Form 57

What is the Form 57

The Form 57, often referred to as the pf 57 form, is a crucial document used in various administrative and legal processes within the United States. This form serves specific purposes, typically related to compliance and record-keeping. Understanding the nature of the Form 57 is essential for individuals and businesses to ensure they meet regulatory requirements and maintain proper documentation.

How to use the Form 57

Using the Form 57 involves several key steps to ensure accurate completion and submission. First, identify the purpose of the form to determine the required information. Next, gather all necessary documents and details needed to fill out the form accurately. After completing the form, review it for any errors or omissions before submitting it through the appropriate channels, whether online, by mail, or in person. Utilizing a digital solution can streamline this process and enhance security.

Steps to complete the Form 57

Completing the Form 57 involves a systematic approach to ensure accuracy and compliance. Follow these steps:

- Read the instructions carefully to understand the requirements.

- Gather all relevant information, including personal details and supporting documents.

- Fill out the form accurately, ensuring all fields are completed as required.

- Review the completed form for any mistakes or missing information.

- Submit the form according to the specified submission methods.

Legal use of the Form 57

The legal use of the Form 57 is governed by various regulations and guidelines. For the form to be considered valid, it must be completed accurately and submitted in accordance with the applicable laws. Electronic signatures are permissible, provided they comply with the ESIGN and UETA acts, ensuring the form holds the same legal weight as a traditional paper document. Understanding these legal frameworks is essential for individuals and organizations using the form.

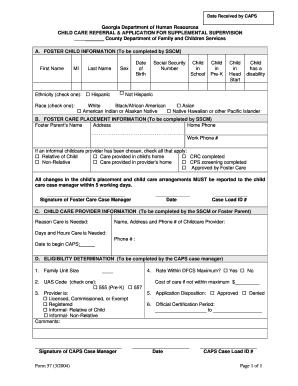

Key elements of the Form 57

The Form 57 contains several key elements that must be accurately filled out to ensure its validity. These elements typically include:

- Personal or business identification information.

- Details relevant to the purpose of the form.

- Signature and date fields to authenticate the document.

- Any additional information required by the issuing authority.

Form Submission Methods

There are various methods available for submitting the Form 57, which may include:

- Online submission through designated platforms.

- Mailing the completed form to the appropriate address.

- In-person submission at specified locations.

Choosing the right submission method can depend on the urgency and specific requirements associated with the form.

Quick guide on how to complete form 57

Effortlessly prepare Form 57 on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents swiftly without interruptions. Handle Form 57 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The simplest way to alter and electronically sign Form 57 with ease

- Locate Form 57 and click on Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive data with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to preserve your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tiresome form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign Form 57 to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 57

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the pf 57 form and why is it important?

The pf 57 form is a crucial document used for various business transactions. It facilitates the secure signing and management of agreements, making it easier for businesses to handle paperwork. Understanding the pf 57 form is essential for ensuring compliance and streamlining business processes.

-

How can airSlate SignNow help with the pf 57 form?

airSlate SignNow simplifies the process of managing the pf 57 form by allowing users to easily prepare, send, and eSign documents online. With its user-friendly platform, you can quickly customize the pf 57 form to meet your specific needs, improving workflow efficiency. Additionally, SignNow ensures that all signed documents are securely stored for your convenience.

-

Is there a cost associated with using airSlate SignNow for the pf 57 form?

airSlate SignNow offers various pricing plans that cater to different business needs when managing the pf 57 form. The cost-effective solutions provide businesses with the flexibility to choose a plan based on their document signing volume. By using SignNow, companies can save signNowly on printing and mailing costs associated with traditional paper documents.

-

What features does airSlate SignNow provide for the pf 57 form?

With airSlate SignNow, features like templates, reminders, and comprehensive tracking are available for the pf 57 form. These tools enhance the signing experience by allowing you to set up recurring requests or send reminders to signers. Furthermore, SignNow's robust security measures ensure that your pf 57 form is protected at all times.

-

Can I integrate airSlate SignNow with my existing software for the pf 57 form?

Yes, airSlate SignNow offers seamless integrations with various software solutions to effectively manage your pf 57 form. This capability ensures that you can incorporate electronic signing into your existing workflows without any disruptions. Popular integrations include CRM systems, cloud storage, and project management tools.

-

What are the benefits of using airSlate SignNow for the pf 57 form?

Using airSlate SignNow for the pf 57 form provides numerous benefits, including increased efficiency, reduced turnaround time, and improved security. By digitizing the signing process, businesses can streamline their operations and minimize the need for physical paperwork. Additionally, eSigning ensures that all transactions are legally binding and verifiable.

-

Is the pf 57 form legally binding when signed electronically?

Yes, the pf 57 form is legally binding when signed electronically through airSlate SignNow. Electronic signatures are recognized by law in many jurisdictions, provided that they comply with regulations like the ESIGN Act and UETA. By using SignNow, you can ensure that your electronic signatures on the pf 57 form hold up in court and maintain legal integrity.

Get more for Form 57

- Secretary of state office form

- Park district youth program cyberdrive illinois form

- Illinois vsd university form

- Illinois dealer certification form

- Illinois hunting turkey permit applications form

- Mandatory vehicle insurance law affirmation illinois secretary of form

- Fraternal order of police illinois forms

- Skills test new skills ally test course illinois secretary of state form

Find out other Form 57

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form