Tax Sheltered Annuity Rollover, Transfer or Exchange the Standard Form

Understanding the Tax Sheltered Annuity Rollover, Transfer or Exchange

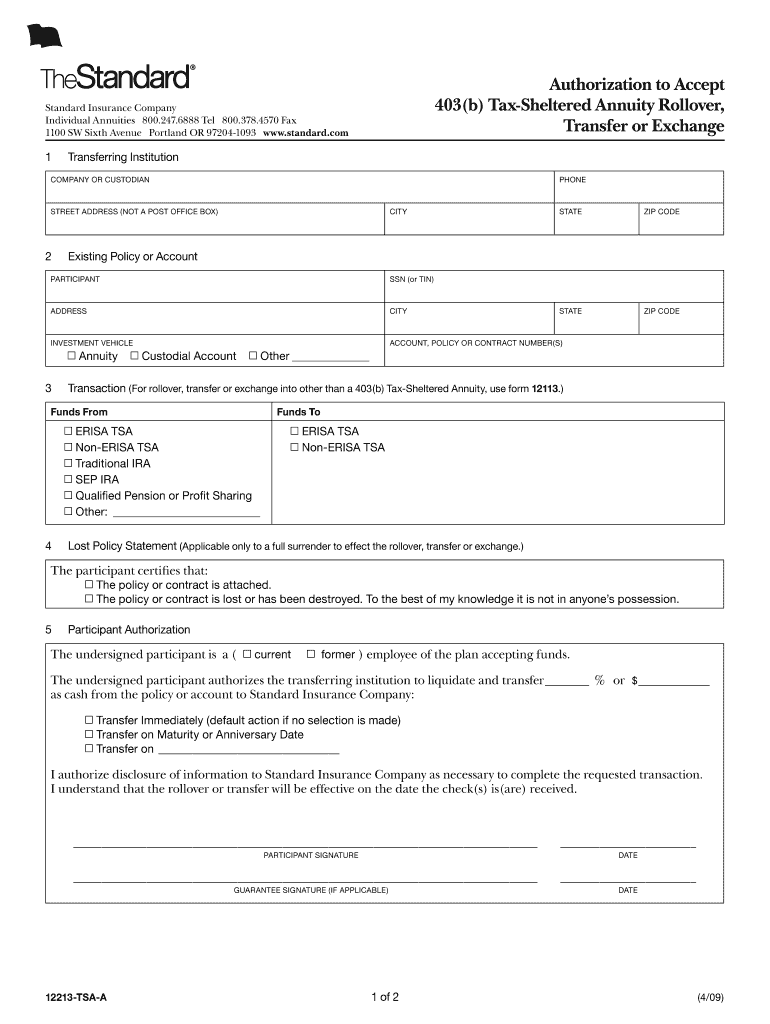

The Tax Sheltered Annuity Rollover, Transfer or Exchange is a financial mechanism primarily designed for employees of public schools and certain tax-exempt organizations. This option allows individuals to move their retirement savings from one tax-sheltered annuity plan to another without incurring immediate tax liabilities. The primary goal is to maintain the tax-deferred status of the funds while providing flexibility in managing retirement savings. Understanding the nuances of this process is essential for individuals looking to optimize their retirement planning.

Steps to Complete the Tax Sheltered Annuity Rollover, Transfer or Exchange

Completing a Tax Sheltered Annuity Rollover, Transfer or Exchange involves several key steps:

- Review your current annuity plan to understand the terms and conditions.

- Contact the receiving institution to obtain their specific requirements for the rollover.

- Fill out the necessary forms provided by both the current and receiving institutions.

- Ensure that all documentation is accurate and complete to avoid delays.

- Submit the forms as instructed, either online or via mail, depending on the institution's guidelines.

- Confirm the completion of the transfer with both institutions to ensure funds are appropriately allocated.

Key Elements of the Tax Sheltered Annuity Rollover, Transfer or Exchange

Several key elements define the Tax Sheltered Annuity Rollover, Transfer or Exchange process:

- Eligibility: Typically available to employees of public schools and certain non-profit organizations.

- Tax Implications: Funds can be transferred without immediate tax consequences, preserving tax-deferred status.

- Documentation: Accurate completion of forms is crucial to ensure compliance and smooth processing.

- Receiving Institution: The choice of a receiving institution can impact investment options and fees.

Legal Use of the Tax Sheltered Annuity Rollover, Transfer or Exchange

The legal framework governing the Tax Sheltered Annuity Rollover, Transfer or Exchange is established by the Internal Revenue Service (IRS). This framework ensures that individuals can transfer their retirement funds without incurring penalties, provided they adhere to specific guidelines. Understanding these regulations is vital for compliance and to avoid potential tax liabilities.

Required Documents for the Tax Sheltered Annuity Rollover, Transfer or Exchange

To successfully complete a Tax Sheltered Annuity Rollover, Transfer or Exchange, several documents are typically required:

- Completed transfer request forms from both the current and receiving institutions.

- Proof of identity, such as a government-issued ID.

- Account statements from the current annuity provider.

- Any additional documentation as required by the receiving institution.

Examples of Using the Tax Sheltered Annuity Rollover, Transfer or Exchange

Individuals may utilize the Tax Sheltered Annuity Rollover, Transfer or Exchange in various scenarios, such as:

- Transferring funds from an old employer's plan to a new employer's plan when changing jobs.

- Moving assets from a traditional annuity to a Roth annuity to take advantage of different tax benefits.

- Consolidating multiple tax-sheltered accounts into a single plan for easier management.

Quick guide on how to complete tax sheltered annuity rollover transfer or exchange the standard

Complete [SKS] seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly option compared to conventional printed and signed documents, as you can easily locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to edit and eSign [SKS] effortlessly

- Locate [SKS] and click on Get Form to begin.

- Make use of the tools provided to complete your form.

- Emphasize relevant parts of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and has the same legal validity as a traditional handwritten signature.

- Verify all the details and click on the Done button to save your updates.

- Select how you want to send your form: via email, SMS, or an invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure outstanding communication at any point during the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Tax Sheltered Annuity Rollover, Transfer Or Exchange The Standard

Create this form in 5 minutes!

How to create an eSignature for the tax sheltered annuity rollover transfer or exchange the standard

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Tax Sheltered Annuity Rollover, Transfer Or Exchange The Standard?

A Tax Sheltered Annuity Rollover, Transfer Or Exchange The Standard allows you to move your retirement funds without incurring tax liabilities. This process helps you maintain the tax-deferred status of your investments while ensuring your funds are managed efficiently.

-

How does the Tax Sheltered Annuity Rollover, Transfer Or Exchange The Standard work?

The Tax Sheltered Annuity Rollover, Transfer Or Exchange The Standard permits you to transfer your existing retirement funds into a new account seamlessly. It involves completing a few forms and working with a financial advisor to ensure compliance with IRS regulations.

-

What are the benefits of using Tax Sheltered Annuity Rollover, Transfer Or Exchange The Standard?

The Tax Sheltered Annuity Rollover, Transfer Or Exchange The Standard offers numerous benefits, including tax deferral on earnings, potential for growth in your retirement account, and simplified management of your investments. Additionally, this option can optimize your savings and provide more future financial security.

-

Are there any fees associated with the Tax Sheltered Annuity Rollover, Transfer Or Exchange The Standard?

Fees for a Tax Sheltered Annuity Rollover, Transfer Or Exchange The Standard can vary depending on your chosen financial institution. It is essential to review the fee structure beforehand to ensure you understand any potential costs involved in the process.

-

How can I initiate a Tax Sheltered Annuity Rollover, Transfer Or Exchange The Standard?

To initiate a Tax Sheltered Annuity Rollover, Transfer Or Exchange The Standard, start by contacting your current plan provider for instructions. Then, consider consulting with a financial advisor to help you navigate the process and ensure all documentation is completed correctly.

-

Can I use the Tax Sheltered Annuity Rollover, Transfer Or Exchange The Standard for different types of accounts?

Yes, the Tax Sheltered Annuity Rollover, Transfer Or Exchange The Standard can be utilized for various qualified retirement accounts, including 403(b)s and IRAs. It's important to confirm with your provider which accounts are eligible for this type of transaction.

-

What documentation do I need for a Tax Sheltered Annuity Rollover, Transfer Or Exchange The Standard?

Documentation for a Tax Sheltered Annuity Rollover, Transfer Or Exchange The Standard typically includes account statements and forms provided by both your current and new plan providers. Be sure to gather all necessary paperwork to facilitate a smooth transfer process.

Get more for Tax Sheltered Annuity Rollover, Transfer Or Exchange The Standard

Find out other Tax Sheltered Annuity Rollover, Transfer Or Exchange The Standard

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself