Print Blank Tax Forms Georgia Department of Revenue

Understanding the GA 1003 Instructions Form

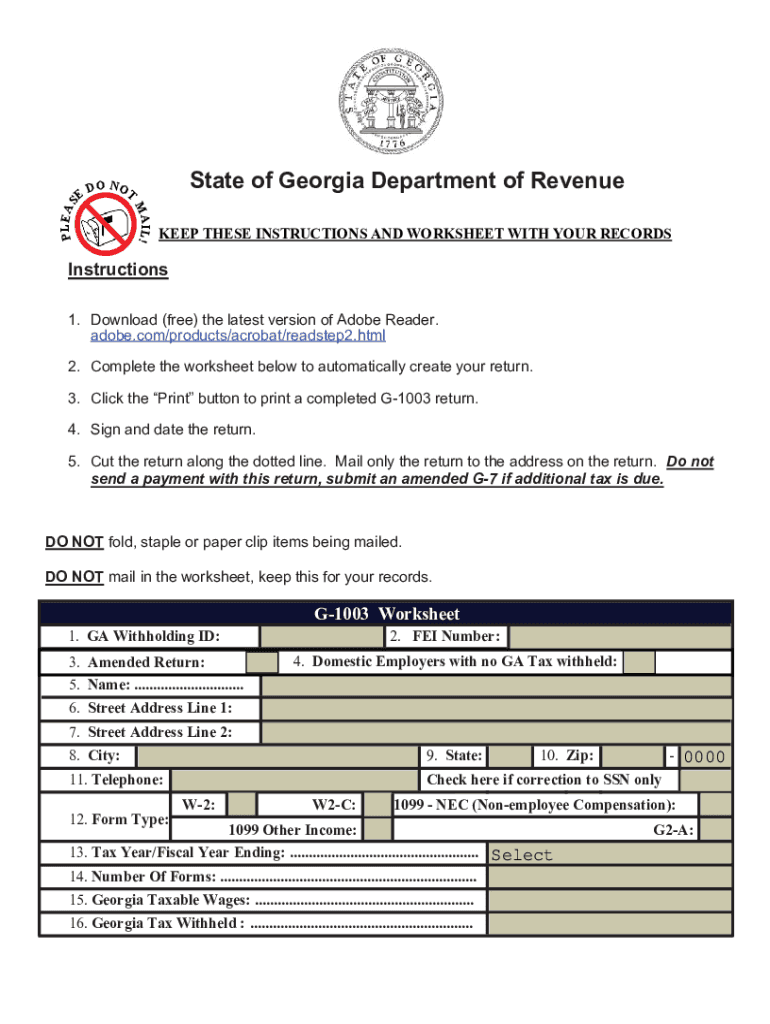

The GA 1003 instructions form, also known as the Georgia G-1003, is an essential document used for reporting income and tax obligations to the Georgia Department of Revenue. This form is specifically designed for individuals and businesses in Georgia to accurately declare their income and ensure compliance with state tax laws. Understanding the purpose and requirements of this form is crucial for proper tax filing.

Steps to Complete the GA 1003 Instructions Form

Completing the GA 1003 instructions form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, follow these steps:

- Enter personal information, including your name, address, and Social Security number.

- Report all sources of income accurately, ensuring that figures match your supporting documents.

- Calculate any deductions or credits for which you may be eligible.

- Review the completed form for accuracy before submission.

Taking the time to follow these steps carefully can help prevent errors and potential penalties.

Required Documents for the GA 1003 Instructions Form

To successfully complete the GA 1003 instructions form, you will need several documents. These include:

- W-2 forms from employers to report wages.

- 1099 forms for any freelance or contract work.

- Documentation of other income sources, such as rental income or investments.

- Records of any deductions or credits you intend to claim.

Having these documents on hand will streamline the process and help ensure that your form is filled out correctly.

Form Submission Methods for the GA 1003

The GA 1003 instructions form can be submitted in various ways, depending on your preference and circumstances. You may choose to file online through the Georgia Department of Revenue's website, which offers a convenient and efficient method. Alternatively, you can mail a paper copy of the completed form to the appropriate address provided in the instructions. In-person submissions may also be possible at designated state offices. Be sure to check the specific submission guidelines to ensure compliance.

Legal Use of the GA 1003 Instructions Form

The GA 1003 instructions form is a legally binding document that must be filled out truthfully and accurately. Misrepresentation or failure to report income can lead to penalties, including fines or legal action. It is essential to understand that this form serves as an official record of your income and tax obligations to the state of Georgia. Compliance with the instructions and guidelines provided is crucial for avoiding potential legal issues.

Filing Deadlines for the GA 1003 Instructions Form

Filing deadlines for the GA 1003 instructions form are critical to ensure timely compliance with state tax regulations. Generally, the deadline for submitting this form aligns with the federal tax filing deadline, which is typically April fifteenth. However, it is advisable to verify any changes or specific deadlines each tax year. Late submissions may incur penalties, so being aware of these dates is essential for all taxpayers.

Quick guide on how to complete print blank tax forms georgia department of revenue

Complete Print Blank Tax Forms Georgia Department Of Revenue effortlessly on any device

Online document management has gained widespread popularity among organizations and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to locate the required form and securely store it online. airSlate SignNow provides you with all the features necessary to create, edit, and electronically sign your documents swiftly without any delays. Manage Print Blank Tax Forms Georgia Department Of Revenue on any device using airSlate SignNow applications for Android or iOS, and enhance any document-based process today.

How to modify and eSign Print Blank Tax Forms Georgia Department Of Revenue with ease

- Obtain Print Blank Tax Forms Georgia Department Of Revenue and then click Get Form to commence.

- Utilize the tools at your disposal to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information using tools that airSlate SignNow provides specifically designed for that purpose.

- Generate your eSignature with the Sign feature, which takes just a few seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to retain your modifications.

- Choose your preferred method for sharing your form, either via email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from your preferred device. Edit and eSign Print Blank Tax Forms Georgia Department Of Revenue and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the print blank tax forms georgia department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the GA 1003 instructions form?

The GA 1003 instructions form is a standardized document used primarily in the mortgage industry. It provides guidelines on how to complete the Uniform Residential Loan Application, ensuring compliance and accuracy in submissions. Familiarizing yourself with this form is essential for both lenders and borrowers.

-

How can airSlate SignNow help with the GA 1003 instructions form?

airSlate SignNow simplifies the process of signing and sending the GA 1003 instructions form electronically. Our platform enhances workflow efficiency by enabling users to complete, sign, and share documents seamlessly. This minimizes printing and faxing while ensuring you remain compliant with industry regulations.

-

Is airSlate SignNow affordable for businesses needing the GA 1003 instructions form?

Yes, airSlate SignNow offers competitive pricing plans suited for businesses of all sizes that frequently handle the GA 1003 instructions form. Our solution is cost-effective, providing exceptional value through its robust features designed to streamline your document management processes. You can choose a plan that best fits your budget and needs.

-

What features does airSlate SignNow offer for the GA 1003 instructions form?

airSlate SignNow provides various features that enhance the handling of the GA 1003 instructions form, including customizable templates, eSigning, and real-time document tracking. These features help ensure that all parties involved can complete the form accurately and efficiently. Additionally, our platform integrates seamlessly with other software tools to optimize your workflow.

-

Can I integrate airSlate SignNow with other software for the GA 1003 instructions form?

Absolutely! airSlate SignNow supports integrations with a variety of software applications, making it easier to manage the GA 1003 instructions form alongside your existing tools. Whether you're using CRM systems, document management software, or accounting platforms, our solution can be tailored to fit your needs.

-

What are the benefits of using airSlate SignNow for the GA 1003 instructions form?

Using airSlate SignNow for the GA 1003 instructions form offers numerous benefits, including enhanced security, faster processing times, and reduced administrative burdens. Our platform ensures that your documents are securely signed and stored, facilitating compliance and audit trails. Additionally, you can save time and resources by completing transactions online.

-

How secure is airSlate SignNow for handling the GA 1003 instructions form?

airSlate SignNow prioritizes the security of your documents, including the GA 1003 instructions form. Our platform utilizes bank-level encryption, conforms to regulatory standards, and offers secure access controls. This means your sensitive information is protected at every stage of the document signing process.

Get more for Print Blank Tax Forms Georgia Department Of Revenue

- Emacs sbcounty form

- Transfer on death deed ohio pdf form

- Life insurance beneficiary designation form anthem

- Behavioral health outpatient treatment when complete please fax to 1 form

- Dss form 3087 sep 12layout 1 dss sc

- St davids healthcare partnership financial assistance application financial assistance application form

- Patient history update form dr covell

- In service documentation form

Find out other Print Blank Tax Forms Georgia Department Of Revenue

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation