Tax Year Form MW508 Annual Employer Withholding Reconciliation Return 2022

Understanding the Maryland Form MW508 Annual Employer Withholding Reconciliation Return

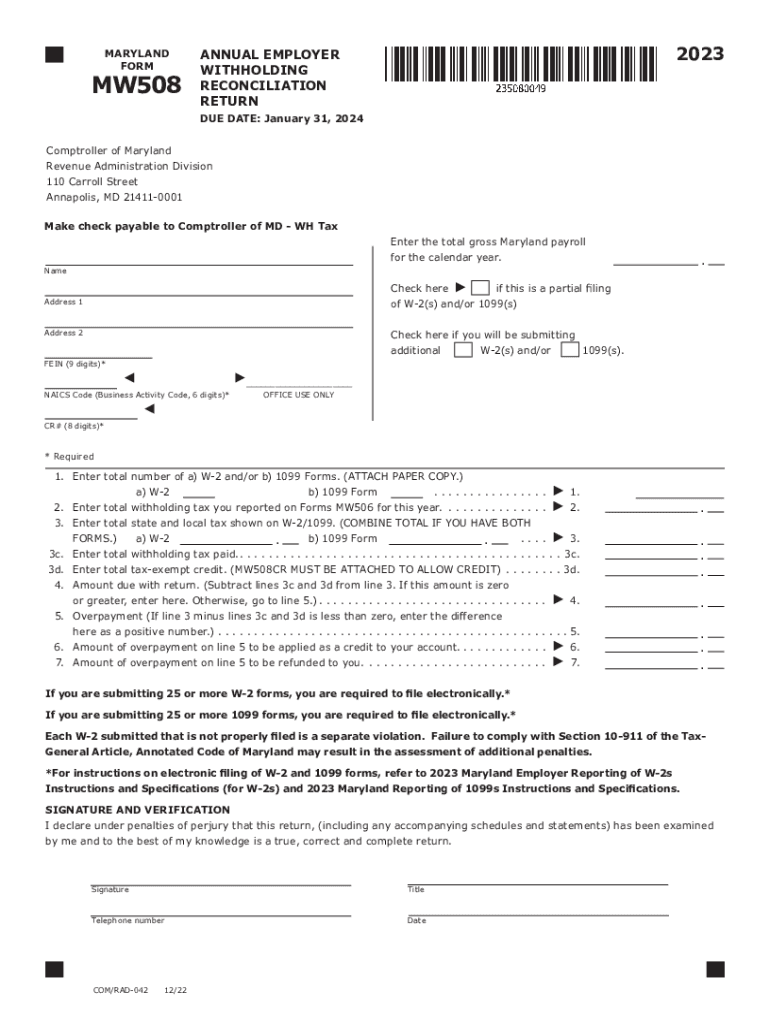

The Maryland Form MW508 is an essential document for employers in Maryland, serving as the Annual Employer Withholding Reconciliation Return. This form is used to report the total amount of state income tax withheld from employees throughout the tax year. It ensures that employers reconcile their withholding amounts with the Maryland State Comptroller's records, providing a clear overview of their tax obligations.

Completing this form accurately is crucial for compliance with state tax laws. It helps prevent discrepancies that could lead to penalties or audits. Employers must ensure that all withheld amounts align with the wages paid to employees during the year.

Steps to Complete the Maryland Form MW508

Filling out the Maryland Form MW508 involves several key steps:

- Gather Required Information: Collect all necessary data, including total wages paid, the amount of state tax withheld, and employee details.

- Fill Out the Form: Enter the total withholding amounts and other required information in the designated fields on the form.

- Review for Accuracy: Double-check all entries to ensure there are no errors or omissions that could affect your tax reporting.

- Submit the Form: Choose your submission method, whether online, by mail, or in person, and ensure it is sent by the due date.

Obtaining the Maryland Form MW508

The Maryland Form MW508 can be easily obtained through the Maryland State Comptroller's website. It is available as a fillable PDF, allowing employers to complete the form digitally. Additionally, printed copies can be requested or downloaded for those who prefer to fill it out manually.

Employers should ensure they have the most current version of the form, as updates may occur annually. The 2023 fillable version is specifically designed to accommodate any changes in tax rates or reporting requirements.

Filing Deadlines for the Maryland Form MW508

Employers must be aware of the filing deadlines associated with the Maryland Form MW508. The form is typically due by January 31 of the year following the tax year being reported. For example, for the tax year 2023, the form must be filed by January 31, 2024. It is essential to adhere to this deadline to avoid potential penalties and interest on unpaid taxes.

Legal Use of the Maryland Form MW508

The Maryland Form MW508 is legally required for all employers who withhold state income tax from their employees' wages. Its proper use ensures compliance with Maryland tax laws and regulations. Failure to file this form can result in penalties, including fines and interest on unpaid taxes.

Employers should maintain accurate records of all withholding amounts and ensure that the information reported on the MW508 matches their payroll records. This practice not only aids in compliance but also supports transparency in tax reporting.

Key Elements of the Maryland Form MW508

Key elements of the Maryland Form MW508 include:

- Total Wages Paid: The total amount paid to employees during the tax year.

- Total State Tax Withheld: The cumulative amount of state income tax withheld from employee wages.

- Employee Information: Details about employees, including their names and Social Security numbers.

- Signature of Employer: The form must be signed by an authorized representative of the employer to validate the information provided.

Quick guide on how to complete tax year form mw508 annual employer withholding reconciliation return

Complete Tax Year Form MW508 Annual Employer Withholding Reconciliation Return effortlessly on any gadget

Digital document management has become favored among companies and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can easily find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, alter, and electronically sign your documents quickly without delays. Manage Tax Year Form MW508 Annual Employer Withholding Reconciliation Return on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest method to modify and eSign Tax Year Form MW508 Annual Employer Withholding Reconciliation Return with ease

- Find Tax Year Form MW508 Annual Employer Withholding Reconciliation Return and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight signNow sections of your documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that task.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a customary wet ink signature.

- Review all the information and click the Done button to save your updates.

- Select your preferred method to send your form, whether by email, text message (SMS), or invite link, or download it onto your computer.

Put an end to lost or misfiled documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Tax Year Form MW508 Annual Employer Withholding Reconciliation Return and guarantee excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax year form mw508 annual employer withholding reconciliation return

Create this form in 5 minutes!

How to create an eSignature for the tax year form mw508 annual employer withholding reconciliation return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Maryland form annual, and why is it important?

The Maryland form annual is a crucial document for businesses operating in Maryland to maintain compliance with state regulations. It typically outlines the financial activities and operational details of the business over the past year. Ensuring proper submission of the Maryland form annual helps avoid penalties and maintain good standing.

-

How can airSlate SignNow help with completing the Maryland form annual?

airSlate SignNow simplifies the process of completing the Maryland form annual by providing an intuitive platform to fill out, sign, and send the document electronically. Our user-friendly interface ensures that you can navigate the form with ease while also helping you save time and reduce paperwork hassles. Utilizing airSlate SignNow for the Maryland form annual ensures accurate submissions and enhances compliance.

-

What are the costs associated with using airSlate SignNow for the Maryland form annual?

The pricing for airSlate SignNow is designed to be cost-effective, allowing businesses of all sizes to access essential e-signature solutions. We offer a variety of plans, including monthly and annual subscriptions, which can be tailored to your specific needs. By using airSlate SignNow to manage the Maryland form annual, you can save on traditional printing and mailing costs.

-

What features does airSlate SignNow offer for completing the Maryland form annual?

airSlate SignNow provides several features to facilitate the completion of the Maryland form annual, including customizable templates, real-time collaboration, and secure electronic signatures. Additionally, you can track the status of your documents and receive notifications once they’re signed, giving you peace of mind and ensuring a streamlined process.

-

Can I integrate airSlate SignNow with other software for managing the Maryland form annual?

Yes, airSlate SignNow seamlessly integrates with various business applications and tools, allowing you to manage the Maryland form annual alongside your existing workflows. Whether you use CRM systems, cloud storage, or accounting software, our integrations enhance efficiency and ensure that your document management processes are cohesive.

-

What are the benefits of using airSlate SignNow for the Maryland form annual?

Using airSlate SignNow for the Maryland form annual comes with numerous benefits, including time-saving automation, improved document accuracy, and enhanced compliance with state regulations. Our platform enables hassle-free e-signatures, which eliminates the need for physical paperwork. This not only accelerates the submission process but also contributes to a more sustainable approach to document management.

-

Is there a mobile app for airSlate SignNow to handle the Maryland form annual?

Yes, airSlate SignNow offers a mobile app that allows you to manage the Maryland form annual on the go. With the app, you can fill out, sign, and send your documents from your smartphone or tablet, ensuring that you never miss a deadline. This flexibility enhances your ability to work efficiently, regardless of your location.

Get more for Tax Year Form MW508 Annual Employer Withholding Reconciliation Return

- Proctor approval form van education center

- Tuition remission form for undergraduate courses lenoir rhyne hr lr

- Laguardia community college immunization form 462902055

- Club name change request form eastcentral edu

- James madison university sport clubs forms

- Mercer university transcript request form

- Pdf voluntary unpaid services san francisco ccsf form

- Transcript request form john jay college of criminal justice johnjay jjay cuny

Find out other Tax Year Form MW508 Annual Employer Withholding Reconciliation Return

- Can I Electronic signature Vermont Bulk Sale Agreement

- Electronic signature Alaska Medical Records Release Mobile

- Electronic signature California Medical Records Release Myself

- Can I Electronic signature Massachusetts Medical Records Release

- How Do I Electronic signature Michigan Medical Records Release

- Electronic signature Indiana Membership Agreement Easy

- How Can I Electronic signature New Jersey Medical Records Release

- Electronic signature New Mexico Medical Records Release Easy

- How Can I Electronic signature Alabama Advance Healthcare Directive

- How Do I Electronic signature South Carolina Advance Healthcare Directive

- eSignature Kentucky Applicant Appraisal Form Evaluation Later

- Electronic signature Colorado Client and Developer Agreement Later

- Electronic signature Nevada Affiliate Program Agreement Secure

- Can I Electronic signature Pennsylvania Co-Branding Agreement

- Can I Electronic signature South Dakota Engineering Proposal Template

- How Do I Electronic signature Arizona Proforma Invoice Template

- Electronic signature California Proforma Invoice Template Now

- Electronic signature New York Equipment Purchase Proposal Now

- How Do I Electronic signature New York Proforma Invoice Template

- How Can I Electronic signature Oklahoma Equipment Purchase Proposal