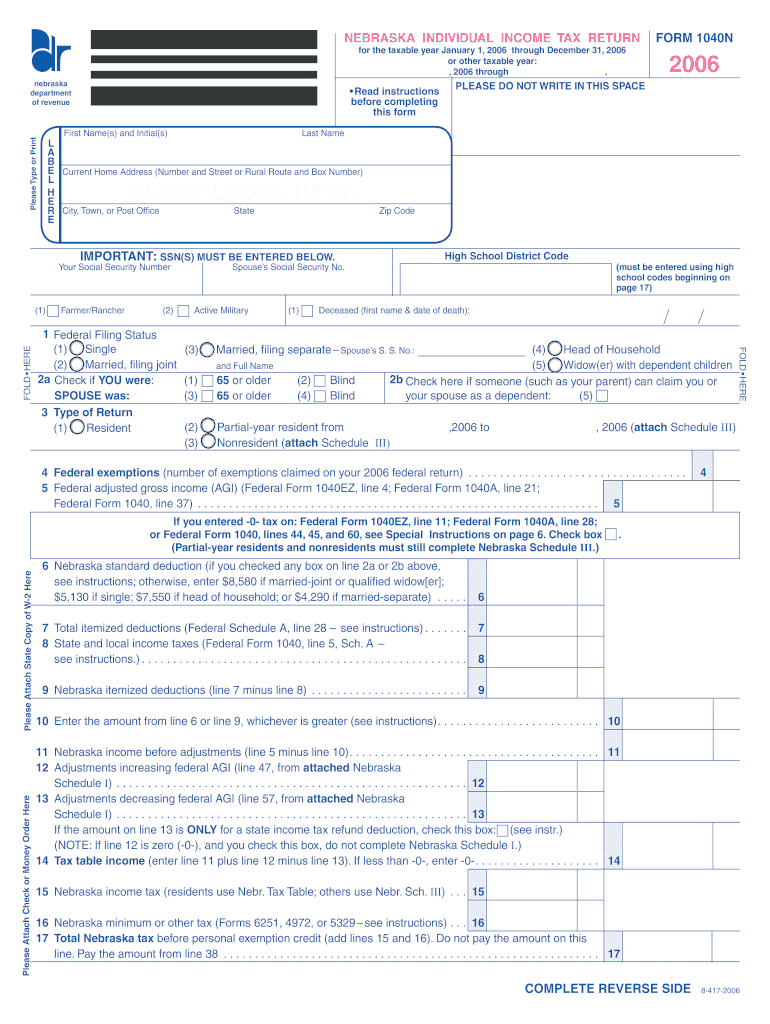

The Fill In Format 1040n Nebraska State Income Tax Forms is a specific document used by residents of Nebraska to report their state income tax obligations. This form is essential for individuals who earn income within the state and are required to file taxes. It captures various financial details, including wages, dividends, and other sources of income, allowing the Nebraska Department of Revenue to assess tax liabilities accurately. Understanding this form is crucial for compliance with state tax laws and ensuring that taxpayers fulfill their financial responsibilities.

Steps to complete the Fill In Format 1040n Nebraska State Income Tax Forms

Completing the Fill In Format 1040n Nebraska State Income Tax Forms involves several important steps:

- Gather necessary documents, including W-2s, 1099s, and other income statements.

- Fill in personal information, such as your name, address, and Social Security number.

- Report your total income by entering figures from your financial documents into the appropriate sections of the form.

- Calculate your deductions and credits, which may reduce your taxable income.

- Determine your total tax liability based on the income reported and applicable tax rates.

- Sign and date the form to validate your submission.

How to obtain the Fill In Format 1040n Nebraska State Income Tax Forms

The Fill In Format 1040n Nebraska State Income Tax Forms can be obtained through various channels. Taxpayers can download the form directly from the Nebraska Department of Revenue website. Additionally, physical copies may be available at local government offices or libraries. It is advisable to ensure you have the most current version of the form to avoid issues during filing.

Legal use of the Fill In Format 1040n Nebraska State Income Tax Forms

The legal use of the Fill In Format 1040n Nebraska State Income Tax Forms is governed by state tax laws. To be considered valid, the form must be completed accurately and submitted by the designated deadline. Electronic submissions are permissible, provided they comply with the legal frameworks governing eSignatures and digital documentation. Ensuring that the form is signed and dated is essential for it to be legally binding.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have multiple options for submitting the Fill In Format 1040n Nebraska State Income Tax Forms. The form can be filed online through the Nebraska Department of Revenue's e-filing system, which offers a convenient and efficient way to submit tax returns. Alternatively, taxpayers may choose to mail a printed version of the form to the appropriate address specified by the state. In-person submissions are also accepted at designated tax offices, allowing for direct interaction with tax officials if needed.

