WV it 104 Employee's Withholding Exemption Certificate Form

What is the WV IT 104 Employee's Withholding Exemption Certificate

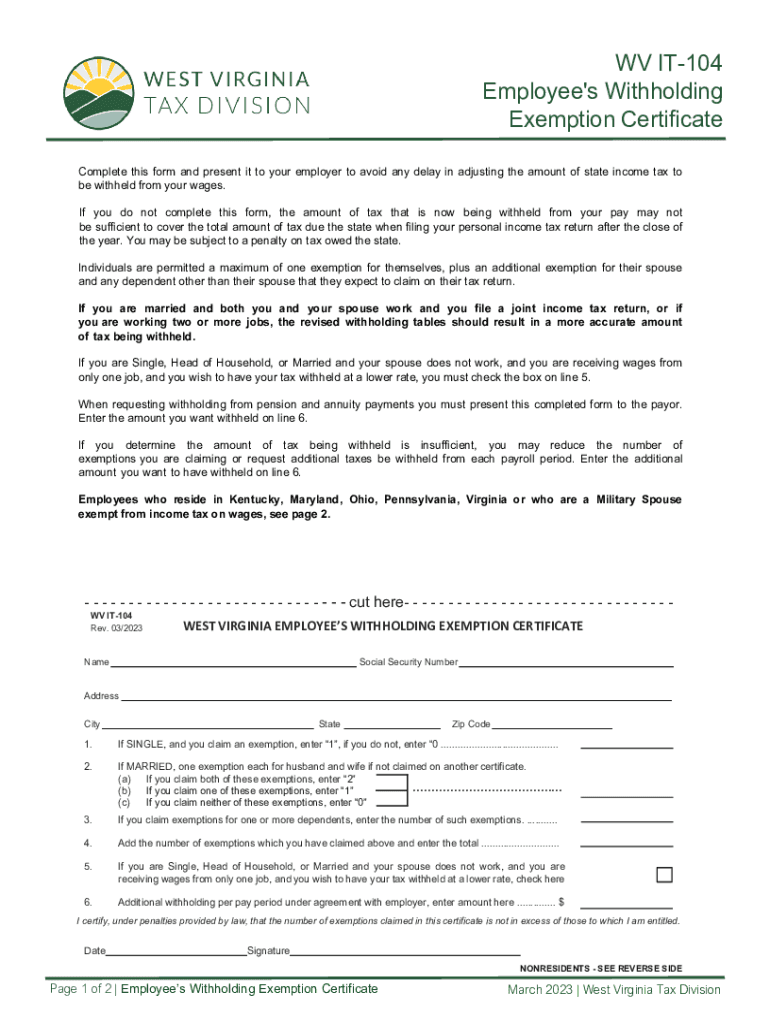

The WV IT 104 is an Employee's Withholding Exemption Certificate used in West Virginia to determine the amount of state income tax to withhold from an employee's paycheck. This form allows employees to claim exemptions from withholding based on their personal circumstances, such as income level or dependency status. Understanding this form is crucial for both employers and employees to ensure compliance with state tax regulations.

How to use the WV IT 104 Employee's Withholding Exemption Certificate

To use the WV IT 104, employees must complete the form accurately and submit it to their employer. The employer will then use the information provided to calculate the appropriate amount of state income tax to withhold from the employee's wages. If an employee qualifies for exemptions, they can reduce their withholding amount, which may result in a higher take-home pay. It's important to review the form annually or when personal circumstances change.

Steps to complete the WV IT 104 Employee's Withholding Exemption Certificate

Completing the WV IT 104 involves several straightforward steps:

- Obtain the form from your employer or download it from the West Virginia State Tax Department website.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate the number of exemptions you are claiming based on your situation.

- Sign and date the form to certify that the information is accurate.

- Submit the completed form to your employer for processing.

Key elements of the WV IT 104 Employee's Withholding Exemption Certificate

The key elements of the WV IT 104 include personal identification details, the number of exemptions claimed, and a declaration of eligibility for those exemptions. Employees must provide accurate information to avoid issues with tax withholding. Additionally, the form includes instructions on how to calculate the number of exemptions based on factors such as dependents and income.

Eligibility Criteria for the WV IT 104 Employee's Withholding Exemption Certificate

Eligibility for claiming exemptions on the WV IT 104 is generally based on the employee's income level and personal circumstances. Employees may qualify for exemptions if they expect to owe no West Virginia income tax for the year or if their income falls below a certain threshold. It is essential for employees to review their financial situation each year to determine their eligibility accurately.

Filing Deadlines / Important Dates

Employees should be aware of important deadlines related to the WV IT 104. While there is no specific filing deadline for submitting the form to an employer, it should be completed and submitted before the first paycheck of the year to ensure correct withholding. Additionally, employees should keep track of state tax filing deadlines to avoid penalties.

Quick guide on how to complete wv it 104 employees withholding exemption certificate

Prepare WV IT 104 Employee's Withholding Exemption Certificate effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to find the necessary form and securely keep it online. airSlate SignNow provides you with all the tools you require to create, modify, and electronically sign your documents quickly and without delays. Manage WV IT 104 Employee's Withholding Exemption Certificate on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to edit and electronically sign WV IT 104 Employee's Withholding Exemption Certificate with ease

- Obtain WV IT 104 Employee's Withholding Exemption Certificate and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your electronic signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the information and then click on the Done button to save your modifications.

- Select how you wish to share your form, whether by email, SMS, an invitation link, or downloading it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that require new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign WV IT 104 Employee's Withholding Exemption Certificate to ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wv it 104 employees withholding exemption certificate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is wv it 104 and how does it relate to airSlate SignNow?

Wv it 104 refers to a key form used in documents related to tax and financial reporting. airSlate SignNow supports the efficient signing and management of such documents, ensuring compliance and ease of use for businesses handling wv it 104 forms.

-

How much does airSlate SignNow cost for handling wv it 104 forms?

airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. Pricing varies based on features and the number of users, making it a cost-effective solution for managing wv it 104 forms and related documents.

-

What features does airSlate SignNow provide for wv it 104 document signing?

airSlate SignNow provides features like customizable templates, in-app notifications, and secure cloud storage for wv it 104 documents. These features enhance the signing process, making it faster and more efficient for users.

-

Can I integrate airSlate SignNow with other software for managing wv it 104 forms?

Yes, airSlate SignNow offers integrations with various software applications, allowing seamless management of wv it 104 forms. Integrating with your existing systems can streamline your workflow and enhance productivity.

-

What are the benefits of using airSlate SignNow for wv it 104 forms?

Using airSlate SignNow for wv it 104 forms provides businesses with speed, security, and convenience. Companies can electronically sign and send these forms quickly while ensuring compliance and protecting sensitive information.

-

Is it easy to use airSlate SignNow for wv it 104 document workflows?

Absolutely! airSlate SignNow is designed to be user-friendly, making it easy for anyone to manage wv it 104 document workflows. With an intuitive interface and step-by-step guidance, users can quickly adapt to the system.

-

How does airSlate SignNow ensure the security of wv it 104 documents?

airSlate SignNow employs advanced encryption and security protocols to protect wv it 104 documents. With industry-standard security measures, you can trust that your document signing and storage are safe and compliant.

Get more for WV IT 104 Employee's Withholding Exemption Certificate

- D league lpt player releaseeligibility form doc

- Cbre bid submission form bofa pdf pro construction inc

- Special power of attorney for representation in the extraordinary general meeting of the shareholders of comvex s comvex form

- Www dcc educulinary artsapplyculinary arts application delgado community college form

- Shippers letter of instruction rhlig logistics form

- Adavit for purchase of motor vehicles form

- Kernan hospital medical records form

- Form 5 doc

Find out other WV IT 104 Employee's Withholding Exemption Certificate

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast