Unrelated Business Income Tax Ubit Questionnaire 2024-2026

What is the Unrelated Business Income Tax UBIT Questionnaire

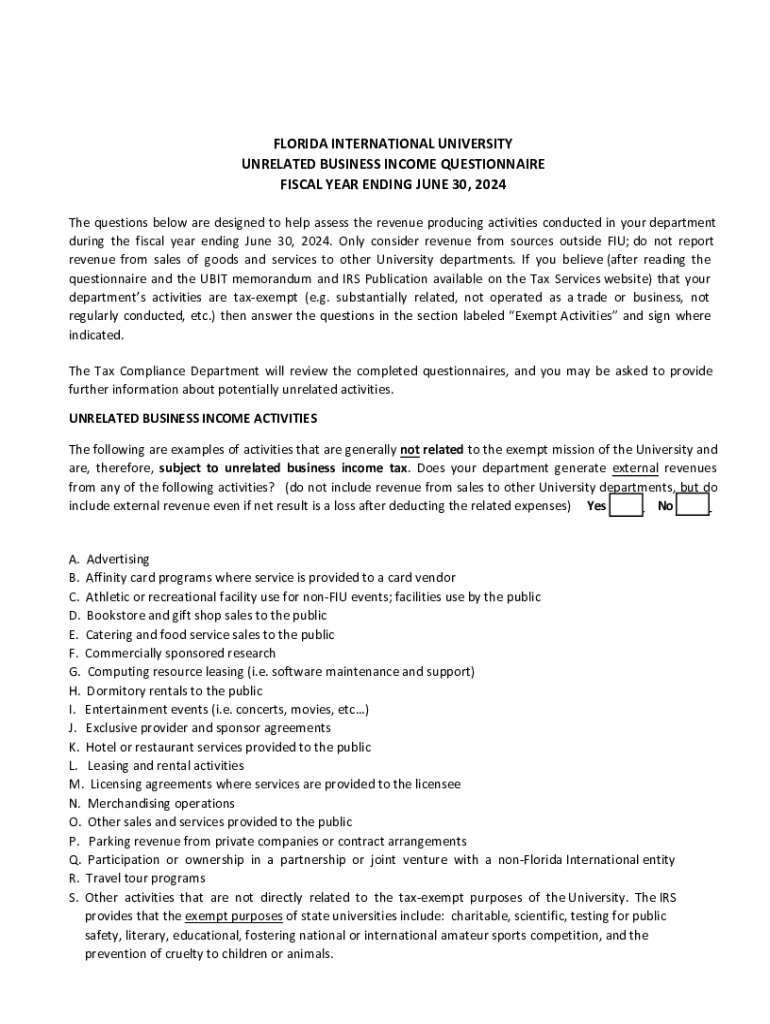

The Unrelated Business Income Tax (UBIT) Questionnaire is a vital document used by tax-exempt organizations to determine if they have any unrelated business income. This income is generated from activities that are not substantially related to the organization's exempt purpose. The UBIT Questionnaire helps organizations assess their tax obligations and ensures compliance with IRS regulations. Understanding this form is essential for maintaining tax-exempt status while engaging in various business activities.

How to use the Unrelated Business Income Tax UBIT Questionnaire

Using the UBIT Questionnaire involves a systematic approach to evaluate potential unrelated business income. Organizations should begin by reviewing their income sources and identifying activities that may fall under UBIT. The questionnaire prompts users to provide detailed information about these activities, including the nature of the business, revenue generated, and expenses incurred. Properly completing this form allows organizations to accurately report their unrelated business income and avoid penalties.

Steps to complete the Unrelated Business Income Tax UBIT Questionnaire

Completing the UBIT Questionnaire requires careful attention to detail. Here are the steps to follow:

- Gather necessary financial records related to all business activities.

- Identify any income streams that may be considered unrelated to the organization's exempt purpose.

- Fill out the questionnaire, providing accurate descriptions of each activity.

- Calculate the total income and expenses associated with unrelated business activities.

- Review the completed questionnaire for accuracy before submission.

Key elements of the Unrelated Business Income Tax UBIT Questionnaire

The UBIT Questionnaire includes several key elements that are crucial for accurate reporting. These elements typically encompass:

- Identification of the organization and its exempt purpose.

- Detailed descriptions of each unrelated business activity.

- Financial data, including gross income and related expenses.

- Information on any applicable deductions or exemptions.

Understanding these components is essential for ensuring compliance and accurately reporting unrelated business income.

Legal use of the Unrelated Business Income Tax UBIT Questionnaire

The UBIT Questionnaire is legally required for tax-exempt organizations that engage in unrelated business activities. Accurate completion and submission of this form help organizations comply with IRS regulations and avoid potential penalties. It is essential for organizations to understand their legal obligations regarding unrelated business income and to use the questionnaire as a tool for transparency and accountability in their financial reporting.

Filing Deadlines / Important Dates

Organizations must be aware of specific filing deadlines associated with the UBIT Questionnaire. Generally, the form should be submitted along with the organization's annual tax return. It is important to stay informed about any changes in deadlines, as failure to file on time can result in penalties. Organizations should mark their calendars with important dates to ensure compliance and avoid any disruptions in their tax-exempt status.

Quick guide on how to complete unrelated business income tax ubit questionnaire

Effortlessly Prepare Unrelated Business Income Tax ubit Questionnaire on Any Device

Digital document management has gained popularity among both companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can obtain the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents promptly without delays. Manage Unrelated Business Income Tax ubit Questionnaire across any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to edit and eSign Unrelated Business Income Tax ubit Questionnaire effortlessly

- Find Unrelated Business Income Tax ubit Questionnaire and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose how you wish to share your form—via email, SMS, an invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow satisfies all your document management needs within a few clicks from your preferred device. Modify and eSign Unrelated Business Income Tax ubit Questionnaire to ensure exceptional communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct unrelated business income tax ubit questionnaire

Create this form in 5 minutes!

How to create an eSignature for the unrelated business income tax ubit questionnaire

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the FIU UBIT questionnaire form PDF?

The FIU UBIT questionnaire form PDF is a document designed to help organizations assess unrelated business income tax obligations. It simplifies the process of gathering necessary information for compliance. By using this form, businesses can ensure they meet regulatory requirements efficiently.

-

How can I access the FIU UBIT questionnaire form PDF?

You can easily access the FIU UBIT questionnaire form PDF through our platform. Simply navigate to the document section, and you will find the form available for download. This ensures you have the latest version for your compliance needs.

-

Is there a cost associated with using the FIU UBIT questionnaire form PDF?

Using the FIU UBIT questionnaire form PDF through airSlate SignNow is part of our subscription plans. We offer various pricing tiers to accommodate different business needs. This cost-effective solution allows you to manage your documents without breaking the bank.

-

What features does airSlate SignNow offer for the FIU UBIT questionnaire form PDF?

airSlate SignNow provides features such as eSigning, document sharing, and secure storage for the FIU UBIT questionnaire form PDF. These tools enhance collaboration and streamline the completion process. Our platform is designed to make document management simple and efficient.

-

Can I integrate the FIU UBIT questionnaire form PDF with other software?

Yes, airSlate SignNow allows for seamless integration with various software applications. This means you can easily incorporate the FIU UBIT questionnaire form PDF into your existing workflows. Integrations enhance productivity and ensure a smooth user experience.

-

What are the benefits of using the FIU UBIT questionnaire form PDF with airSlate SignNow?

Using the FIU UBIT questionnaire form PDF with airSlate SignNow offers numerous benefits, including time savings and improved accuracy. Our platform automates many processes, reducing the risk of errors. Additionally, you can track document status in real-time, enhancing accountability.

-

How secure is the FIU UBIT questionnaire form PDF on airSlate SignNow?

Security is a top priority at airSlate SignNow. The FIU UBIT questionnaire form PDF is protected with advanced encryption and secure access controls. This ensures that your sensitive information remains confidential and safe from unauthorized access.

Get more for Unrelated Business Income Tax ubit Questionnaire

- Tn workers compensation 497326953 form

- Common carrier form

- Agreement of general contractor for workers compensation tennessee form

- Notice of termination of agreement general contractor for workers compensation tennessee form

- Tennessee workers compensation 497326957 form

- Tennessee annual file form

- Notices resolutions simple stock ledger and certificate tennessee form

- Minutes organizational meeting 497326960 form

Find out other Unrelated Business Income Tax ubit Questionnaire

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template