DR 0104PN, Part Year ResidentNonresident Tax Calculation Schedule Form

What is the DR 0104PN, Part Year Resident/Nonresident Tax Calculation Schedule

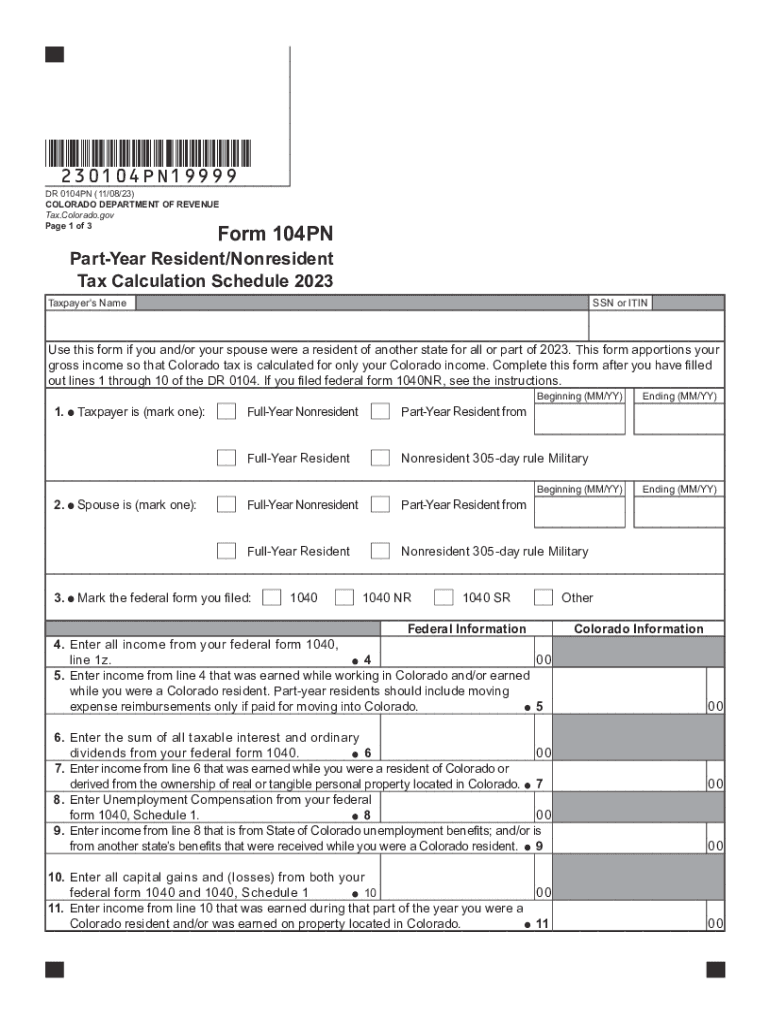

The DR 0104PN is a crucial tax calculation schedule used by part-year residents and nonresidents of Colorado. This form helps determine the appropriate amount of state income tax owed based on income earned while residing in Colorado. It is essential for individuals who have moved into or out of the state during the tax year, ensuring that they only pay taxes on income earned within Colorado's borders. The DR 0104PN is specifically designed to accommodate the unique tax situations of individuals who do not reside in Colorado for the entire year.

Steps to Complete the DR 0104PN, Part Year Resident/Nonresident Tax Calculation Schedule

Completing the DR 0104PN involves several key steps to ensure accurate reporting of income and tax liability. First, gather all relevant financial documents, including W-2 forms and other income statements. Next, determine your total income earned while a resident of Colorado and any income earned while a nonresident. Following this, calculate your Colorado taxable income by applying state-specific deductions and credits. Finally, use the tax tables provided with the form to determine the tax owed based on your calculated income. Ensure that all calculations are double-checked for accuracy before submission.

Legal Use of the DR 0104PN, Part Year Resident/Nonresident Tax Calculation Schedule

The DR 0104PN is legally mandated for use by part-year residents and nonresidents who need to report their Colorado income tax. It complies with Colorado state tax laws and regulations, ensuring that taxpayers fulfill their legal obligations. Proper use of this form is essential to avoid potential penalties or audits from the Colorado Department of Revenue. Taxpayers must ensure that they are eligible to use this form based on their residency status during the tax year.

Key Elements of the DR 0104PN, Part Year Resident/Nonresident Tax Calculation Schedule

Several key elements are crucial when filling out the DR 0104PN. These include:

- Residency Status: Clearly indicate whether you were a part-year resident or a nonresident during the tax year.

- Income Sources: Detail all income earned while residing in Colorado, as well as any income earned while living outside the state.

- Deductions and Credits: Identify any applicable state-specific deductions or credits that may reduce your tax liability.

- Tax Calculation: Use the provided tax tables to accurately calculate the amount of tax owed based on your taxable income.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the DR 0104PN is essential for compliance. Generally, the deadline for submitting the Colorado state income tax return, including the DR 0104PN, aligns with the federal tax return deadline, typically falling on April fifteenth. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any specific extensions or changes announced by the Colorado Department of Revenue that may affect their filing timeline.

Examples of Using the DR 0104PN, Part Year Resident/Nonresident Tax Calculation Schedule

Practical examples can clarify how to use the DR 0104PN effectively. For instance, if an individual moved to Colorado in June and earned $50,000 while living in the state, but earned $30,000 while residing in another state, they would report only the $50,000 on the DR 0104PN. Conversely, if they had income from both states, they would need to allocate their income correctly based on residency periods. Such examples help taxpayers understand how to navigate their unique tax situations accurately.

Quick guide on how to complete dr 0104pn part year residentnonresident tax calculation schedule

Effortlessly Prepare DR 0104PN, Part Year ResidentNonresident Tax Calculation Schedule on Any Device

Digital document management has become increasingly favored by organizations and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, edit, and electronically sign your documents swiftly and without interruptions. Handle DR 0104PN, Part Year ResidentNonresident Tax Calculation Schedule on any device using airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

How to Edit and Electronically Sign DR 0104PN, Part Year ResidentNonresident Tax Calculation Schedule with Ease

- Obtain DR 0104PN, Part Year ResidentNonresident Tax Calculation Schedule and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of your documents or obscure sensitive details with tools specifically designed by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Verify all information and then click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Edit and electronically sign DR 0104PN, Part Year ResidentNonresident Tax Calculation Schedule to ensure effective communication at every step of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dr 0104pn part year residentnonresident tax calculation schedule

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the pricing for airSlate SignNow for colorado nonresident users?

The pricing for colorado nonresident users of airSlate SignNow is designed to be cost-effective. We offer various subscription plans tailored to meet different needs, starting with a basic plan that provides essential features. You can choose the plan that best fits your business requirements, whether you're a small business or a larger organization.

-

What features does airSlate SignNow offer for colorado nonresident businesses?

airSlate SignNow offers a variety of features specifically beneficial for colorado nonresident businesses. These include secure eSigning, document management, and integration with popular platforms to streamline workflows. The user-friendly interface makes it easy to navigate and utilize all available features efficiently.

-

How can colorado nonresident users benefit from using airSlate SignNow?

Colorado nonresident users can benefit from airSlate SignNow by enhancing their workflow efficiency through quick and secure document signing. This platform reduces turnaround time and minimizes the need for physical paperwork, leading to signNow time and cost savings. Additionally, it's ideal for remote teams and improves overall business productivity.

-

Does airSlate SignNow integrate with other tools for colorado nonresident customers?

Yes, airSlate SignNow offers seamless integration with a variety of tools and applications that can help colorado nonresident customers enhance their business processes. You can easily connect with popular platforms such as Google Drive, Salesforce, and others, making it convenient to manage documents and data efficiently. Custom integrations are also possible to suit specific business needs.

-

Is airSlate SignNow compliant with legal standards for colorado nonresident users?

Absolutely, airSlate SignNow is fully compliant with legal standards required for colorado nonresident users. Our platform adheres to the regulations set forth by the ESIGN Act and UETA, ensuring that all electronic signatures are legally binding and secure. This compliance ensures confidence for businesses when handling sensitive documents.

-

What types of documents can be signed using airSlate SignNow for colorado nonresident users?

Colorado nonresident users can sign a wide range of documents using airSlate SignNow, including contracts, agreements, waivers, and more. The platform supports various file formats, making it versatile for different business needs. Whether you need to sign simple forms or complex contracts, airSlate SignNow can handle it all.

-

How does airSlate SignNow ensure security for colorado nonresident users?

AirSlate SignNow employs robust security measures to protect the sensitive information of colorado nonresident users. We utilize encryption protocols, multi-factor authentication, and secure data storage to ensure that your documents are safe from unauthorized access. Your peace of mind is our priority, knowing that your data is well-protected.

Get more for DR 0104PN, Part Year ResidentNonresident Tax Calculation Schedule

- Membership form california state university east bay www20 csueastbay

- H r 218 the law enforcement officers safety act and s form

- Seatle dci form permit transfer electrical sign seatle dci form permit transfer electricalsign

- Naugatuck ct current items for bid form

- Doti permit 103 1 block parties on residential streets form

- Facultystaff tuition waiver form east carolina university ecu

- Teacher change of pay status request form boulder valley school bvsd

- Allan james memorial scholarship form

Find out other DR 0104PN, Part Year ResidentNonresident Tax Calculation Schedule

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure