MW506NRS49 010423 B MW506NRS49 010423 B Form

Understanding the Maryland Tax Form MW506NRS

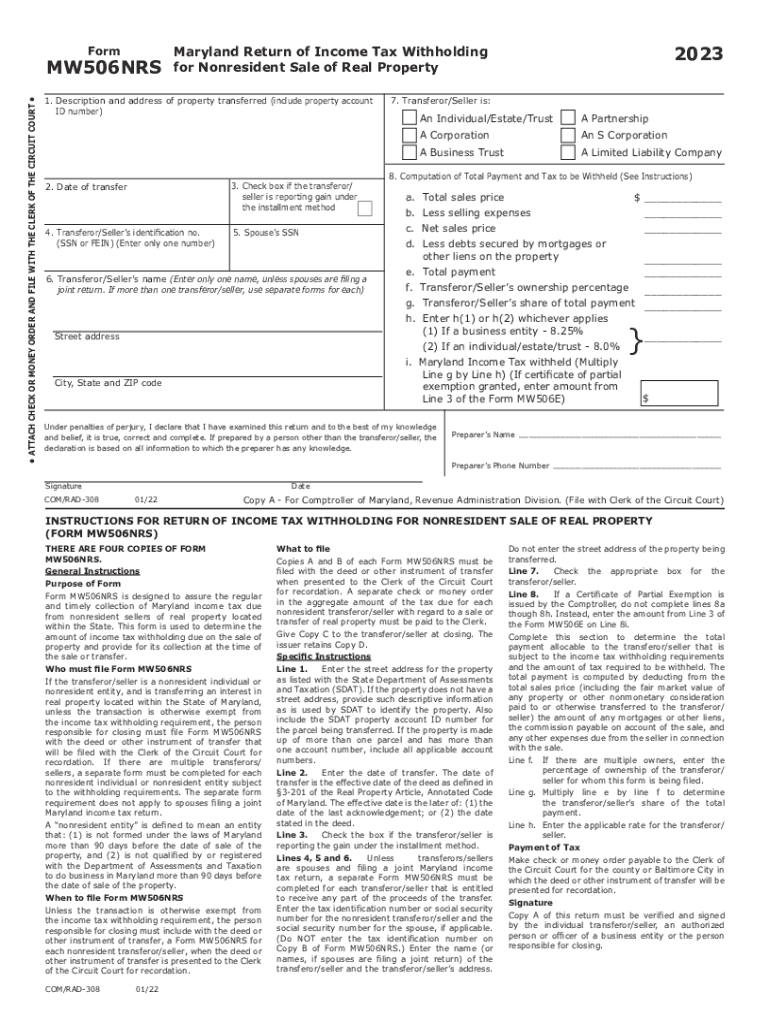

The Maryland tax form MW506NRS is specifically designed for nonresidents who are required to report income derived from real property transactions in Maryland. This form is essential for individuals and entities that have sold or transferred real estate within the state, ensuring compliance with Maryland’s tax withholding regulations. The MW506NRS form allows the Maryland Comptroller to collect taxes on income generated from these transactions, which is crucial for maintaining state revenue.

Steps to Complete the MW506NRS Form

Completing the MW506NRS form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary information, including details about the property transaction and the parties involved. Next, fill out the form by providing your name, address, and the specifics of the transaction. It is important to accurately calculate the withholding amount based on the sale price and applicable tax rates. Finally, review the completed form for any errors before submitting it.

Required Documents for MW506NRS Submission

When submitting the MW506NRS form, certain documents are essential for verification and compliance. These typically include:

- Proof of ownership of the real property

- Settlement statement or closing disclosure

- Identification details of the seller and buyer

- Any prior tax documents related to the property

Having these documents ready will facilitate a smoother submission process and help avoid delays.

Filing Deadlines for the MW506NRS Form

Timely filing of the MW506NRS form is crucial to avoid penalties. Generally, the form must be filed at the time of the real property transfer. It is advisable to check the specific deadlines related to your transaction, as they may vary based on the nature of the sale and the parties involved. Keeping track of these deadlines ensures compliance with Maryland tax regulations.

Digital Submission of the MW506NRS Form

The MW506NRS form can be submitted digitally, which streamlines the process for taxpayers. Utilizing electronic filing methods reduces the risk of errors and expedites processing times. Ensure that you have the necessary software or access to online platforms that support the submission of Maryland tax forms. Digital submission is often preferred for its convenience and efficiency.

Penalties for Non-Compliance with the MW506NRS

Failure to file the MW506NRS form or to remit the required withholding tax can result in significant penalties. Maryland imposes fines and interest on unpaid taxes, which can accumulate over time. It is important to understand these consequences and ensure that all necessary forms and payments are submitted on time to avoid financial repercussions.

Quick guide on how to complete mw506nrs49 010423 b mw506nrs49 010423 b

Effortlessly Prepare MW506NRS49 010423 B MW506NRS49 010423 B on Any Gadget

Managing documents online has become increasingly favored by both businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can easily locate the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without any hold-ups. Manage MW506NRS49 010423 B MW506NRS49 010423 B on any gadget using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The Easiest Way to Modify and eSign MW506NRS49 010423 B MW506NRS49 010423 B Effortlessly

- Obtain MW506NRS49 010423 B MW506NRS49 010423 B and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign feature, which only takes seconds and carries the same legal validity as a conventional handwritten signature.

- Review the information carefully and click on the Done button to save your changes.

- Select how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassles of lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign MW506NRS49 010423 B MW506NRS49 010423 B while ensuring outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mw506nrs49 010423 b mw506nrs49 010423 b

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Maryland MW506NRS form and why is it important?

The Maryland MW506NRS form is used for reporting income tax withheld on certain non-resident payments. It is crucial for businesses that engage with non-resident workers to ensure compliance with state tax laws. Using the Maryland MW506NRS form correctly helps avoid any penalties associated with incorrect filing.

-

How can airSlate SignNow assist in signing the Maryland MW506NRS form?

airSlate SignNow provides a user-friendly platform for businesses to electronically sign the Maryland MW506NRS form. With features like templates and secure cloud storage, you can streamline the signing process, making it efficient and compliant with each deadline. It simplifies collaboration between multiple parties who need to sign the form.

-

Is airSlate SignNow a cost-effective option for managing the Maryland MW506NRS form?

Yes, airSlate SignNow offers flexible pricing plans to suit diverse business needs, making it a cost-effective choice for managing the Maryland MW506NRS form. By eliminating the need for physical paperwork and expediting signature collection, businesses save time and reduce costs. This efficiency can be vital for services requiring frequent submissions of tax forms.

-

What features does airSlate SignNow offer for filling out the Maryland MW506NRS form?

AirSlate SignNow includes features such as customizable templates, automated workflows, and advanced security measures tailored for the Maryland MW506NRS form. These features facilitate easy form completion and ensure that documents are securely processed. Additionally, the platform supports easy integration with existing business applications.

-

Can I integrate airSlate SignNow with other software for handling the Maryland MW506NRS form?

Absolutely! airSlate SignNow allows for seamless integration with various business applications, improving the process of managing the Maryland MW506NRS form. This means you can easily sync data, eliminate manual entry, and ensure consistent documentation across your systems. Popular integrations include CRMs and human resource management tools.

-

How does eSigning the Maryland MW506NRS form enhance compliance?

Using airSlate SignNow for eSigning the Maryland MW506NRS form enhances compliance by ensuring that all signatures are captured securely and logged. This creates a clear audit trail that can be referenced in case of disputes or audits. Additionally, electronic signatures are legally binding, which further reinforces compliance with state regulations.

-

What support does airSlate SignNow provide for users filling out the Maryland MW506NRS form?

airSlate SignNow offers comprehensive support for users, including tutorials, a dedicated help center, and customer support for any inquiries related to the Maryland MW506NRS form. Whether you're facing technical issues or need assistance with specific features, help is readily available. This ensures a smooth experience for all users.

Get more for MW506NRS49 010423 B MW506NRS49 010423 B

- Rapid rhtest results form wagner meters

- Baptized and changed 9 in those days jesus came form

- From the moment a child is born they start to communicate with those form

- Lgbt status qualifiers fo r business owners my nglcc form

- Hsbc dispute form fill online printable fillable blank

- Content form 34890040

- Embank m broad bonus rewards program level 8 me form

- Form for reservation of a registration mark national transport

Find out other MW506NRS49 010423 B MW506NRS49 010423 B

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement