Request for Voluntary Disqualification from Present Use Value Form

What is the Request For Voluntary Disqualification From Present Use Value

The Request For Voluntary Disqualification From Present Use Value is a formal document used by property owners in the United States who wish to withdraw their property from a specific tax assessment program. This program typically allows for reduced property taxes based on the land's current use, such as agricultural or forestry purposes. By submitting this request, property owners can disqualify their property from these benefits, which may be necessary for various reasons, including changes in land use or ownership. Understanding the implications of this request is crucial for property owners to ensure compliance with local tax regulations.

How to use the Request For Voluntary Disqualification From Present Use Value

Using the Request For Voluntary Disqualification From Present Use Value involves a straightforward process. Property owners must fill out the form accurately, providing necessary details about the property and the reasons for disqualification. It is essential to check for any specific state requirements that may affect the submission process. After completing the form, it should be submitted to the appropriate local tax authority. This ensures that the request is processed correctly and that the property owner receives confirmation of the disqualification.

Steps to complete the Request For Voluntary Disqualification From Present Use Value

Completing the Request For Voluntary Disqualification From Present Use Value requires several key steps:

- Gather necessary information about the property, including its location, current use, and ownership details.

- Obtain the official form from your local tax authority or their website.

- Fill out the form, ensuring all sections are completed accurately.

- Provide a clear explanation for the disqualification request, as this may be reviewed by tax officials.

- Submit the completed form by the specified deadline, either online, by mail, or in person, depending on local guidelines.

Eligibility Criteria

Eligibility for filing the Request For Voluntary Disqualification From Present Use Value typically includes being the legal owner of the property in question. Property owners must also ensure that they are currently enrolled in a tax assessment program that allows for disqualification. Additionally, the reasons for disqualification should align with local tax regulations, which may vary by state. It is advisable for property owners to consult with their local tax authority to confirm eligibility and understand any specific criteria that may apply.

Form Submission Methods

The Request For Voluntary Disqualification From Present Use Value can generally be submitted through various methods, depending on local regulations. Common submission methods include:

- Online: Many local tax authorities offer digital submission options through their official websites.

- Mail: Property owners can print the completed form and send it via postal service to the designated tax office.

- In-Person: Submitting the form in person may be an option, allowing for immediate confirmation of receipt.

Key elements of the Request For Voluntary Disqualification From Present Use Value

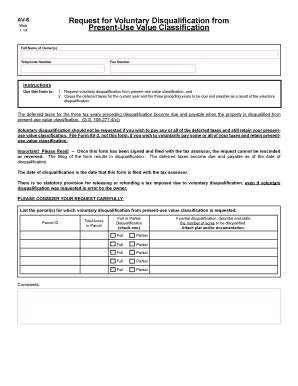

When completing the Request For Voluntary Disqualification From Present Use Value, several key elements must be included to ensure the form is valid. These elements typically consist of:

- Property Information: Details such as the property address, parcel number, and current use must be clearly stated.

- Owner Information: The name and contact details of the property owner should be provided.

- Reason for Disqualification: A concise explanation of why the disqualification is requested is essential.

- Signature: The form must be signed by the property owner or an authorized representative.

Quick guide on how to complete request for voluntary disqualification from present use value

Handle [SKS] conveniently on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to find the necessary form and securely store it online. airSlate SignNow provides you with all the resources needed to create, edit, and electronically sign your documents promptly without any hold-ups. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to adjust and eSign [SKS] effortlessly

- Find [SKS] and click on Get Form to commence.

- Make use of the tools we provide to complete your document.

- Emphasize relevant sections of your documents or redact sensitive information using tools that airSlate SignNow specifically offers for this purpose.

- Create your signature with the Sign feature, which takes seconds and carries the same legal authority as a conventional wet ink signature.

- Review all your information and then click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Adjust and eSign [SKS] and guarantee excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the request for voluntary disqualification from present use value

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Request For Voluntary Disqualification From Present Use Value?

A Request For Voluntary Disqualification From Present Use Value is a formal process that allows property owners to withdraw their property from a special assessment program, typically related to agricultural use. This request may be necessary if ownership or use of the property changes, or if the owner no longer meets the eligibility criteria.

-

How can airSlate SignNow assist with making a Request For Voluntary Disqualification From Present Use Value?

airSlate SignNow provides an efficient platform for creating, sending, and eSigning documents like a Request For Voluntary Disqualification From Present Use Value. With our user-friendly interface, you can easily draft and manage necessary paperwork, ensuring your request is filed correctly and promptly.

-

What are the costs associated with using airSlate SignNow for my Request For Voluntary Disqualification From Present Use Value?

The pricing for using airSlate SignNow varies based on the plan you choose. We offer flexible pricing options that provide excellent value for features tailored to assist users in creating documents such as a Request For Voluntary Disqualification From Present Use Value. This includes eSigning capabilities, templates, and more.

-

Are there any features in airSlate SignNow that specifically help with government forms like the Request For Voluntary Disqualification From Present Use Value?

Yes, airSlate SignNow includes features designed to simplify the completion of government forms, including the Request For Voluntary Disqualification From Present Use Value. Our template library and form automation tools can expedite the process, ensuring accuracy and compliance with local regulations.

-

What benefits does eSigning provide for a Request For Voluntary Disqualification From Present Use Value?

eSigning a Request For Voluntary Disqualification From Present Use Value offers several benefits, including the convenience of signing from anywhere and at any time. It speeds up the approval process and reduces paper usage, making it an eco-friendly choice that aligns with modern business practices.

-

Can I integrate airSlate SignNow with other tools to manage my Request For Voluntary Disqualification From Present Use Value?

Absolutely! airSlate SignNow offers seamless integrations with various applications like Google Drive, Salesforce, and more. This means you can easily manage your Request For Voluntary Disqualification From Present Use Value documents alongside other business processes, streamlining your workflow.

-

Is airSlate SignNow compliant with legal standards for submissions like a Request For Voluntary Disqualification From Present Use Value?

Yes, airSlate SignNow is fully compliant with eSignature laws, including the ESIGN Act and UETA. This ensures that your Request For Voluntary Disqualification From Present Use Value and other documents are legally binding and secure, providing peace of mind during the submission process.

Get more for Request For Voluntary Disqualification From Present Use Value

Find out other Request For Voluntary Disqualification From Present Use Value

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement