Immediate Annuity Application Form

What is the Immediate Annuity Application

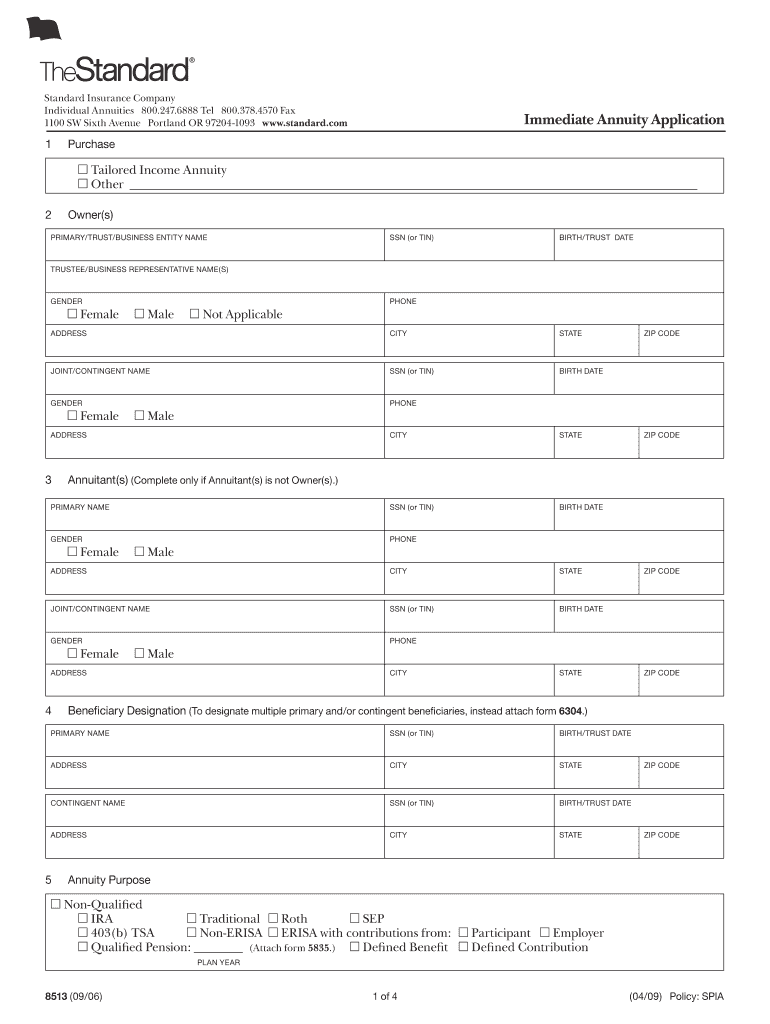

The Immediate Annuity Application is a financial document used to initiate an immediate annuity contract. This type of annuity provides guaranteed income payments to the annuitant shortly after the purchase, typically within one month. It is designed for individuals seeking a steady income stream, often during retirement. The application collects essential information about the applicant, including personal details, financial background, and preferences regarding the annuity terms.

Steps to complete the Immediate Annuity Application

Completing the Immediate Annuity Application involves several key steps:

- Gather necessary information: Collect personal identification details, including your Social Security number, date of birth, and contact information.

- Financial details: Prepare information about your financial situation, including income sources, assets, and any existing annuities.

- Choose your annuity options: Decide on the payment frequency, duration, and any additional riders or benefits you may want to include.

- Complete the application: Fill out the form accurately, ensuring all required fields are completed.

- Review and sign: Check the application for errors and sign it to confirm your agreement to the terms.

- Submit the application: Send the completed form to the issuing company through the preferred submission method.

Required Documents

When applying for an immediate annuity, certain documents are typically required to support your application:

- Proof of identity: A government-issued photo ID, such as a driver's license or passport.

- Social Security information: Your Social Security card or number.

- Financial statements: Recent bank statements, tax returns, or other documents that demonstrate your financial status.

- Existing annuity contracts: If applicable, provide details of any current annuities you hold.

Eligibility Criteria

To qualify for an immediate annuity, applicants must meet specific eligibility criteria, which may include:

- Age requirement: Most companies require applicants to be at least fifty-five years old.

- Financial stability: Applicants should demonstrate sufficient financial resources to make the initial premium payment.

- Residency: Applicants must be residents of the United States, as regulations may vary by state.

Legal use of the Immediate Annuity Application

The Immediate Annuity Application is legally binding once signed and submitted. It is essential to understand the terms and conditions outlined in the contract, as they govern the relationship between the annuitant and the issuing company. Compliance with state regulations and federal guidelines is also crucial to ensure the legality of the annuity contract.

Form Submission Methods

Applicants can submit the Immediate Annuity Application through various methods, depending on the issuing company’s policies:

- Online submission: Many companies offer a secure online portal for completing and submitting the application.

- Mail: Applicants can print the completed form and send it via postal service to the designated address.

- In-person: Some applicants may prefer to submit their application directly at a local office or through an insurance agent.

Quick guide on how to complete immediate annuity application

Effortlessly Prepare [SKS] on Any Device

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to easily locate the appropriate form and securely save it online. airSlate SignNow supplies you with all the tools necessary to create, modify, and eSign your documents promptly without any hold-up. Handle [SKS] on any device using the airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

The easiest method to modify and eSign [SKS] seamlessly

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or obscure sensitive data with the tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your edits.

- Choose how you'd like to share your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and eSign [SKS] and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Immediate Annuity Application

Create this form in 5 minutes!

How to create an eSignature for the immediate annuity application

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an Immediate Annuity Application?

An Immediate Annuity Application is a financial product that allows individuals to convert a lump sum of money into a stream of income. This application provides a reliable source of immediate cash flow, helping retirees manage their finances effectively. Understanding how to complete the Immediate Annuity Application can ease the transition into retirement.

-

How can I apply for an Immediate Annuity?

To apply for an Immediate Annuity, you typically need to complete the Immediate Annuity Application available through financial institutions or insurance companies. Most applications can be filled out online, making the process simple and efficient. Additionally, ensure you have all relevant financial information ready for a smooth application process.

-

What documents are required for the Immediate Annuity Application?

The Immediate Annuity Application generally requires personal identification, financial statements, and information about any existing assets or liabilities. Specific requirements may vary by provider, so it's a good idea to check with the institution handling your application. Having these documents on hand will facilitate a quicker processing time.

-

What are the benefits of using an Immediate Annuity?

Utilizing an Immediate Annuity can offer several benefits, including guaranteed income for life, financial stability, and peace of mind during retirement. This type of financial planning tool can also help you allocate your funds efficiently. The Immediate Annuity Application process allows you to start enjoying these benefits almost immediately.

-

How much does it cost to set up an Immediate Annuity?

The costs associated with setting up an Immediate Annuity can vary depending on the provider and specific terms of the annuity contract. Generally, there may be some initial fees or charges included in the Immediate Annuity Application process. It's crucial to review these costs in detail to understand the total investment involved.

-

Can I customize my Immediate Annuity?

Yes, many providers allow for customization of your Immediate Annuity based on your specific financial goals and needs. This can include options for payment frequency, payout duration, and beneficiary designations. Understanding how to navigate these options is essential during your Immediate Annuity Application.

-

Are there any tax implications with an Immediate Annuity?

There are tax implications associated with an Immediate Annuity that should be carefully considered. The income received from the annuity may be taxable, and the specifics can differ based on your location and the structure of the annuity. Consulting a financial advisor can help clarify these aspects during your Immediate Annuity Application process.

Get more for Immediate Annuity Application

Find out other Immediate Annuity Application

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast