10 158 Crude Oil Tax Producer Report Window on State Government Window Texas Form

Understanding the 10 158 Crude Oil Tax Producer Report

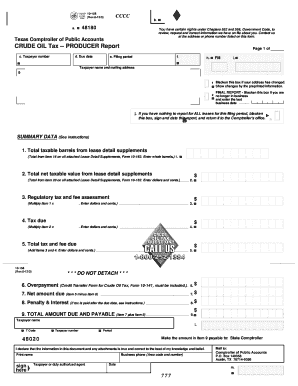

The 10 158 Crude Oil Tax Producer Report is a specific form used by producers in Texas to report crude oil production and related tax obligations to the state government. This report provides essential information about the quantity of crude oil produced, the applicable tax rates, and any exemptions or deductions that may apply. It is crucial for ensuring compliance with state tax regulations and for the accurate assessment of taxes owed by producers.

Steps to Complete the 10 158 Crude Oil Tax Producer Report

Completing the 10 158 Crude Oil Tax Producer Report involves several key steps:

- Gather necessary production data, including the volume of crude oil produced during the reporting period.

- Determine the applicable tax rates based on current Texas tax regulations.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the report for any errors or omissions before submission.

How to Obtain the 10 158 Crude Oil Tax Producer Report

The 10 158 Crude Oil Tax Producer Report can be obtained through the Texas Comptroller of Public Accounts website. Producers can access the form in a digital format, which can be filled out online or printed for manual completion. It is advisable to check for the most current version of the form to ensure compliance with any recent changes in tax regulations.

Key Elements of the 10 158 Crude Oil Tax Producer Report

Important components of the 10 158 Crude Oil Tax Producer Report include:

- Identification information for the producer, including name, address, and tax identification number.

- Details of crude oil production, specifying the amount produced and the reporting period.

- Tax calculations, including the total tax owed and any applicable deductions or credits.

- Signature of the producer or authorized representative, confirming the accuracy of the information provided.

Legal Use of the 10 158 Crude Oil Tax Producer Report

The 10 158 Crude Oil Tax Producer Report must be used in accordance with Texas state law. Producers are required to submit this report to ensure they are fulfilling their tax obligations. Failure to submit the report accurately and on time can result in penalties, including fines and interest on unpaid taxes.

Form Submission Methods

The completed 10 158 Crude Oil Tax Producer Report can be submitted through various methods:

- Online submission via the Texas Comptroller's website, which may offer a streamlined process for electronic filing.

- Mailing a printed copy of the form to the appropriate state office.

- In-person submission at designated state offices, if preferred.

Quick guide on how to complete 10 158 crude oil tax producer report window on state government window texas

Effortlessly Prepare [SKS] on Any Device

Managing documents online has gained traction among both businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Handle [SKS] on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The Easiest Way to Modify and eSign [SKS] Seamlessly

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools provided to complete your form.

- Highlight pertinent sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Decide how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choosing. Modify and eSign [SKS] to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to 10 158 Crude Oil Tax Producer Report Window On State Government Window Texas

Create this form in 5 minutes!

How to create an eSignature for the 10 158 crude oil tax producer report window on state government window texas

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 10 158 Crude Oil Tax Producer Report Window On State Government Window Texas?

The 10 158 Crude Oil Tax Producer Report Window On State Government Window Texas is a detailed document that producers must submit regarding crude oil taxes in Texas. This report helps ensure compliance with state regulations and provides transparency in oil production tax reporting.

-

How does airSlate SignNow facilitate the submission of the 10 158 Crude Oil Tax Producer Report?

airSlate SignNow streamlines the submission process for the 10 158 Crude Oil Tax Producer Report Window On State Government Window Texas by allowing users to create, send, and eSign documents electronically. This enhances efficiency and reduces the time spent on paperwork, ensuring timely compliance with state requirements.

-

What are the pricing plans for using airSlate SignNow to manage the 10 158 Crude Oil Tax Producer Report?

airSlate SignNow offers various pricing plans that cater to different business needs, making it an affordable solution for managing the 10 158 Crude Oil Tax Producer Report Window On State Government Window Texas. Pricing typically includes several features such as unlimited document signing and integrations, providing excellent value for users.

-

What features does airSlate SignNow offer for handling the 10 158 Crude Oil Tax Producer Report?

airSlate SignNow provides essential features for managing the 10 158 Crude Oil Tax Producer Report Window On State Government Window Texas, including customizable templates, secure eSignature options, and real-time document tracking. These features help businesses stay organized and ensure successful submissions.

-

Can airSlate SignNow integrate with other software for the 10 158 Crude Oil Tax Producer Report?

Yes, airSlate SignNow offers robust integrations with various software applications, enhancing the management of the 10 158 Crude Oil Tax Producer Report Window On State Government Window Texas. These integrations help businesses maintain smooth workflows and easily access all necessary documentation.

-

What benefits do businesses gain by using airSlate SignNow for the 10 158 Crude Oil Tax Producer Report?

By utilizing airSlate SignNow for the 10 158 Crude Oil Tax Producer Report Window On State Government Window Texas, businesses can experience faster processing times, enhanced compliance, and improved accuracy. The platform's ease of use and affordability make it a smart choice for oil producers managing tax reports.

-

Is airSlate SignNow secure for submitting the 10 158 Crude Oil Tax Producer Report?

Absolutely! AirSlate SignNow employs industry-leading security measures to protect your documents and data, ensuring that the 10 158 Crude Oil Tax Producer Report Window On State Government Window Texas is submitted securely. This commitment to security gives businesses peace of mind when handling sensitive information.

Get more for 10 158 Crude Oil Tax Producer Report Window On State Government Window Texas

- Section 1 taxpayer information

- Tax form tax tableamarta karya

- A social security number refund total 12 reason 1 form

- Fillable employee contract grievance complaint form

- Summary sheet for assurances and certificationform vem vermont

- Authorization for pre tax payroll reduction enrollment form

- The education of police o cers in england and wales form

- Over 18 years old i d with birthday change form

Find out other 10 158 Crude Oil Tax Producer Report Window On State Government Window Texas

- How Can I Sign Michigan Personal Leave Policy

- Sign South Carolina Pregnancy Leave Policy Safe

- How To Sign South Carolina Time Off Policy

- How To Sign Iowa Christmas Bonus Letter

- How To Sign Nevada Christmas Bonus Letter

- Sign New Jersey Promotion Announcement Simple

- Sign Louisiana Company Bonus Letter Safe

- How To Sign Delaware Letter of Appreciation to Employee

- How To Sign Florida Letter of Appreciation to Employee

- How Do I Sign New Jersey Letter of Appreciation to Employee

- How Do I Sign Delaware Direct Deposit Enrollment Form

- How To Sign Alabama Employee Emergency Notification Form

- How To Sign Oklahoma Direct Deposit Enrollment Form

- Sign Wyoming Direct Deposit Enrollment Form Online

- Sign Nebraska Employee Suggestion Form Now

- How Can I Sign New Jersey Employee Suggestion Form

- Can I Sign New York Employee Suggestion Form

- Sign Michigan Overtime Authorization Form Mobile

- How To Sign Alabama Payroll Deduction Authorization

- How To Sign California Payroll Deduction Authorization