Sec 03 04 12 04 Certificate of Full or Partial Exemption Form

Understanding the MW506AE 2023 Form

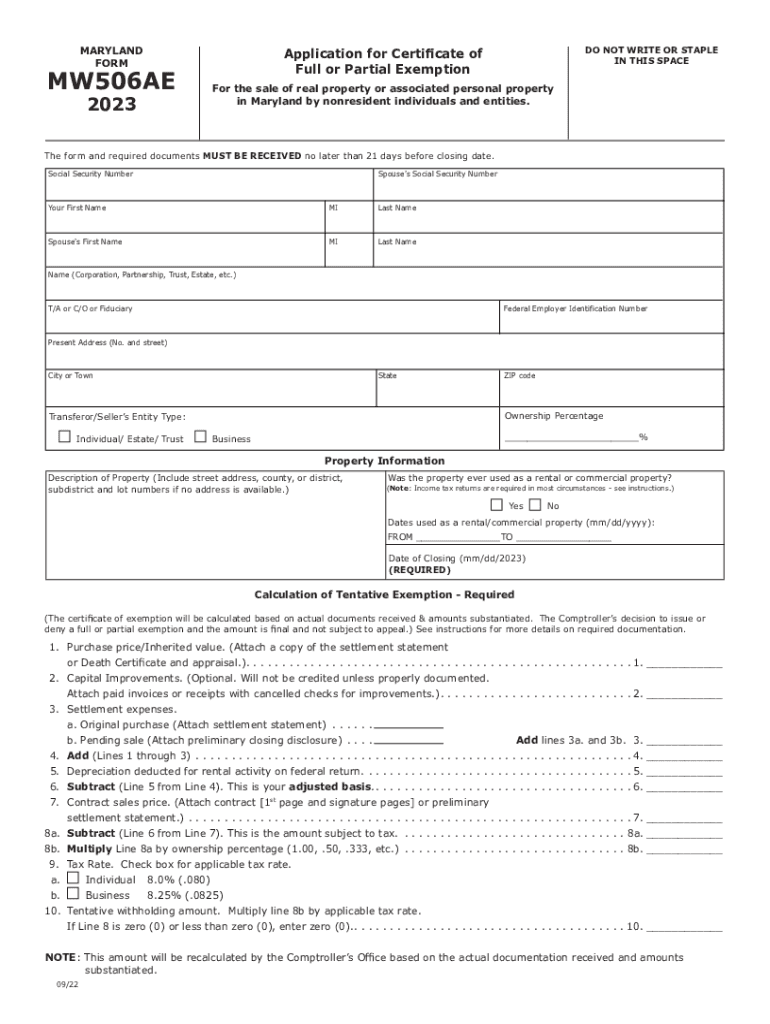

The MW506AE 2023 form is a critical document used by non-residents in Maryland to claim a tax exemption. This form specifically addresses the tax obligations of individuals who may not reside in Maryland but have income sourced from the state. Understanding the purpose and requirements of the MW506AE is essential for ensuring compliance with Maryland tax laws.

Steps to Complete the MW506AE 2023 Form

Completing the MW506AE 2023 form involves a series of straightforward steps:

- Gather necessary information, including your personal identification details and income sources.

- Fill out the form accurately, ensuring all sections are completed as required.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the appropriate Maryland tax authority.

Eligibility Criteria for the MW506AE 2023 Form

To qualify for using the MW506AE 2023 form, individuals must meet specific criteria:

- Must be a non-resident of Maryland.

- Must have income sourced from Maryland.

- Must not have a permanent establishment in Maryland.

Required Documents for the MW506AE 2023 Form

When filing the MW506AE 2023 form, certain documents are typically required:

- Proof of income earned in Maryland.

- Identification documents, such as a Social Security number or taxpayer identification number.

- Any previous tax returns that may support your exemption claim.

Filing Deadlines for the MW506AE 2023 Form

Timely submission of the MW506AE 2023 form is crucial to avoid penalties. The filing deadline generally aligns with the Maryland tax return due date, which is typically April fifteenth. It is advisable to check for any updates or changes to ensure compliance with current regulations.

Form Submission Methods for the MW506AE 2023 Form

The MW506AE 2023 form can be submitted through various methods:

- Online submission via the Maryland state tax website.

- Mailing the completed form to the designated tax office.

- In-person submission at local tax offices, if available.

Quick guide on how to complete sec 03 04 12 04 certificate of full or partial exemption

Effortlessly Prepare Sec 03 04 12 04 Certificate Of Full Or Partial Exemption on Any Device

Web-based document management has become increasingly popular among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Sec 03 04 12 04 Certificate Of Full Or Partial Exemption on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to Modify and eSign Sec 03 04 12 04 Certificate Of Full Or Partial Exemption with Ease

- Find Sec 03 04 12 04 Certificate Of Full Or Partial Exemption and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight relevant sections of your documents or obscure sensitive information using tools provided by airSlate SignNow specifically for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to deliver your form, via email, SMS, an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Sec 03 04 12 04 Certificate Of Full Or Partial Exemption to ensure effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sec 03 04 12 04 certificate of full or partial exemption

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 'maryland form full'?

The 'maryland form full' refers to the comprehensive document that requires signatures and specific information to fulfill various administrative purposes in Maryland. airSlate SignNow allows you to create, send, and eSign this form effortlessly, ensuring compliance and accuracy.

-

How does airSlate SignNow simplify the process of completing the 'maryland form full'?

With airSlate SignNow, you can easily fill out the 'maryland form full' online, which eliminates the need for paper forms. Our platform provides intuitive tools that simplify document editing and signing, ensuring a seamless experience for all users.

-

What are the pricing plans for using airSlate SignNow to manage the 'maryland form full'?

AirSlate SignNow offers flexible pricing plans that cater to different business needs. You can choose from monthly or annual subscriptions, and all plans provide full access to the features required to handle the 'maryland form full' effectively, making it cost-effective for organizations of any size.

-

Can I integrate airSlate SignNow with other applications for handling the 'maryland form full'?

Yes! AirSlate SignNow easily integrates with various applications, including CRMs and cloud storage services. This seamless integration allows you to manage the 'maryland form full' alongside your other business workflows, enhancing efficiency and productivity.

-

What are the benefits of using airSlate SignNow for the 'maryland form full'?

Using airSlate SignNow for the 'maryland form full' offers numerous benefits, including time savings and enhanced accuracy. With eSignature capabilities, you eliminate the hassle of printing and scanning, thus expediting your document processing.

-

Is the 'maryland form full' legally binding when signed through airSlate SignNow?

Absolutely! Signatures obtained through airSlate SignNow for the 'maryland form full' are legally binding and comply with all necessary regulations. Our platform ensures that your documents maintain their integrity and validity, satisfying legal requirements.

-

How secure is my data when using airSlate SignNow for the 'maryland form full'?

Security is a top priority for airSlate SignNow. When you’re handling the 'maryland form full', all data is encrypted and stored securely, ensuring that sensitive information remains protected from unauthorized access.

Get more for Sec 03 04 12 04 Certificate Of Full Or Partial Exemption

- Online selfexclusion removal request form

- Wisconsin dnr air pollution control permit application form

- Brownfield assessment grant invoice for professional services form

- Good cause claim dcf f dwsp2019 e division of family and economic security form

- Fees notaries publicwashington state wa dol form

- Dot form 224 032 construction agreement wsdot wa gov

- Please read these instructions carefully before completing the application form

- Virginia homeless and special needs housing funding form

Find out other Sec 03 04 12 04 Certificate Of Full Or Partial Exemption

- eSign Hawaii High Tech Claim Later

- How To eSign Hawaii High Tech Confidentiality Agreement

- How Do I eSign Hawaii High Tech Business Letter Template

- Can I eSign Hawaii High Tech Memorandum Of Understanding

- Help Me With eSign Kentucky Government Job Offer

- eSign Kentucky Healthcare / Medical Living Will Secure

- eSign Maine Government LLC Operating Agreement Fast

- eSign Kentucky Healthcare / Medical Last Will And Testament Free

- eSign Maine Healthcare / Medical LLC Operating Agreement Now

- eSign Louisiana High Tech LLC Operating Agreement Safe

- eSign Massachusetts Government Quitclaim Deed Fast

- How Do I eSign Massachusetts Government Arbitration Agreement

- eSign Maryland High Tech Claim Fast

- eSign Maine High Tech Affidavit Of Heirship Now

- eSign Michigan Government LLC Operating Agreement Online

- eSign Minnesota High Tech Rental Lease Agreement Myself

- eSign Minnesota High Tech Rental Lease Agreement Free

- eSign Michigan Healthcare / Medical Permission Slip Now

- eSign Montana High Tech Lease Agreement Online

- eSign Mississippi Government LLC Operating Agreement Easy