Variable Life Product Directed Monthly Deduction MassMutual Form

Understanding the Variable Life Product Directed Monthly Deduction MassMutual

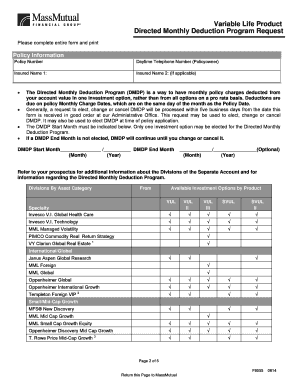

The Variable Life Product Directed Monthly Deduction from MassMutual is a financial product designed to provide policyholders with flexible life insurance coverage while allowing for investment opportunities. This product combines life insurance protection with a variable investment component, where the cash value can fluctuate based on the performance of selected investment options. The monthly deduction typically includes the cost of insurance, administrative fees, and any applicable charges related to the investment options chosen by the policyholder.

Steps to Complete the Variable Life Product Directed Monthly Deduction MassMutual

Completing the Variable Life Product Directed Monthly Deduction involves several key steps. First, policyholders need to review their policy documents to understand the specific terms and conditions. Next, they should gather all necessary information, including personal identification and financial details. After that, filling out the required forms accurately is crucial, ensuring all sections are completed to avoid delays. Finally, submitting the forms can be done through various methods, including online submissions, mailing, or in-person visits to a MassMutual office.

Eligibility Criteria for the Variable Life Product Directed Monthly Deduction MassMutual

Eligibility for the Variable Life Product Directed Monthly Deduction typically requires applicants to meet certain criteria. Generally, individuals must be of legal age, usually at least eighteen years old, and may need to provide proof of insurability. Additionally, applicants should have a clear understanding of their financial goals and risk tolerance, as these factors will influence their investment choices within the policy. It's advisable to consult with a MassMutual representative to ensure all eligibility requirements are met.

Legal Use of the Variable Life Product Directed Monthly Deduction MassMutual

The legal use of the Variable Life Product Directed Monthly Deduction is governed by state and federal regulations. Policyholders must comply with all applicable laws regarding life insurance products, including disclosure requirements and reporting obligations. It is essential to maintain accurate records of all transactions and communications related to the policy. Understanding these legal frameworks helps ensure that policyholders can maximize the benefits of their investment while remaining compliant with the law.

Required Documents for the Variable Life Product Directed Monthly Deduction MassMutual

To successfully complete the Variable Life Product Directed Monthly Deduction process, several documents are typically required. Applicants should prepare identification documents, such as a driver's license or Social Security card, along with financial information that may include income statements and tax returns. Additionally, any previous insurance policies or investment documentation may be necessary to provide a comprehensive view of the applicant's financial situation. Having these documents ready can streamline the application process.

Examples of Using the Variable Life Product Directed Monthly Deduction MassMutual

Using the Variable Life Product Directed Monthly Deduction can vary based on individual financial goals. For instance, a young professional may choose this product to secure life insurance while also investing for future needs, such as retirement. Alternatively, a family might utilize it to ensure financial protection for their dependents while also building a cash value that can be accessed in emergencies. Each scenario highlights the versatility of the product in meeting diverse financial objectives.

Quick guide on how to complete variable life product directed monthly deduction massmutual

Complete [SKS] with ease on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and handwritten documents, allowing you to access the correct form and reliably store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents quickly without delays. Handle [SKS] on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to edit and eSign [SKS] effortlessly

- Obtain [SKS] and then click Get Form to begin.

- Make use of the tools we provide to finalize your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, invite link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searching, or mistakes that require printing out new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] while ensuring optimal communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Variable Life Product Directed Monthly Deduction MassMutual

Create this form in 5 minutes!

How to create an eSignature for the variable life product directed monthly deduction massmutual

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Variable Life Product Directed Monthly Deduction from MassMutual?

The Variable Life Product Directed Monthly Deduction from MassMutual is a flexible life insurance option that allows policyholders to allocate their premiums among a variety of investment options. This approach helps users balance their life coverage with investment growth, depending on market performance.

-

How does the pricing work for the Variable Life Product Directed Monthly Deduction from MassMutual?

Pricing for the Variable Life Product Directed Monthly Deduction from MassMutual typically depends on various factors such as age, health status, and chosen investment options. Prospective customers should consult a financial advisor to understand the specific costs associated with their coverage and investment choices.

-

What benefits does the Variable Life Product Directed Monthly Deduction from MassMutual offer?

The Variable Life Product Directed Monthly Deduction from MassMutual provides policyholders with death benefits, tax-deferred cash value accumulation, and flexibility in premium payments. Additionally, the investment portion can grow based on market conditions, potentially increasing your overall investment returns.

-

Are there any minimum or maximum investment limits for the Variable Life Product Directed Monthly Deduction from MassMutual?

Yes, the Variable Life Product Directed Monthly Deduction from MassMutual often has minimum and maximum thresholds for investments within the policy. These limits ensure that policyholders maintain adequate coverage while allowing for growth opportunities but can vary based on the specific policy terms.

-

Can I customize my investment options with the Variable Life Product Directed Monthly Deduction from MassMutual?

Absolutely, the Variable Life Product Directed Monthly Deduction from MassMutual allows policyholders to customize their investment choices according to their financial goals and risk tolerance. This customization empowers users to adjust their portfolios as market conditions and personal circumstances change.

-

How do I manage my Variable Life Product Directed Monthly Deduction from MassMutual account?

Management of your Variable Life Product Directed Monthly Deduction from MassMutual account can be done through their online platform. It offers tools for tracking your investments, viewing policy performance, and making necessary adjustments to your contributions or allocations.

-

What integration options are available with the Variable Life Product Directed Monthly Deduction from MassMutual?

The Variable Life Product Directed Monthly Deduction from MassMutual offers integration with various financial planning tools and management systems. This connectivity allows users to streamline their financial tracking and ensure their life insurance aligns with their overall investment strategy.

Get more for Variable Life Product Directed Monthly Deduction MassMutual

- Household items list pdf form

- Vocabulary workbook grade 3 pdf form

- Order of operations word problems with answers pdf form

- Var form 210rev 0811 virginia association of realtors

- Eeoc pre charge inquiry form

- Health card renewal gibraltar form

- Sermon preparation worksheet pdf form

- Assignment of funds form

Find out other Variable Life Product Directed Monthly Deduction MassMutual

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself