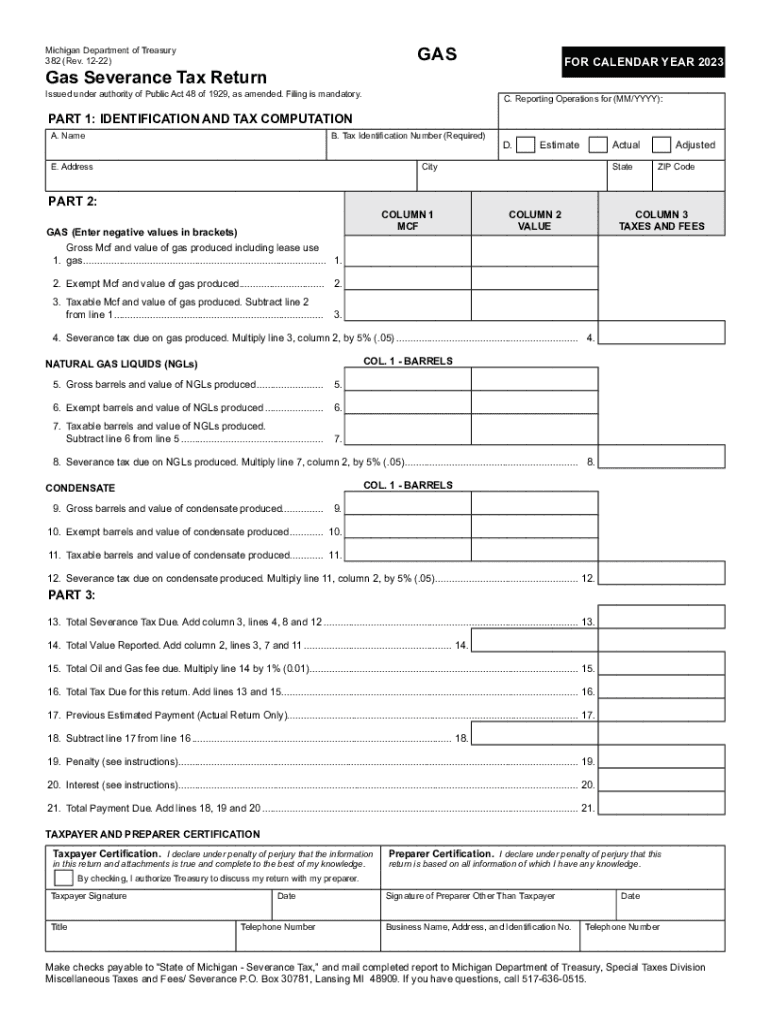

382, Gas Severance Tax Return Form

What is the Michigan 382, Gas Severance Tax Return

The Michigan 382 form, also known as the Gas Severance Tax Return, is a tax document used by businesses and individuals engaged in the extraction of natural gas in Michigan. This form is essential for reporting the amount of gas severed from the ground and calculating the severance tax owed to the state. The severance tax is a tax on the extraction of non-renewable resources, and it plays a crucial role in funding state services.

How to Use the Michigan 382, Gas Severance Tax Return

To effectively use the Michigan 382 form, taxpayers must first gather all relevant data regarding the volume of gas extracted during the reporting period. This includes production records and any applicable deductions. Once the information is compiled, taxpayers can fill out the form, ensuring that all sections are completed accurately. It is important to review the completed form for any errors before submission to avoid penalties.

Steps to Complete the Michigan 382, Gas Severance Tax Return

Completing the Michigan 382 form involves several key steps:

- Collect production data: Gather all records related to the amount of gas extracted during the reporting period.

- Fill out the form: Input the collected data into the appropriate sections of the Michigan 382 form.

- Calculate the tax owed: Use the provided tax rates to determine the total severance tax liability.

- Review the form: Check for accuracy and completeness to prevent errors that could lead to penalties.

- Submit the form: File the completed form by the designated deadline either online or by mail.

Filing Deadlines / Important Dates

Timely filing of the Michigan 382 form is crucial to avoid penalties. The filing deadline for the Gas Severance Tax Return is typically on or before the last day of the month following the end of the reporting period. For example, if the reporting period ends on December 31, the form must be filed by January 31 of the following year. It is advisable to keep track of any changes in deadlines or requirements by consulting state resources.

Required Documents

When preparing to file the Michigan 382 form, several documents are necessary to ensure accurate reporting:

- Production records detailing the amount of gas extracted.

- Invoices or receipts related to gas sales.

- Any relevant deductions or credits documentation.

- Prior year tax returns, if applicable, for reference.

Penalties for Non-Compliance

Failing to file the Michigan 382 form on time or inaccurately reporting information can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is essential for taxpayers to understand the importance of compliance and to take necessary steps to ensure that all filings are completed correctly and on time.

Quick guide on how to complete 382 gas severance tax return

Effortlessly prepare 382, Gas Severance Tax Return on any device

Digital document management has gained traction among both businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage 382, Gas Severance Tax Return on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest method to modify and electronically sign 382, Gas Severance Tax Return with ease

- Find 382, Gas Severance Tax Return and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Generate your electronic signature with the Sign tool, which takes moments and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, exhausting form searches, or mistakes that necessitate printing new copies of documents. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign 382, Gas Severance Tax Return to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 382 gas severance tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a treasury 382 return PDF and why do I need it?

A treasury 382 return PDF is a vital document used primarily for tax reporting related to employee stock options and other compensatory arrangements. Businesses need this PDF to ensure compliance with IRS regulations and accurately report taxable income. Using airSlate SignNow simplifies the process of managing and signing this document.

-

How can airSlate SignNow help me prepare a treasury 382 return PDF?

airSlate SignNow provides a user-friendly platform that allows you to easily create, fill, and send your treasury 382 return PDF. The platform offers templates and electronic signature capabilities to streamline the process, making it efficient and reliable. This helps reduce the time and effort involved in generating tax-related documents.

-

Is there a cost associated with generating a treasury 382 return PDF using airSlate SignNow?

Yes, there is a pricing structure for using airSlate SignNow, which varies based on the features you choose. However, the service is designed to be cost-effective, ensuring that businesses can manage their treasury 382 return PDF needs without breaking the bank. It's worth comparing pricing options to find a plan that suits your budget.

-

What features does airSlate SignNow offer for managing treasury 382 return PDFs?

airSlate SignNow offers extensive features for managing treasury 382 return PDFs, including easy document creation, advanced collaboration tools, and secure electronic signatures. Users can track document status in real-time, ensuring nothing gets overlooked during the signing process. These features simplify compliance and enhance overall productivity.

-

Can I integrate airSlate SignNow with other software for treasury 382 return PDFs?

Absolutely! airSlate SignNow supports various integrations with popular accounting and HR software, making it convenient to manage your treasury 382 return PDFs within your existing workflows. This interoperability allows for seamless data transfer and improves efficiency, reducing the risk of errors during document processing.

-

What are the security measures in place for treasury 382 return PDFs on airSlate SignNow?

Security is a top priority at airSlate SignNow. When handling treasury 382 return PDFs, our platform employs advanced encryption standards, secure cloud storage, and user authentication protocols to protect sensitive information. This ensures that your documents remain confidential and secure throughout the entire signing process.

-

How does eSigning a treasury 382 return PDF work in airSlate SignNow?

Signing a treasury 382 return PDF in airSlate SignNow is straightforward. Once the document is prepared, you can send it to signers via email. They simply click the link, review the document, and use their electronic signature to approve it—ensuring a quick and hassle-free process for all parties involved.

Get more for 382, Gas Severance Tax Return

- Bvicaps form

- No known loss statement date ramsgate insurance inc form

- Sunlighten saunas release form the lindsey group massage

- Deed of secondary conveyance of incorporeal hereditaments template form

- Applying to change conditions or extend your stay in form

- Department of the secretary of state bureau of mot form

- Missouri department of social services family form

- Xi 15 a nursing intake assessment form

Find out other 382, Gas Severance Tax Return

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors