Sales and Use Tax Refund Checklist Form

Understanding the Ohio Use Tax Refund Checklist

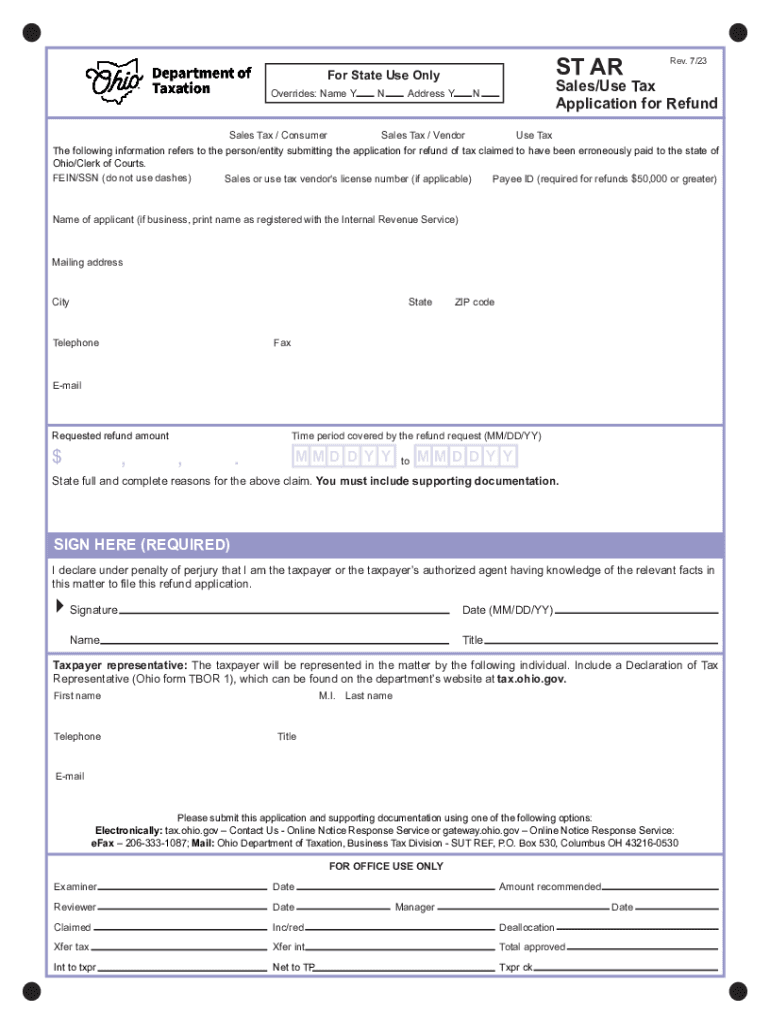

The Ohio use tax refund checklist is a vital tool for individuals and businesses seeking to reclaim overpaid use tax. This checklist outlines the necessary steps and documentation required to ensure a smooth refund process. It includes information on eligible purchases, applicable tax rates, and specific situations that may qualify for a refund. Familiarizing yourself with this checklist can help streamline the application process and improve the chances of a successful refund.

Steps to Complete the Ohio Use Tax Refund Checklist

Completing the Ohio use tax refund checklist involves several key steps:

- Gather all relevant purchase receipts and documentation.

- Identify the items that qualify for a refund based on Ohio tax regulations.

- Fill out the appropriate forms, including the Ohio ST AR form, accurately.

- Review your application for completeness and accuracy before submission.

- Submit your application via the preferred method, whether online, by mail, or in person.

Required Documents for Ohio Use Tax Refund

To successfully apply for an Ohio use tax refund, you will need to provide specific documentation. This typically includes:

- Receipts or invoices for purchases made.

- Proof of payment of the use tax.

- Completed Ohio ST AR form.

- Any additional documentation that supports your claim, such as exemption certificates if applicable.

Filing Deadlines for Ohio Use Tax Refund

It is essential to be aware of the filing deadlines for the Ohio use tax refund. Generally, claims must be submitted within four years from the date of the original purchase. Missing this deadline may result in the forfeiture of your refund. Keeping track of these dates can help ensure that your application is timely and valid.

Eligibility Criteria for Ohio Use Tax Refund

To qualify for an Ohio use tax refund, certain eligibility criteria must be met. These include:

- The items purchased must be subject to use tax.

- The tax must have been paid to the state of Ohio.

- The claimant must have documentation proving the purchase and tax payment.

- Claims must be filed within the specified time frame.

Form Submission Methods for Ohio Use Tax Refund

There are various methods available for submitting your Ohio use tax refund application. These methods include:

- Online submission through the Ohio Department of Taxation website.

- Mailing the completed forms to the appropriate tax office.

- In-person submission at designated tax offices if preferred.

Key Elements of the Ohio Use Tax Refund Process

Understanding the key elements of the Ohio use tax refund process can enhance your experience. Important aspects include:

- Accurate completion of the required forms.

- Timely submission of your application.

- Providing comprehensive documentation to support your claim.

- Awareness of any potential follow-up requests from the tax authority.

Quick guide on how to complete sales and use tax refund checklist

Complete Sales And Use Tax Refund Checklist effortlessly on any device

Managing documents online has gained popularity among organizations and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, as you can easily find the necessary form and securely keep it online. airSlate SignNow provides you with all the resources needed to create, modify, and eSign your documents swiftly without any hindrances. Manage Sales And Use Tax Refund Checklist on any device with the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to edit and eSign Sales And Use Tax Refund Checklist with ease

- Obtain Sales And Use Tax Refund Checklist and click Get Form to begin.

- Utilize our provided tools to fill out your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which only takes seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and eSign Sales And Use Tax Refund Checklist to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sales and use tax refund checklist

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for claiming an Ohio use tax refund?

To claim an Ohio use tax refund, you must complete the appropriate tax forms provided by the Ohio Department of Taxation. Ensure that you gather all necessary receipts and documentation that support your claim for the Ohio use tax refund. Submitting accurate information will facilitate a smoother review and approval process.

-

How do I know if I'm eligible for an Ohio use tax refund?

Eligibility for an Ohio use tax refund typically applies to individuals or businesses that have paid use tax on purchases made outside of Ohio. You should verify if the tax was assessed incorrectly or if you have purchased items that qualify for exemption. Reviewing Ohio's use tax regulations will help clarify your eligibility for the refund.

-

What documents do I need to provide for an Ohio use tax refund?

To successfully file for an Ohio use tax refund, you need to gather receipts, proof of payment, and any relevant documentation showing the items purchased. Additionally, you'll require completed tax forms specifying the details of your purchases and your claim for the Ohio use tax refund. Keeping organized records is essential for a smoother submission process.

-

How long does it take to process an Ohio use tax refund?

The processing time for an Ohio use tax refund can vary depending on the volume of claims being processed. Generally, it may take anywhere from several weeks to a few months. It's advisable to keep track of your submission and check with the Ohio Department of Taxation for updates on your Ohio use tax refund status.

-

Can I file for an Ohio use tax refund online?

Yes, you can file for an Ohio use tax refund online through the Ohio Department of Taxation's website. Utilizing the online filing system can expedite your submission and improve tracking capabilities. Ensure that you have all your supporting documents ready to streamline the process for your Ohio use tax refund.

-

Are there any fees associated with filing an Ohio use tax refund?

Filing an Ohio use tax refund through the Ohio Department of Taxation typically does not involve any processing fees. However, it is advisable to confirm any potential fees associated with preparing your claim or obtaining necessary documents. Understanding these aspects in advance will help you budget for your Ohio use tax refund application.

-

What are the benefits of claiming an Ohio use tax refund?

Claiming an Ohio use tax refund can lead to a signNow financial benefit by recouping taxes that were paid unnecessarily. This refund can also contribute to a proper tax compliance strategy, enhancing your overall financial management. It's an opportunity to ensure you're not losing money on taxes that you shouldn’t have had to pay.

Get more for Sales And Use Tax Refund Checklist

- Application for advanced placement program doc form

- Ultra mobile authorized retailer ar form

- Forensic files sign of the zodiac answers form

- 0751 form 112812 docx

- Neea efficient homes pilot phase 3 field checklist version 1 form

- Zo vul je het overnameformulier inde watergroep

- Inkassoauftrag englisch form

- Uwi cavehill mail form

Find out other Sales And Use Tax Refund Checklist

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors