DR 1002 Colorado SalesUse Tax Rates Form

What is the DR 1002 Colorado Sales/Use Tax Rates

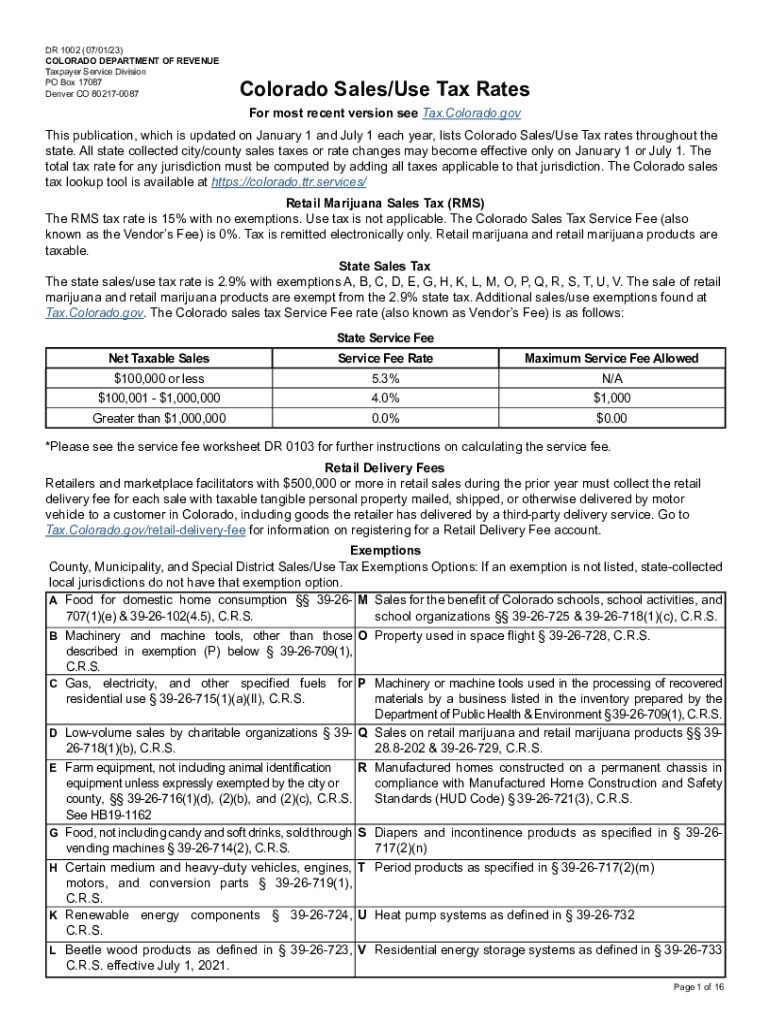

The DR 1002 form is a crucial document used in Colorado for reporting sales and use tax rates. It provides detailed information about the applicable tax rates for various goods and services within the state. Understanding the DR 1002 is essential for businesses to ensure compliance with Colorado tax regulations. The form outlines the specific rates that apply to different jurisdictions, helping businesses accurately calculate the taxes they need to collect from customers.

How to use the DR 1002 Colorado Sales/Use Tax Rates

Using the DR 1002 form involves several steps to ensure accurate reporting of sales and use tax. First, businesses should identify the appropriate tax rate based on their location and the type of goods or services sold. The form provides a comprehensive list of rates categorized by jurisdiction. Once the correct rate is determined, businesses can apply this rate to their sales transactions. It is important to keep records of all sales and tax collected for reporting purposes.

Steps to complete the DR 1002 Colorado Sales/Use Tax Rates

Completing the DR 1002 form requires careful attention to detail. Here are the steps to follow:

- Gather all necessary sales data for the reporting period.

- Identify the applicable sales tax rate using the DR 1002 form.

- Calculate the total sales tax based on the sales amount and the identified rate.

- Complete the form by entering the total sales and tax collected.

- Submit the form by the designated deadline to avoid penalties.

Legal use of the DR 1002 Colorado Sales/Use Tax Rates

Legal compliance with the DR 1002 form is essential for all businesses operating within Colorado. The form must be used accurately to report sales and use tax, as failure to comply can result in penalties and interest charges. Businesses should ensure they are using the most current version of the form and adhere to all state regulations regarding tax collection and reporting. Legal use includes maintaining accurate records and submitting the form within the specified deadlines.

Key elements of the DR 1002 Colorado Sales/Use Tax Rates

Several key elements are essential when working with the DR 1002 form. These include:

- The specific sales tax rates applicable to different goods and services.

- The jurisdictions in which these rates apply, including city and county rates.

- Instructions for completing the form accurately.

- Information on filing deadlines and submission methods.

Filing Deadlines / Important Dates

Filing deadlines for the DR 1002 form are critical for maintaining compliance. Businesses must be aware of the specific dates for submitting their sales and use tax reports. Typically, the deadlines align with the end of each reporting period, which can be monthly, quarterly, or annually, depending on the volume of sales. It is important to check the Colorado Department of Revenue's guidelines for the most up-to-date deadlines to avoid late fees.

Quick guide on how to complete dr 1002 colorado salesuse tax rates 666885017

Complete DR 1002 Colorado SalesUse Tax Rates seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides all the tools necessary for you to create, modify, and electronically sign your documents swiftly without holdups. Manage DR 1002 Colorado SalesUse Tax Rates on any device using airSlate SignNow’s Android or iOS applications and streamline any document-related task today.

The simplest way to edit and eSign DR 1002 Colorado SalesUse Tax Rates effortlessly

- Locate DR 1002 Colorado SalesUse Tax Rates and click Obtain Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your electronic signature using the Sign tool, which only takes seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and then hit the Finish button to save your modifications.

- Select your preferred method for submitting your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the concern of lost or misplaced documents, monotonous form navigation, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from the device of your choice. Edit and eSign DR 1002 Colorado SalesUse Tax Rates and ensure effective communication throughout every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dr 1002 colorado salesuse tax rates 666885017

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the current colorado rates for airSlate SignNow?

The current colorado rates for airSlate SignNow vary based on the plan you choose. We offer competitive pricing structures designed to meet various business needs. Depending on the features and functionalities you require, you can find a plan that suits your budget and operational requirements.

-

How does the pricing of airSlate SignNow compare to other eSignature solutions in Colorado?

airSlate SignNow is known for offering some of the most competitive colorado rates in the eSignature market. Our cost-effective plans are designed to provide maximum value while maintaining high quality and efficiency. Many businesses in Colorado choose SignNow for its affordability and robust features, making it an excellent choice compared to other providers.

-

What features are included in the colorado rates for airSlate SignNow?

The colorado rates for airSlate SignNow include a wide range of features such as document editing, team collaboration tools, and secure eSigning. Additionally, our solution supports integrations with various applications to streamline your workflow. This comprehensive feature set ensures businesses can maximize their efficiency for document management.

-

Are there any discounts available on colorado rates for annual subscriptions?

Yes, we offer discounts on colorado rates for businesses that opt for annual subscriptions. Choosing an annual plan can signNowly reduce your overall costs and provide additional features at no extra charge. This way, you can enjoy the full suite of airSlate SignNow functionalities while saving money in the long run.

-

Can I integrate airSlate SignNow with other software under the colorado rates?

Absolutely! The colorado rates for airSlate SignNow include options for seamless integration with numerous software platforms. Whether you use CRM systems, cloud storage services, or productivity tools, our solution easily connects with them to enhance your document workflow and efficiency.

-

Is there a free trial available to evaluate the colorado rates of airSlate SignNow?

Yes, we offer a free trial of airSlate SignNow that allows you to experience our platform without any commitment. This trial period makes it easy to assess the value and features of our solution compared to the colorado rates. During this time, you can evaluate how SignNow meets your business needs before making a financial commitment.

-

What payment methods are accepted for the colorado rates?

We accept various payment methods for the colorado rates of airSlate SignNow, including major credit cards and online payment systems. This flexibility allows businesses to select the payment option that is most convenient for them. We prioritize making the subscription process as easy as possible for our customers.

Get more for DR 1002 Colorado SalesUse Tax Rates

- 979 532 3593 979 532 2781 fax form

- Authorization agreement for automatic payments ach debits form

- Ioof 80 waxahachie odd fellows scholarship schools wisd form

- Ms voter registration form

- Atlas valley country club membership form

- Department of community amp neighborhood services form

- Cross connection control amp backflow prevention device test and maintenance report form

- Architectural review board submission form

Find out other DR 1002 Colorado SalesUse Tax Rates

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney

- How To Sign Pennsylvania Car Dealer Quitclaim Deed

- How Can I Sign Pennsylvania Car Dealer Quitclaim Deed

- Sign Rhode Island Car Dealer Agreement Safe

- Sign South Dakota Car Dealer Limited Power Of Attorney Now

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast

- How To Sign Wisconsin Car Dealer Rental Lease Agreement

- How To Sign Wisconsin Car Dealer Quitclaim Deed

- How Do I Sign Wisconsin Car Dealer Quitclaim Deed

- Sign Wyoming Car Dealer Purchase Order Template Mobile

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement