D 101a Form 1 ES Instructions Estimated Income Tax for Individuals, Estates, and Trusts Form 1 ES Instructions 2022

What is the D 101a Form 1 ES Instructions Estimated Income Tax For Individuals, Estates, And Trusts Form 1 ES Instructions

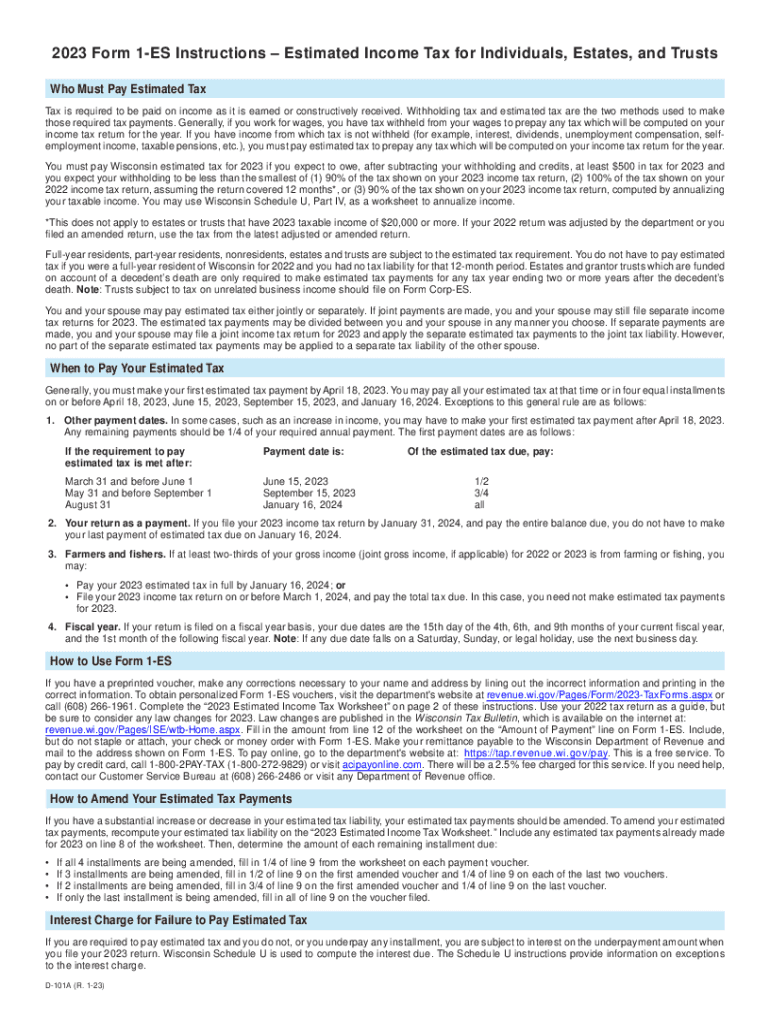

The D 101a Form 1 ES Instructions are essential guidelines for individuals, estates, and trusts to calculate and pay estimated income tax. This form is used primarily by taxpayers who expect to owe tax of $1,000 or more when filing their return. It provides detailed instructions on how to estimate tax liabilities accurately, ensuring compliance with federal tax regulations. Understanding this form is crucial for managing tax obligations effectively and avoiding penalties.

Steps to complete the D 101a Form 1 ES Instructions Estimated Income Tax For Individuals, Estates, And Trusts Form 1 ES Instructions

Completing the D 101a Form 1 ES Instructions involves several key steps:

- Gather necessary financial information, including income sources and deductions.

- Calculate your expected taxable income for the year.

- Use the provided tax tables to determine your estimated tax liability.

- Complete the form by entering your calculated amounts in the appropriate fields.

- Review the form for accuracy before submission.

Following these steps will help ensure that you provide accurate information, reducing the risk of errors and potential penalties.

How to obtain the D 101a Form 1 ES Instructions Estimated Income Tax For Individuals, Estates, And Trusts Form 1 ES Instructions

The D 101a Form 1 ES Instructions can be obtained through various channels. Taxpayers can download the form directly from the official state tax authority website. Alternatively, physical copies may be available at local tax offices or libraries. It is advisable to ensure that you are using the most current version of the form to comply with any recent changes in tax regulations.

Filing Deadlines / Important Dates

Filing deadlines for the D 101a Form 1 ES Instructions are critical for compliance. Generally, estimated tax payments are due quarterly, with specific deadlines typically falling on April 15, June 15, September 15, and January 15 of the following year. It is important to mark these dates on your calendar to avoid late payment penalties and interest charges.

Key elements of the D 101a Form 1 ES Instructions Estimated Income Tax For Individuals, Estates, And Trusts Form 1 ES Instructions

Key elements of the D 101a Form 1 ES Instructions include:

- Identification of taxpayer information, such as name and Social Security number.

- Sections for reporting expected income and deductions.

- Calculation fields for determining estimated tax payments.

- Instructions for payment methods and submission.

Each of these elements plays a vital role in ensuring that taxpayers can accurately report their estimated tax obligations.

IRS Guidelines

The IRS provides comprehensive guidelines for completing the D 101a Form 1 ES Instructions. These guidelines include information on eligibility, calculation methods, and acceptable payment methods. Taxpayers are encouraged to refer to the IRS website or consult tax professionals for clarification on any complex issues related to their estimated tax obligations.

Quick guide on how to complete d 101a form 1 es instructions estimated income tax for individuals estates and trusts form 1 es instructions

Complete D 101a Form 1 ES Instructions Estimated Income Tax For Individuals, Estates, And Trusts Form 1 ES Instructions with ease on any device

Digital document management has gained traction among businesses and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed paperwork, as you can obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage D 101a Form 1 ES Instructions Estimated Income Tax For Individuals, Estates, And Trusts Form 1 ES Instructions on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven operation today.

The easiest way to update and eSign D 101a Form 1 ES Instructions Estimated Income Tax For Individuals, Estates, And Trusts Form 1 ES Instructions seamlessly

- Locate D 101a Form 1 ES Instructions Estimated Income Tax For Individuals, Estates, And Trusts Form 1 ES Instructions and then click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal standing as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Choose how you would like to deliver your form, via email, text message (SMS), or invite link, or download it to your computer.

Forget about misplaced or lost documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Alter and eSign D 101a Form 1 ES Instructions Estimated Income Tax For Individuals, Estates, And Trusts Form 1 ES Instructions and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct d 101a form 1 es instructions estimated income tax for individuals estates and trusts form 1 es instructions

Create this form in 5 minutes!

How to create an eSignature for the d 101a form 1 es instructions estimated income tax for individuals estates and trusts form 1 es instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the D 101a Form 1 ES Instructions Estimated Income Tax For Individuals, Estates, And Trusts Form 1 ES Instructions?

The D 101a Form 1 ES Instructions Estimated Income Tax For Individuals, Estates, And Trusts Form 1 ES Instructions provides detailed guidance on how to calculate and pay estimated income taxes for individuals, estates, and trusts. This form is essential for ensuring compliance with tax obligations and avoiding penalties related to underpayment of taxes.

-

How much does it cost to use the features related to the D 101a Form 1 ES Instructions Estimated Income Tax For Individuals, Estates, And Trusts Form 1 ES Instructions?

Using airSlate SignNow to manage your D 101a Form 1 ES Instructions Estimated Income Tax For Individuals, Estates, And Trusts Form 1 ES Instructions comes with a variety of pricing plans designed to fit different business needs. The costs are competitive, ensuring that you receive a cost-effective solution while handling your document management effortlessly.

-

What are the main benefits of utilizing airSlate SignNow for D 101a Form 1 ES Instructions?

By using airSlate SignNow for your D 101a Form 1 ES Instructions Estimated Income Tax For Individuals, Estates, And Trusts Form 1 ES Instructions, you streamline your document workflow, ensuring faster and more secure document handling. The platform enhances collaboration, reduces errors, and allows for easy tracking of document status and signatures.

-

Can I integrate airSlate SignNow with other software to facilitate the D 101a Form 1 ES Instructions process?

Yes, airSlate SignNow offers seamless integration with various third-party applications, making the process of managing your D 101a Form 1 ES Instructions Estimated Income Tax For Individuals, Estates, And Trusts Form 1 ES Instructions more efficient. This allows you to synchronize data across platforms, improving your overall workflow and productivity.

-

Is electronic signing of the D 101a Form 1 ES Instructions legally binding?

Absolutely! Electronic signatures created using airSlate SignNow for the D 101a Form 1 ES Instructions Estimated Income Tax For Individuals, Estates, And Trusts Form 1 ES Instructions are legally binding and compliant with federal and state laws. This feature ensures that your signed documents are valid in legal matters and can be securely stored.

-

What features does airSlate SignNow offer to assist with the D 101a Form 1 ES Instructions?

airSlate SignNow offers a wide range of features to assist with the D 101a Form 1 ES Instructions Estimated Income Tax For Individuals, Estates, And Trusts Form 1 ES Instructions, such as templates for quick document creation, advanced security features, and automated workflows. These tools not only simplify the process but also ensure your data remains protected.

-

How user-friendly is airSlate SignNow when it comes to the D 101a Form 1 ES Instructions?

airSlate SignNow is designed with a focus on user-friendliness, making it easy for individuals and businesses to navigate through the D 101a Form 1 ES Instructions Estimated Income Tax For Individuals, Estates, And Trusts Form 1 ES Instructions process. With an intuitive interface, users can quickly learn how to create, send, and manage documents without extensive training.

Get more for D 101a Form 1 ES Instructions Estimated Income Tax For Individuals, Estates, And Trusts Form 1 ES Instructions

- Bt welcoming business nomination form indd

- Building permit city of decatur form

- Design environment form

- Boe 502 ah oakland form

- Principals address form

- Planning subdivision fees and forms government of waplanning subdivision fees and forms government of waunderstanding the

- Business credit application 609120624 form

- Demolition permit dem application planning ampamp building form

Find out other D 101a Form 1 ES Instructions Estimated Income Tax For Individuals, Estates, And Trusts Form 1 ES Instructions

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document