Pensions and Annuity WithholdingInternal Revenue Service IRS Gov Form

Understanding Pensions and Annuity Withholding

The Pensions and Annuity Withholding form is a crucial document used by the Internal Revenue Service (IRS) to manage federal tax withholding on pension and annuity payments. This form allows recipients of pensions and annuities to specify how much federal income tax should be withheld from their payments. Understanding this form is essential for ensuring compliance with tax obligations and for managing personal finances effectively.

How to Fill Out the Pensions and Annuity Withholding Form

Completing the Pensions and Annuity Withholding form involves several key steps. First, gather necessary personal information, including your Social Security number and details about your pension or annuity provider. Next, indicate your desired withholding amount by selecting the appropriate options provided in the form. It is important to review your selections carefully to ensure they align with your financial situation. Finally, sign and date the form before submitting it to your pension or annuity provider.

Required Documents for Submission

When submitting the Pensions and Annuity Withholding form, certain documents may be required to verify your identity and financial status. Typically, you will need to provide a copy of your Social Security card and any relevant tax documents, such as previous tax returns or income statements. Ensure that all documents are accurate and up-to-date to avoid delays in processing.

IRS Guidelines for Pensions and Annuity Withholding

The IRS has established specific guidelines for the withholding of taxes on pensions and annuities. These guidelines outline the acceptable withholding rates and the types of payments that are subject to withholding. It is important to familiarize yourself with these guidelines to ensure compliance and to understand how your withholding choices may impact your overall tax liability. The IRS updates these guidelines periodically, so staying informed is essential.

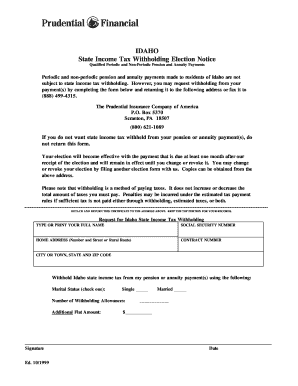

State-Specific Rules for Withholding

In addition to federal regulations, state-specific rules may also apply to pension and annuity withholding. Each state has its own tax laws, which can affect the amount withheld from your payments. It is advisable to check with your state’s tax authority to understand any additional requirements or options available to you. This will help ensure that you are meeting both federal and state tax obligations.

Penalties for Non-Compliance

Failure to comply with the IRS requirements for pensions and annuity withholding can result in significant penalties. This may include underpayment penalties if the correct amount of tax is not withheld, as well as interest on any unpaid taxes. Understanding the potential consequences of non-compliance can motivate timely and accurate completion of the withholding form.

Quick guide on how to complete pensions and annuity withholdinginternal revenue service irs gov

Manage [SKS] effortlessly on any device

Digital document organization has become widely embraced by businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, amend, and eSign your documents rapidly without delays. Handle [SKS] on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-centric operation today.

The simplest way to modify and eSign [SKS] with ease

- Locate [SKS] and click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Verify the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing additional copies. airSlate SignNow addresses your document management requirements in just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Pensions And Annuity WithholdingInternal Revenue Service IRS gov

Create this form in 5 minutes!

How to create an eSignature for the pensions and annuity withholdinginternal revenue service irs gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the role of Pensions And Annuity WithholdingInternal Revenue Service IRS gov in tax reporting?

Pensions And Annuity WithholdingInternal Revenue Service IRS gov provides guidelines on how pensions and annuities are taxed. It ensures that proper amounts are withheld for federal income tax purposes, helping recipients avoid underpayment penalties. By following these guidelines, individuals can accurately report their income to the IRS.

-

How can airSlate SignNow assist with Pensions And Annuity WithholdingInternal Revenue Service IRS gov compliance?

airSlate SignNow offers streamlined document management solutions that help businesses stay compliant with Pensions And Annuity WithholdingInternal Revenue Service IRS gov requirements. Our secure eSignature and document workflow tools allow users to easily collect necessary signatures and keep records organized, ensuring adherence to IRS regulations.

-

Are there any fees associated with using airSlate SignNow for documents related to Pensions And Annuity WithholdingInternal Revenue Service IRS gov?

airSlate SignNow provides various pricing plans that cater to businesses of all sizes. While there may be fees based on the plan you choose, the cost-effectiveness of our service often outweighs the benefits. Ensuring compliance with Pensions And Annuity WithholdingInternal Revenue Service IRS gov can save your business from potential penalties.

-

What features does airSlate SignNow provide that support Pensions And Annuity WithholdingInternal Revenue Service IRS gov documentation?

airSlate SignNow includes features such as customizable templates, automated reminders, and secure cloud storage specifically geared towards Pensions And Annuity WithholdingInternal Revenue Service IRS gov documentation. These tools make the process of creating, signing, and storing important documents seamless and compliant.

-

How does airSlate SignNow ensure data security for Pensions And Annuity WithholdingInternal Revenue Service IRS gov forms?

We prioritize data security by utilizing advanced encryption and secure user authentication to protect all documents related to Pensions And Annuity WithholdingInternal Revenue Service IRS gov. Our platform is compliant with industry standards to ensure that your sensitive information remains safe at all times.

-

Can airSlate SignNow integrate with other tools to manage Pensions And Annuity WithholdingInternal Revenue Service IRS gov-related documents?

Yes, airSlate SignNow offers seamless integrations with various business tools, enhancing your ability to manage Pensions And Annuity WithholdingInternal Revenue Service IRS gov documents. Popular applications such as Google Drive, Salesforce, and others can be connected to streamline your workflows and improve efficiency.

-

What benefits does airSlate SignNow provide for handling Pensions And Annuity WithholdingInternal Revenue Service IRS gov paperwork?

By using airSlate SignNow for your Pensions And Annuity WithholdingInternal Revenue Service IRS gov paperwork, you gain faster turnaround times, improved accuracy, and enhanced compliance. Our platform helps reduce manual errors and ensures you’re following best practices recommended by the IRS.

Get more for Pensions And Annuity WithholdingInternal Revenue Service IRS gov

Find out other Pensions And Annuity WithholdingInternal Revenue Service IRS gov

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document