Filing Deadlines / Important Dates

Filing deadlines for the Fill In Format 1040n Nebraska State Income Tax Forms are critical for compliance. Typically, the deadline for filing state income tax returns is April fifteenth of each year. However, taxpayers should be aware of any changes or extensions that may apply. It is important to stay informed about these dates to avoid penalties and ensure timely submission.

Quick guide on how to complete fill in format 1040n nebraska state income tax forms

Complete Fill In Format 1040n Nebraska State Income Tax Forms effortlessly on any device

Online document management has become increasingly prevalent among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly and without hold-ups. Manage Fill In Format 1040n Nebraska State Income Tax Forms on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Fill In Format 1040n Nebraska State Income Tax Forms without any hassle

- Obtain Fill In Format 1040n Nebraska State Income Tax Forms and click Get Form to begin.

- Employ the tools we offer to fill out your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and has the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you prefer to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate the printing of new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from your selected device. Modify and eSign Fill In Format 1040n Nebraska State Income Tax Forms to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fill in format 1040n nebraska state income tax forms

Create this form in 5 minutes!

How to create an eSignature for the fill in format 1040n nebraska state income tax forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Fill In Format 1040n Nebraska State Income Tax Forms?

Fill In Format 1040n Nebraska State Income Tax Forms are the state's official documents required for filing individual income taxes in Nebraska. These forms allow taxpayers to report their income, deductions, and credits efficiently. Using airSlate SignNow, you can easily fill out and eSign these forms, ensuring they are completed correctly and submitted on time.

-

How can I access Fill In Format 1040n Nebraska State Income Tax Forms?

You can access Fill In Format 1040n Nebraska State Income Tax Forms directly through the airSlate SignNow platform. Our user-friendly interface allows for seamless navigation and form filling. Simply sign up, and you'll have immediate access to fill out and eSign these essential tax documents.

-

Are there any costs associated with using airSlate SignNow for Fill In Format 1040n Nebraska State Income Tax Forms?

Yes, airSlate SignNow offers various pricing plans, allowing you to choose one that fits your needs when utilizing Fill In Format 1040n Nebraska State Income Tax Forms. We provide cost-effective solutions for both individuals and businesses, ensuring that you can effectively manage your tax documentation without breaking the bank.

-

What are the benefits of using airSlate SignNow for tax forms?

Using airSlate SignNow for Fill In Format 1040n Nebraska State Income Tax Forms streamlines your tax filing process. Our platform not only allows you to fill and eSign documents quickly but also provides secure storage and easy access to your forms anytime. This helps reduce errors and ensures compliance with state requirements.

-

Can I integrate airSlate SignNow with other tools for tax preparation?

Absolutely! airSlate SignNow is designed to integrate seamlessly with various accounting and tax preparation tools. This means you can efficiently manage your Fill In Format 1040n Nebraska State Income Tax Forms alongside your existing applications, ensuring a smoother workflow during tax season.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Yes, airSlate SignNow prioritizes the security of your sensitive information. When filling out and eSigning Fill In Format 1040n Nebraska State Income Tax Forms through our platform, your data is encrypted and protected against unauthorized access. We comply with industry standards to ensure your tax documents are handled securely.

-

How can I get help if I encounter issues with Fill In Format 1040n Nebraska State Income Tax Forms?

If you encounter any issues while using airSlate SignNow for Fill In Format 1040n Nebraska State Income Tax Forms, our dedicated customer support team is here to help. You can access resources, guides, and FAQs on our website or get in touch with our support team for personalized assistance.

Get more for Fill In Format 1040n Nebraska State Income Tax Forms

- Hud single family claims input help part b form

- Instructions for completing dbpr abt 6035 form

- State of wisconsin death certificate application form 16056715

- Form certificate poll watcher

- New brunswick provincial nominee program pxw1 snb form

- Padls avian necropsy submission form

- Fl 1099r instructions form

- Schlie plan formular schachermayer

Find out other Fill In Format 1040n Nebraska State Income Tax Forms

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe

- Electronic signature Kentucky Standard rental application Fast

- Electronic signature Arkansas Real estate document Online

- Electronic signature Oklahoma Real estate document Mobile

- Electronic signature Louisiana Real estate forms Secure

- Electronic signature Louisiana Real estate investment proposal template Fast