Regulation B Federal Reserve Federalreserve Form

Understanding Regulation B

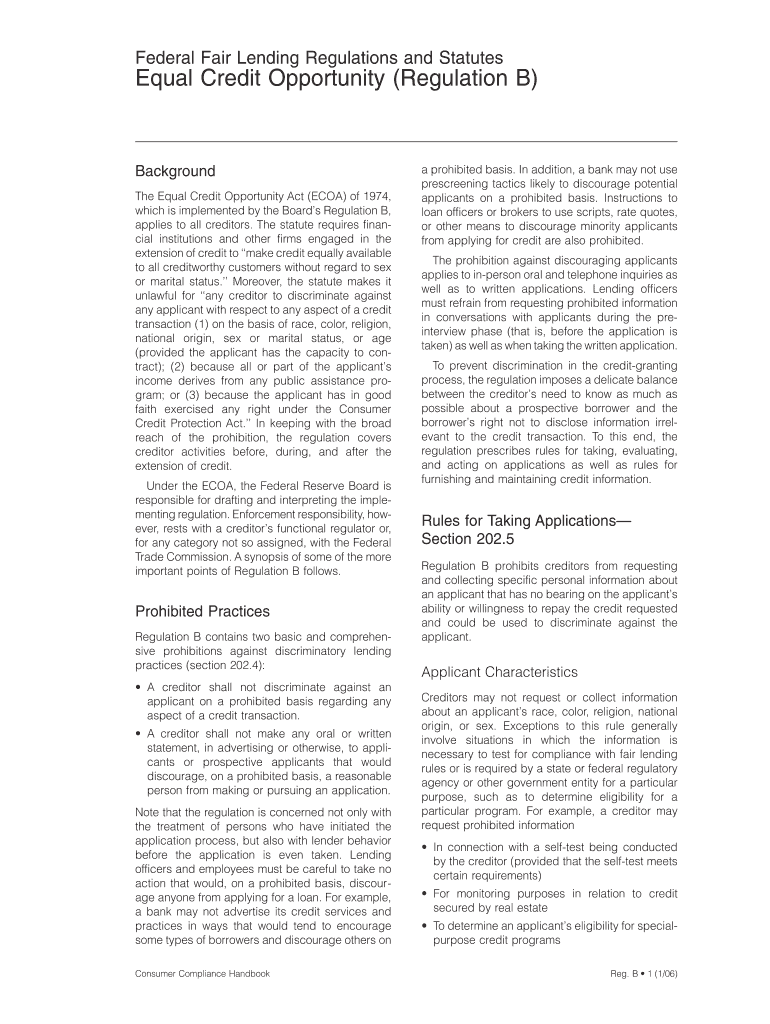

Regulation B, established by the Federal Reserve, is a crucial component of the Equal Credit Opportunity Act (ECOA). It aims to prevent discrimination in credit transactions, ensuring that all consumers have equal access to credit regardless of race, color, religion, national origin, sex, marital status, age, or because they receive public assistance. This regulation applies to various lending institutions, including banks and credit unions, and mandates fair treatment in the application process and evaluation of creditworthiness.

Key Elements of Regulation B

The essential elements of Regulation B include the requirement for lenders to provide applicants with specific disclosures. These disclosures must inform applicants of their rights under the ECOA and outline the reasons for any adverse actions taken against them, such as denial of credit. Additionally, lenders must maintain records of credit applications to ensure compliance with the regulation and to facilitate monitoring for discriminatory practices.

Steps to Comply with Regulation B

Compliance with Regulation B involves several critical steps for lenders. First, institutions must develop clear policies and procedures that align with the regulation's requirements. Training staff on these policies is essential to ensure that all employees understand their responsibilities. Regular audits and reviews of credit practices help identify potential areas of non-compliance, allowing institutions to address issues proactively. Finally, maintaining accurate and detailed records of credit applications is vital for compliance verification.

Legal Use of Regulation B

Regulation B is legally binding, and non-compliance can result in significant penalties for financial institutions. The regulation empowers consumers to file complaints against lenders who violate their rights. Legal actions may lead to monetary damages, including punitive damages in cases of willful discrimination. Understanding the legal implications of Regulation B is crucial for both lenders and consumers to ensure fair lending practices.

Examples of Regulation B Applications

Regulation B applies in various scenarios, such as when a lender evaluates a loan application. For instance, if a consumer applies for a mortgage and is denied, the lender must provide a notice explaining the reasons for the denial. This notice ensures transparency and allows the consumer to understand their rights. Another example is when a lender must consider a borrower's income from public assistance programs as part of their overall creditworthiness, promoting equitable treatment across all applicants.

Disclosure Requirements Under Regulation B

Disclosure requirements under Regulation B are designed to inform consumers about their rights and the lending process. Lenders must provide a notice of action taken within thirty days of receiving a completed application. This notice should detail the decision made, the reasons for adverse actions, and the applicant's right to request additional information. These disclosures are vital for fostering trust and transparency in the lending process.

Penalties for Non-Compliance

Financial institutions that fail to comply with Regulation B face various penalties, including fines and legal repercussions. The Consumer Financial Protection Bureau (CFPB) enforces compliance, and violations can lead to investigations and audits. Institutions may also face reputational damage and loss of consumer trust, making adherence to Regulation B not only a legal obligation but also a critical aspect of maintaining a positive relationship with clients.

Quick guide on how to complete regulation b federal reserve federalreserve

Complete [SKS] effortlessly on any gadget

Web-based document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed papers, as you can easily locate the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to generate, modify, and eSign your documents swiftly without delays. Handle [SKS] on any gadget using airSlate SignNow applications for Android or iOS and enhance any document-related procedure today.

The simplest method to modify and eSign [SKS] with ease

- Locate [SKS] and select Get Form to initiate.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent parts of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature using the Sign feature, which only takes seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method for submitting your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choosing. Modify and eSign [SKS] and guarantee excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Regulation B Federal Reserve Federalreserve

Create this form in 5 minutes!

How to create an eSignature for the regulation b federal reserve federalreserve

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Regulation B and how does it relate to the Federal Reserve?

Regulation B is a federal regulation that implements the Equal Credit Opportunity Act, which is enforced by the Federal Reserve. The regulation ensures fair lending practices and prohibits discrimination in credit transactions. Understanding Regulation B is crucial for businesses to maintain compliance and avoid penalties.

-

How can airSlate SignNow help in complying with Regulation B?

airSlate SignNow provides a secure platform for businesses to manage and eSign documents, which aids in complying with Regulation B requirements. By ensuring that all documents related to credit transactions are accurately signed and stored, businesses can avoid potential violations. This makes airSlate SignNow an important tool for companies dealing with regulated lending.

-

What features does airSlate SignNow offer for businesses operating under Regulation B?

airSlate SignNow offers features like secure eSignature, audit trails, and form templates that help businesses comply with Regulation B. These features ensure that every step in the document signing process is recorded and verifiable, enhancing transparency and accountability. This is essential for businesses wishing to adhere to the guidelines set by the Federal Reserve.

-

Is airSlate SignNow affordable for small businesses needing to comply with Regulation B?

Yes, airSlate SignNow offers an affordable pricing structure tailored for businesses of all sizes, including small businesses that need to comply with Regulation B. The cost-effective solution allows small businesses to access essential eSignature features without overspending. Compliance with federal regulations doesn’t have to be a financial burden.

-

What integrations does airSlate SignNow offer that can support Regulation B compliance?

airSlate SignNow integrates seamlessly with many popular applications, enhancing the efficiency of businesses needing to comply with Regulation B. Integrations with CRM platforms and document management systems allow for streamlined workflows, ensuring that all credit-related transactions can be handled effectively. This versatility is key for managing compliance across various tools.

-

Can airSlate SignNow facilitate the secure storing of documents relevant to Regulation B?

Absolutely! airSlate SignNow offers robust document storage solutions that protect documents related to Regulation B compliance. With secure cloud storage and easy access controls, businesses can ensure that sensitive information is maintained securely. This is crucial for maintaining compliance and safeguarding customer data.

-

How does airSlate SignNow enhance the eSigning process in relation to Regulation B?

airSlate SignNow enhances the eSigning process by offering an intuitive interface that simplifies document signing while ensuring compliance with Regulation B. Features like real-time notifications and reminders help users complete documents promptly, which is essential for meeting deadlines dictated by federal regulations. This streamlining reduces paperwork delays and improves overall efficiency.

Get more for Regulation B Federal Reserve Federalreserve

Find out other Regulation B Federal Reserve Federalreserve

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will

- How Do I eSign Hawaii Car Dealer Living Will

- eSign Hawaii Business Operations Contract Online