500 ES Estimated Tax IndividualFiduciaryGeorgia Department of Form

Understanding the Georgia 500 ES Payment Voucher

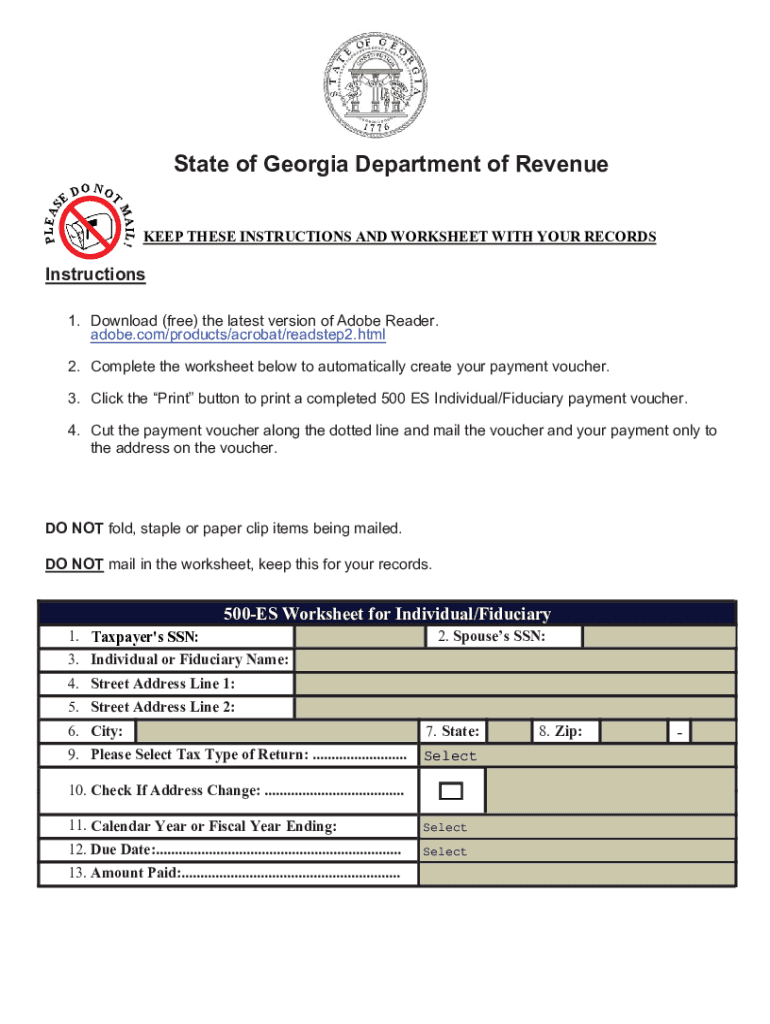

The Georgia 500 ES payment voucher is a crucial form for individuals and fiduciaries who need to make estimated tax payments to the Georgia Department of Revenue. This form is specifically designed to help taxpayers calculate and remit their estimated tax obligations for the year. It is essential for those who expect to owe tax of $500 or more when filing their annual return. Understanding the purpose and requirements of this form ensures compliance with state tax laws.

Steps to Complete the Georgia 500 ES Payment Voucher

Completing the Georgia 500 ES payment voucher involves several key steps:

- Gather necessary financial information, including income estimates and deductions.

- Calculate your estimated tax liability using the appropriate tax rates.

- Fill out the Georgia 500 ES form with your personal and financial details.

- Determine the payment amount based on your calculations.

- Submit the completed form along with your payment by the specified deadline.

Following these steps carefully will help ensure that your estimated tax payments are accurate and timely.

Filing Deadlines for the Georgia 500 ES Payment Voucher

It is important to be aware of the filing deadlines associated with the Georgia 500 ES payment voucher. Typically, estimated tax payments are due on the 15th of April, June, September, and January of the following year. Missing these deadlines may result in penalties and interest charges. Keeping a calendar of these dates can help you stay organized and compliant with state tax requirements.

Required Documents for the Georgia 500 ES Payment Voucher

To complete the Georgia 500 ES payment voucher, you will need specific documents, including:

- Your previous year's tax return for reference.

- Income statements, such as W-2s or 1099s.

- Records of any deductions or credits you plan to claim.

- Any additional documentation that supports your estimated income and expenses.

Having these documents ready will streamline the process of filling out the voucher and ensure accuracy in your calculations.

Legal Use of the Georgia 500 ES Payment Voucher

The Georgia 500 ES payment voucher is legally required for individuals and fiduciaries who expect to owe a certain amount in state taxes. Using this form correctly helps taxpayers avoid penalties for underpayment. It is advisable to keep a copy of the submitted voucher and payment confirmation for your records, as these documents may be needed for future reference or in case of an audit.

Examples of Using the Georgia 500 ES Payment Voucher

Consider a self-employed individual who anticipates earning $60,000 in the current tax year. Based on their income and deductions, they estimate they will owe $3,000 in state taxes. By dividing this amount into quarterly payments, they would use the Georgia 500 ES payment voucher to remit $750 each quarter. This proactive approach helps manage tax liabilities and avoids a large payment at tax time.

Quick guide on how to complete 500 es estimated tax individualfiduciarygeorgia department of

Effortlessly Complete 500 ES Estimated Tax IndividualFiduciaryGeorgia Department Of on Any Device

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to obtain the right forms and securely store them online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly and without complications. Handle 500 ES Estimated Tax IndividualFiduciaryGeorgia Department Of on any platform using airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

How to Edit and eSign 500 ES Estimated Tax IndividualFiduciaryGeorgia Department Of with Ease

- Find 500 ES Estimated Tax IndividualFiduciaryGeorgia Department Of and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information using the specific tools that airSlate SignNow offers for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to finalize your changes.

- Choose your preferred method to send your form: via email, text message (SMS), invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced documents, frustrating form navigation, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign 500 ES Estimated Tax IndividualFiduciaryGeorgia Department Of and ensure seamless communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 500 es estimated tax individualfiduciarygeorgia department of

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Georgia 500 ES payment voucher?

The Georgia 500 ES payment voucher is a tax form used by individuals in Georgia to make estimated tax payments. This voucher simplifies the process of paying taxes quarterly and ensures compliance with Georgia state tax regulations. Utilizing the Georgia 500 ES payment voucher can help you avoid penalties and interest on unpaid taxes.

-

How can I complete the Georgia 500 ES payment voucher using airSlate SignNow?

You can easily complete the Georgia 500 ES payment voucher with airSlate SignNow by uploading the form directly to our platform. Our user-friendly interface allows you to fill out the necessary fields, sign electronically, and securely send it for submission. This streamlines the process and saves you valuable time.

-

Are there any fees associated with using the Georgia 500 ES payment voucher?

While the Georgia 500 ES payment voucher itself does not incur any fees, using airSlate SignNow may involve a subscription cost depending on your plan. However, our pricing is competitive and designed to provide businesses with cost-effective solutions for managing documents. Investing in airSlate SignNow enables greater efficiency in managing all your tax forms.

-

What are the benefits of using airSlate SignNow for the Georgia 500 ES payment voucher?

Using airSlate SignNow for the Georgia 500 ES payment voucher offers numerous benefits, including efficient document management and secure electronic signatures. Our platform reduces the risks of lost paperwork and enhances collaboration among your team members. With airSlate SignNow, you can ensure timely submission and compliance with state tax requirements.

-

Can I integrate airSlate SignNow with other software to manage the Georgia 500 ES payment voucher?

Yes, airSlate SignNow allows for a wide range of integrations with popular accounting and document management software. This capability simplifies the process of managing the Georgia 500 ES payment voucher alongside your other financial documents. Our platform enhances your existing workflows by allowing seamless data transfer between applications.

-

Is the Georgia 500 ES payment voucher submission deadline fixed?

Yes, the submission deadline for the Georgia 500 ES payment voucher is fixed according to Georgia state tax regulations. Typically, these vouchers are due quarterly, with specific dates for each period. Utilizing airSlate SignNow helps ensure your documents are submitted on time and in compliance with the state’s requirements.

-

What information do I need to provide to complete the Georgia 500 ES payment voucher?

To complete the Georgia 500 ES payment voucher, you will need to provide essential information, including your name, address, Social Security number or Tax ID, estimated tax amount, and payment details. airSlate SignNow makes it easy to input this information directly into the form. Maintaining accuracy ensures a smooth processing experience.

Get more for 500 ES Estimated Tax IndividualFiduciaryGeorgia Department Of

- Koc medical records form

- Isaac spine joint amp pain institute pllc form

- Bls ambulance service medical directors agreement form

- Ltd claim form instructions please note the policy number for long term disability ltd is vpl301475 please fax completed claim

- Ninth street internal medicine authorization for release of form

- Who completes the ncbrtl clinical performance appraisal reference summary form

- Zzzz2014 treatment plan wax up template copy form

- Fillable online contact us nm human services department form

Find out other 500 ES Estimated Tax IndividualFiduciaryGeorgia Department Of

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form