Estimated Tax Worksheet Form

What is the Estimated Tax Worksheet

The Estimated Tax Worksheet is a crucial tool for individuals and businesses in the United States to calculate their estimated tax payments. This worksheet helps taxpayers determine how much they should pay in quarterly installments to avoid penalties and interest charges. It is particularly beneficial for self-employed individuals, freelancers, and anyone who receives income that is not subject to withholding. By accurately estimating tax obligations, users can manage their finances more effectively and ensure compliance with federal tax laws.

How to use the Estimated Tax Worksheet

Using the Estimated Tax Worksheet involves a series of straightforward steps. First, gather your financial information, including income sources, deductions, and credits. Next, follow the worksheet's prompts to input your expected income for the year. This includes wages, dividends, and any other earnings. After calculating your total income, subtract any deductions to arrive at your taxable income. Finally, use the tax tables provided to determine your estimated tax liability, and divide that amount by four to figure out your quarterly payments.

Steps to complete the Estimated Tax Worksheet

Completing the Estimated Tax Worksheet requires careful attention to detail. Begin by entering your personal information, including your filing status and any dependents. Then, list all sources of income, such as salary, rental income, and interest. After calculating your total income, apply any deductions you qualify for, such as student loan interest or retirement contributions. Once you have your taxable income, refer to the IRS tax rate schedules to find your estimated tax amount. Divide this figure by four to establish your quarterly payment amounts.

Filing Deadlines / Important Dates

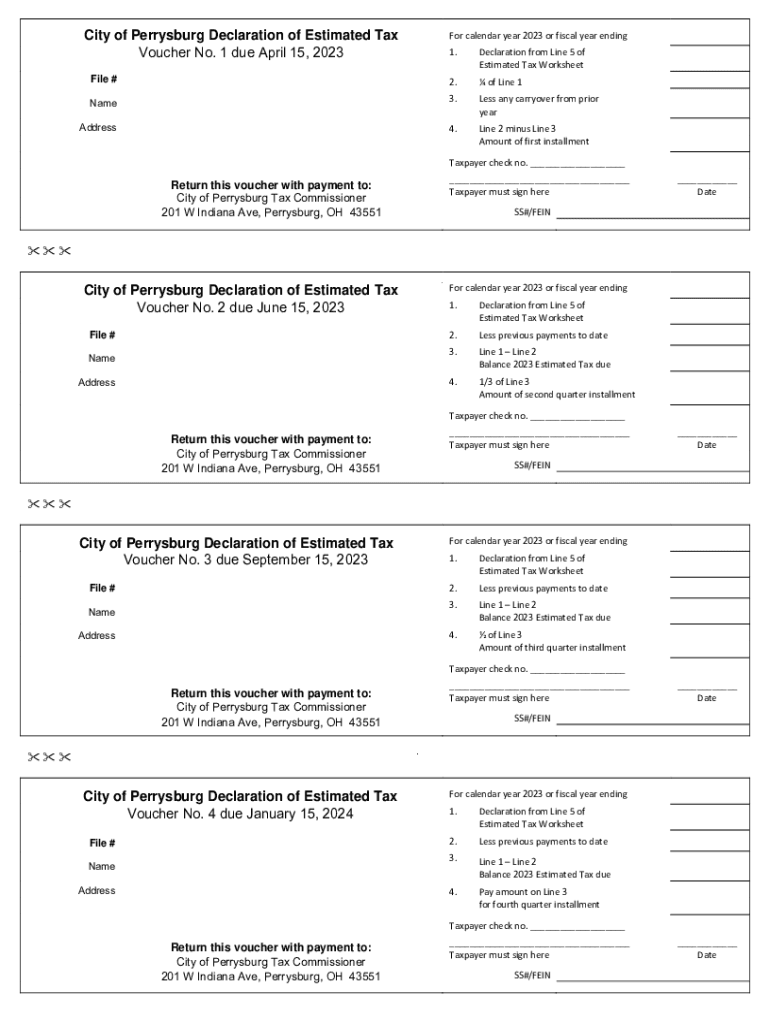

It is essential to be aware of the filing deadlines associated with the Estimated Tax Worksheet. Generally, estimated tax payments are due on the fifteenth day of April, June, September, and January of the following year. If these dates fall on a weekend or holiday, the deadline is extended to the next business day. Timely payments help avoid penalties and interest, making it crucial for taxpayers to mark these dates on their calendars to ensure compliance.

Examples of using the Estimated Tax Worksheet

Examples of using the Estimated Tax Worksheet can clarify its practical application. For instance, a self-employed graphic designer might project an annual income of $50,000. After accounting for $10,000 in deductions, their taxable income would be $40,000. Referring to the IRS tax tables, they find their estimated tax liability is $4,000. Dividing this by four indicates quarterly payments of $1,000. This process helps the designer plan their finances and avoid a large tax bill at the end of the year.

IRS Guidelines

The IRS provides specific guidelines for completing the Estimated Tax Worksheet. These guidelines emphasize the importance of accurately estimating income and deductions to avoid underpayment penalties. The IRS also outlines who must make estimated tax payments, including self-employed individuals and those with significant investment income. Familiarizing oneself with these guidelines ensures compliance and helps taxpayers make informed decisions about their tax obligations.

Quick guide on how to complete estimated tax worksheet

Effortlessly prepare Estimated Tax Worksheet on any device

Digital document management has become increasingly popular among companies and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed paperwork, as you can access the necessary forms and securely store them online. airSlate SignNow supplies all the resources you require to create, modify, and eSign your documents swiftly without delays. Manage Estimated Tax Worksheet on any device with airSlate SignNow apps for Android or iOS and simplify any document-related process today.

The easiest way to modify and eSign Estimated Tax Worksheet without hassle

- Locate Estimated Tax Worksheet and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether it’s via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from your preferred device. Modify and eSign Estimated Tax Worksheet and ensure excellent communication at any point in the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the estimated tax worksheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Estimated Tax Worksheet and how does it work?

The Estimated Tax Worksheet is a tool designed to help individuals calculate their estimated tax payments for the year. By inputting your income and deductions, it simplifies the process of determining how much tax you should set aside. With airSlate SignNow, you can easily fill out and sign your Estimated Tax Worksheet, streamlining your tax preparation.

-

How can airSlate SignNow assist with filling out the Estimated Tax Worksheet?

airSlate SignNow offers an intuitive platform where users can access templates for the Estimated Tax Worksheet. You can easily complete the form online, save your progress, and sign it digitally. This saves you time and minimizes errors, ensuring your tax calculations are accurate.

-

Is there a cost associated with using the Estimated Tax Worksheet on airSlate SignNow?

While airSlate SignNow offers several pricing plans, the tools to fill out and eSign the Estimated Tax Worksheet can be accessed as part of these plans. They are competitively priced, ensuring that you get an effective solution without breaking the bank. You can choose a plan that suits your business needs and budget.

-

What features of airSlate SignNow make it ideal for completing the Estimated Tax Worksheet?

AirSlate SignNow includes features like customizable templates, automatic data input, and secure document storage, making it ideal for completing the Estimated Tax Worksheet. Additionally, the platform provides features such as real-time collaboration and easy sharing, enhancing your workflow efficiency. These functions allow you to complete your tax documents quickly and accurately.

-

Can I integrate airSlate SignNow with other accounting software for tax preparation?

Yes, airSlate SignNow offers integrations with popular accounting and tax preparation software, allowing you to streamline your entire tax preparation process, including the use of the Estimated Tax Worksheet. This means you can easily synchronize your financial data and ensure accurate estimates. Integrating various tools simplifies your workflow and enhances productivity.

-

What are the benefits of using an online service like airSlate SignNow for the Estimated Tax Worksheet?

Using airSlate SignNow for the Estimated Tax Worksheet provides many benefits, such as convenience, accessibility, and enhanced accuracy. Online services reduce the hassle of paper forms and enable you to access your worksheets anytime, from anywhere. Furthermore, the digital signing feature increases security and validity of your documents.

-

Is support available if I encounter issues while using the Estimated Tax Worksheet?

Yes, airSlate SignNow offers robust customer support for users facing issues with the Estimated Tax Worksheet. Whether you have questions about the form or need assistance with the e-signature process, their support team is ready to help. You can access resources, chat with representatives, or browse FAQs for quick resolutions.

Get more for Estimated Tax Worksheet

- Application for reciprocity examination dps mn form

- Application for driver education program approval minnesota dps mn form

- Minnesota board dps mn form

- Qualified medicare beneficiary qmb specified low form

- Alumni recognition awards form

- Unco ursa form

- Attention seniors the deadline to turn in your hours is mon april 12 form

- Termination of contract template form

Find out other Estimated Tax Worksheet

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship