1 Home Buy Down Loan Program Applicant Packet Your First Kictribe Form

Understanding the 1 Home Buy Down Loan Program Applicant Packet Your First Kictribe

The 1 Home Buy Down Loan Program Applicant Packet is a crucial document for individuals seeking to participate in a specific financing option aimed at making home ownership more accessible. This program allows applicants to reduce their mortgage interest rate temporarily, which can result in lower monthly payments during the initial years of the loan. The packet typically includes essential information about eligibility requirements, application procedures, and necessary documentation. Understanding this packet is vital for applicants to ensure they meet all criteria and submit a complete application.

How to Complete the 1 Home Buy Down Loan Program Applicant Packet Your First Kictribe

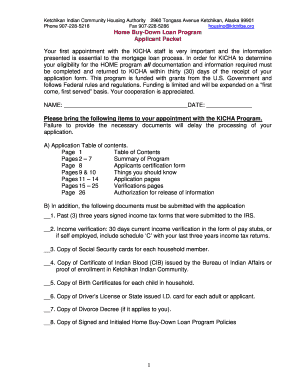

Completing the 1 Home Buy Down Loan Program Applicant Packet involves several key steps. Begin by gathering all required personal and financial information, including income statements, credit history, and identification documents. Carefully read through the instructions provided in the packet to ensure you understand each section. Fill out the application form accurately, double-checking for any errors or omissions. Once completed, review the packet to ensure all necessary documents are included before submission.

Eligibility Criteria for the 1 Home Buy Down Loan Program Applicant Packet Your First Kictribe

Eligibility for the 1 Home Buy Down Loan Program typically requires applicants to meet specific criteria. These may include having a stable income, a certain credit score, and a willingness to occupy the home as a primary residence. Additionally, there may be income limits based on household size and location. It is essential for applicants to review these criteria closely to determine if they qualify for the program before proceeding with the application.

Required Documents for the 1 Home Buy Down Loan Program Applicant Packet Your First Kictribe

Submitting the 1 Home Buy Down Loan Program Applicant Packet requires several key documents to support your application. Commonly required documents include proof of income, such as pay stubs or tax returns, identification verification like a driver's license or passport, and credit history reports. Some programs may also ask for additional documentation, such as bank statements or employment verification. Ensuring all required documents are included will facilitate a smoother application process.

Steps to Submit the 1 Home Buy Down Loan Program Applicant Packet Your First Kictribe

Once the 1 Home Buy Down Loan Program Applicant Packet is completed, the next step is submission. Applicants typically have multiple options for submitting their packets, including online, by mail, or in person at designated locations. If submitting online, ensure that all documents are scanned clearly and uploaded according to the instructions. For mail submissions, use a reliable service to track the packet and confirm delivery. In-person submissions may require an appointment, so check ahead for availability.

Legal Considerations for the 1 Home Buy Down Loan Program Applicant Packet Your First Kictribe

Understanding the legal implications of the 1 Home Buy Down Loan Program is essential for applicants. This program is governed by federal and state regulations that dictate eligibility, funding limits, and compliance requirements. Applicants should be aware of their rights and responsibilities under the program, including any potential penalties for misrepresentation or failure to comply with program guidelines. Consulting with a legal expert or housing counselor can provide additional clarity on these matters.

Quick guide on how to complete 1 home buy down loan program applicant packet your first kictribe

Effortlessly prepare [SKS] on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed paperwork, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign [SKS] effortlessly

- Find [SKS] and click on Get Form to commence.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or obscure sensitive information using tools specifically available from airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to store your modifications.

- Choose how you want to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Modify and eSign [SKS] to ensure excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to 1 Home Buy Down Loan Program Applicant Packet Your First Kictribe

Create this form in 5 minutes!

How to create an eSignature for the 1 home buy down loan program applicant packet your first kictribe

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1 Home Buy Down Loan Program Applicant Packet Your First Kictribe?

The 1 Home Buy Down Loan Program Applicant Packet Your First Kictribe is a comprehensive resource designed to guide applicants through the home buying process. It includes essential documentation and forms necessary for applying for a home buy-down loan. This packet ensures that you are well-prepared and informed every step of the way.

-

What benefits can I expect from using the 1 Home Buy Down Loan Program Applicant Packet Your First Kictribe?

By utilizing the 1 Home Buy Down Loan Program Applicant Packet Your First Kictribe, you can streamline the application process and reduce potential delays. The packet is designed to clarify requirements and enhance your understanding of loan options, ultimately leading to a more informed decision-making process.

-

How much does the 1 Home Buy Down Loan Program Applicant Packet Your First Kictribe cost?

The 1 Home Buy Down Loan Program Applicant Packet Your First Kictribe is competitively priced to ensure accessibility for all potential homebuyers. For detailed pricing information, it is recommended to contact our support team or visit our pricing page for the most up-to-date details.

-

Are there any specific features included in the 1 Home Buy Down Loan Program Applicant Packet Your First Kictribe?

Yes, the 1 Home Buy Down Loan Program Applicant Packet Your First Kictribe includes various features such as customizable templates, informative checklists, and resources related to the loan application process. These tools are designed to simplify your experience and help ensure you don’t miss any critical steps.

-

How can I integrate the 1 Home Buy Down Loan Program Applicant Packet Your First Kictribe with my current systems?

The 1 Home Buy Down Loan Program Applicant Packet Your First Kictribe can easily be integrated with popular document management systems and eSignature tools. This allows users to work seamlessly with existing workflows for maximum efficiency in document handling.

-

What documents are typically required to complete the 1 Home Buy Down Loan Program Applicant Packet Your First Kictribe?

To complete the 1 Home Buy Down Loan Program Applicant Packet Your First Kictribe, you will generally need recent pay stubs, tax returns, and a credit report. Specific requirements may vary based on your lender’s policies, so it's crucial to review the packet thoroughly for any additional documentation needed.

-

Is the 1 Home Buy Down Loan Program Applicant Packet Your First Kictribe user-friendly for first-time homebuyers?

Absolutely! The 1 Home Buy Down Loan Program Applicant Packet Your First Kictribe is designed with first-time homebuyers in mind, providing clear instructions and supportive resources. Our goal is to empower you with the knowledge and tools necessary to navigate the loan process confidently.

Get more for 1 Home Buy Down Loan Program Applicant Packet Your First Kictribe

Find out other 1 Home Buy Down Loan Program Applicant Packet Your First Kictribe

- Electronic signature Alabama Non-disclosure agreement PDF Safe

- Electronic signature Missouri Non-disclosure agreement PDF Myself

- How To Electronic signature New York Non-disclosure agreement PDF

- Electronic signature South Carolina Partnership agreements Online

- How Can I Electronic signature Florida Rental house lease agreement

- How Can I Electronic signature Texas Rental house lease agreement

- eSignature Alabama Trademark License Agreement Secure

- Electronic signature Maryland Rental agreement lease Myself

- How To Electronic signature Kentucky Rental lease agreement

- Can I Electronic signature New Hampshire Rental lease agreement forms

- Can I Electronic signature New Mexico Rental lease agreement forms

- How Can I Electronic signature Minnesota Rental lease agreement

- Electronic signature Arkansas Rental lease agreement template Computer

- Can I Electronic signature Mississippi Rental lease agreement

- Can I Electronic signature Missouri Rental lease contract

- Electronic signature New Jersey Rental lease agreement template Free

- Electronic signature New Jersey Rental lease agreement template Secure

- Electronic signature Vermont Rental lease agreement Mobile

- Electronic signature Maine Residential lease agreement Online

- Electronic signature Minnesota Residential lease agreement Easy