Securing Your Tax Clearance Certificate Form

Understanding the Tax Clearance Certificate

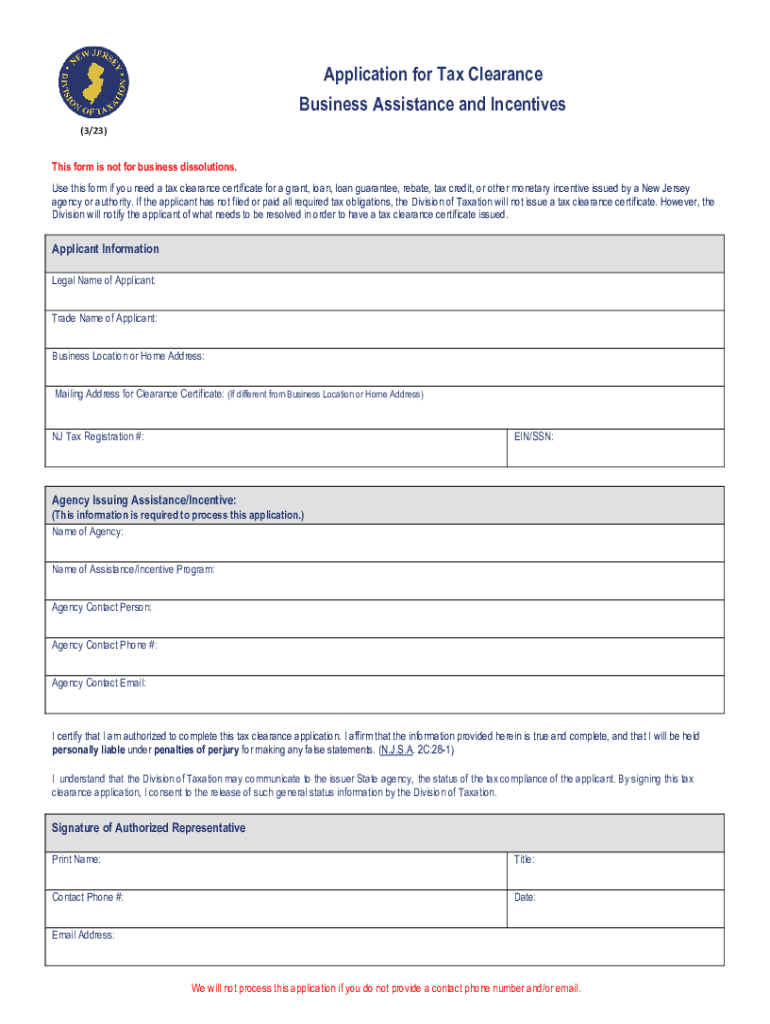

The tax clearance certificate is an important document that verifies an individual or business has fulfilled all tax obligations. This certificate is often required for various purposes, including loan applications, business licenses, and contract bidding. It serves as proof that there are no outstanding tax liabilities, ensuring compliance with federal and state tax regulations.

Steps to Obtain Your Tax Clearance Certificate

To secure your tax clearance certificate, follow these steps:

- Determine your eligibility based on your tax status and any outstanding obligations.

- Gather necessary documentation, including previous tax returns and identification.

- Complete the required application form, which may vary by state.

- Submit your application online or via mail to the appropriate tax authority.

- Wait for processing, which can take several weeks depending on your state’s procedures.

Required Documents for Application

When applying for a tax clearance certificate, you will typically need to provide:

- Proof of identity, such as a government-issued ID.

- Previous tax returns for the relevant years.

- Any correspondence from the tax authority regarding your tax status.

- Documentation of any payments made towards outstanding taxes.

Legal Uses of the Tax Clearance Certificate

The tax clearance certificate is legally recognized and can be used in various situations, including:

- Applying for loans or mortgages, where lenders require proof of tax compliance.

- Obtaining business licenses or permits, which often require a clearance certificate.

- Participating in government contracts, where tax compliance is a prerequisite.

Filing Deadlines and Important Dates

It is crucial to be aware of filing deadlines related to your tax clearance application. Generally, these deadlines can vary by state and may align with tax return due dates. Keeping track of these dates ensures timely submission and avoids penalties.

Application Process and Approval Time

The application process for a tax clearance certificate typically involves filling out the appropriate forms and submitting them to the tax authority. Approval times can vary significantly, often ranging from a few days to several weeks, depending on the complexity of your tax situation and the efficiency of the tax office.

Quick guide on how to complete securing your tax clearance certificate

Complete Securing Your Tax Clearance Certificate effortlessly on any device

Online document management has become increasingly favored by organizations and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, alter, and electronically sign your documents swiftly without delays. Handle Securing Your Tax Clearance Certificate on any platform using airSlate SignNow Android or iOS applications and streamline your document-based activities today.

The easiest method to modify and electronically sign Securing Your Tax Clearance Certificate with ease

- Locate Securing Your Tax Clearance Certificate and click Get Form to begin.

- Use the tools we provide to finalize your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Select your preferred method of sending your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing additional document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Securing Your Tax Clearance Certificate and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the securing your tax clearance certificate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a tax application clearance pdf, and why is it important?

A tax application clearance pdf is a document that confirms an individual's or business's compliance with tax obligations. It is important as it can be required for various financial transactions, such as applying for loans or permits, and ensures that all tax affairs are in order.

-

How can airSlate SignNow help with obtaining a tax application clearance pdf?

airSlate SignNow provides a streamlined platform to create and e-sign the necessary documents for obtaining a tax application clearance pdf. By using our service, you can easily fill out, sign, and share your forms, making the process efficient and user-friendly.

-

What features does airSlate SignNow offer for handling tax-related documents?

airSlate SignNow offers features like customizable templates, secure e-signatures, and easy document sharing that enhance the process of managing tax-related documents. These features ensure that your tax application clearance pdf is created promptly and securely, meeting all regulatory requirements.

-

Is there a cost associated with generating a tax application clearance pdf through airSlate SignNow?

Yes, there is a pricing structure based on the features you need, including options for individual users and businesses. Whether you require a basic plan or a more advanced package, airSlate SignNow provides cost-effective solutions to help you manage your tax application clearance pdf efficiently.

-

Can I integrate airSlate SignNow with other software for managing tax documents?

Absolutely! airSlate SignNow seamlessly integrates with various accounting and cloud storage systems, enhancing your ability to manage your tax documents, including the tax application clearance pdf. This integration streamlines workflows, saving you time and ensuring accuracy.

-

What are the benefits of using airSlate SignNow for my tax application clearance pdf needs?

Using airSlate SignNow for your tax application clearance pdf needs offers numerous benefits, including improved efficiency, cost savings, and enhanced security. You can easily manage document workflows, reduce processing times, and keep track of all your tax-related documentation in one secure place.

-

How do I get started with airSlate SignNow for preparing my tax application clearance pdf?

Getting started with airSlate SignNow is easy! Simply sign up for an account, choose a plan that fits your needs, and start creating your tax application clearance pdf using our user-friendly interface. Our support team is also available to assist you throughout the process.

Get more for Securing Your Tax Clearance Certificate

Find out other Securing Your Tax Clearance Certificate

- eSign California Sublease Agreement Template Safe

- How To eSign Colorado Sublease Agreement Template

- How Do I eSign Colorado Sublease Agreement Template

- eSign Florida Sublease Agreement Template Free

- How Do I eSign Hawaii Lodger Agreement Template

- eSign Arkansas Storage Rental Agreement Now

- How Can I eSign Texas Sublease Agreement Template

- eSign Texas Lodger Agreement Template Free

- eSign Utah Lodger Agreement Template Online

- eSign Hawaii Rent to Own Agreement Mobile

- How To eSignature Colorado Postnuptial Agreement Template

- How Do I eSignature Colorado Postnuptial Agreement Template

- Help Me With eSignature Colorado Postnuptial Agreement Template

- eSignature Illinois Postnuptial Agreement Template Easy

- eSignature Kentucky Postnuptial Agreement Template Computer

- How To eSign California Home Loan Application

- How To eSign Florida Home Loan Application

- eSign Hawaii Home Loan Application Free

- How To eSign Hawaii Home Loan Application

- How To eSign New York Home Loan Application