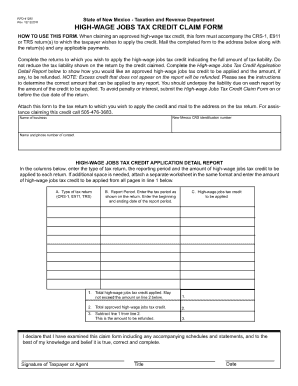

New Mexico Rpd 41290 Form

What is the New Mexico Rpd 41290 Form

The New Mexico Rpd 41290 Form is a state-specific document used primarily for tax purposes. It serves as a declaration for certain tax-related transactions and is essential for individuals and businesses operating within New Mexico. This form helps ensure compliance with state tax regulations and provides necessary information to the New Mexico Taxation and Revenue Department.

How to use the New Mexico Rpd 41290 Form

Using the New Mexico Rpd 41290 Form involves several key steps. First, identify the purpose of the form, which may include reporting income, claiming deductions, or providing information related to tax obligations. Next, gather all required information and documentation to complete the form accurately. After filling out the form, review it for any errors before submission to ensure compliance with state requirements.

Steps to complete the New Mexico Rpd 41290 Form

Completing the New Mexico Rpd 41290 Form involves a systematic approach:

- Obtain the form from the New Mexico Taxation and Revenue Department website or authorized sources.

- Fill in your personal information, including name, address, and taxpayer identification number.

- Provide details relevant to the specific tax situation, such as income amounts or deductions.

- Double-check all entries for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the New Mexico Rpd 41290 Form

The legal use of the New Mexico Rpd 41290 Form is governed by state tax laws. It is crucial to ensure that the form is filled out correctly and submitted within the designated timeframes to avoid penalties. The information provided on this form must be truthful and accurate, as any discrepancies can lead to legal repercussions or audits by the state tax authorities.

Key elements of the New Mexico Rpd 41290 Form

Key elements of the New Mexico Rpd 41290 Form include:

- Taxpayer identification information

- Details of income or deductions being reported

- Signature and date fields

- Any additional documentation required to support the claims made on the form

Form Submission Methods

The New Mexico Rpd 41290 Form can be submitted through various methods, including:

- Online submission via the New Mexico Taxation and Revenue Department's website

- Mailing the completed form to the appropriate state office

- In-person submission at designated tax offices

Who Issues the Form

The New Mexico Rpd 41290 Form is issued by the New Mexico Taxation and Revenue Department. This state agency is responsible for administering tax laws and ensuring compliance among taxpayers. It provides resources and guidance on how to properly complete and submit the form, as well as information on related tax obligations.

Quick guide on how to complete new mexico rpd 41290 form

Manage New Mexico Rpd 41290 Form effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It presents an ideal environmentally friendly substitute for traditional printed and signed documents, as you can easily locate the right form and securely store it online. airSlate SignNow equips you with everything necessary to create, modify, and eSign your files quickly and efficiently. Manage New Mexico Rpd 41290 Form on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to modify and eSign New Mexico Rpd 41290 Form with minimal effort

- Locate New Mexico Rpd 41290 Form and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or hide sensitive information using the tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you'd like to send your form, whether by email, SMS, invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form hunting, or mistakes that require new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any preferred device. Modify and eSign New Mexico Rpd 41290 Form and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the new mexico rpd 41290 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the New Mexico Rpd 41290 Form?

The New Mexico Rpd 41290 Form is a document used by residents in New Mexico for specific tax purposes. It is typically required for reporting and processing various state transactions. Understanding this form is essential for ensuring compliance with state regulations.

-

How can airSlate SignNow help me with the New Mexico Rpd 41290 Form?

AirSlate SignNow simplifies the signing and submission process for the New Mexico Rpd 41290 Form. With its eSigning capabilities, you can quickly send this form for signature and manage it from anywhere. This enhances efficiency and ensures all documents are legally binding.

-

Is there a cost associated with using airSlate SignNow for the New Mexico Rpd 41290 Form?

AirSlate SignNow offers various pricing plans that cater to different needs, making it cost-effective for managing the New Mexico Rpd 41290 Form. You can choose a plan that fits your budget while still accessing powerful features. Sign up today to explore our flexible pricing options.

-

What features does airSlate SignNow offer for the New Mexico Rpd 41290 Form?

AirSlate SignNow includes features like eSigning, document templates, and secure storage specifically for forms like the New Mexico Rpd 41290 Form. These tools streamline document management and improve workflow efficiency. Easily track the status of documents to ensure timely submission.

-

Can I integrate airSlate SignNow with other applications for the New Mexico Rpd 41290 Form?

Yes, airSlate SignNow offers seamless integrations with various applications to enhance your experience when working with the New Mexico Rpd 41290 Form. This includes integration with CRMs, cloud storage, and productivity tools. These connections allow for a more unified document management process.

-

What are the benefits of using airSlate SignNow for my New Mexico Rpd 41290 Form needs?

Using airSlate SignNow for your New Mexico Rpd 41290 Form needs provides a quick, efficient, and secure way to manage your documents. The platform improves collaboration among signers and reduces turnaround time signNowly. It ensures that your workflow is streamlined and hassle-free.

-

Is it easy to use airSlate SignNow for the New Mexico Rpd 41290 Form?

Absolutely! AirSlate SignNow is designed with user-friendliness in mind, making it very simple to use for the New Mexico Rpd 41290 Form. Its intuitive interface allows you to create, send, and manage documents with ease, ensuring you can focus on what matters most—your business.

Get more for New Mexico Rpd 41290 Form

- Planning pre submission application citywindsor ca form

- Homestars com2653184 superior safety codes incsuperior safety codes inchome inspection in red deer form

- Tennis waiver form camp riverwood

- Canada transit program application form

- Canada mortgage loan agreement 612443804 form

- M icbc comvehicle registrationcollector modsmv1426 application for modified collector motor vehicle icbc form

- Www pdffiller com463102554 land dedicationget the land dedication reserve fund application city form

- Id replacement form university of guelph humber

Find out other New Mexico Rpd 41290 Form

- How To eSign Pennsylvania Residential lease agreement

- eSign Maine Simple confidentiality agreement Easy

- eSign Iowa Standard rental agreement Free

- eSignature Florida Profit Sharing Agreement Template Online

- eSignature Florida Profit Sharing Agreement Template Myself

- eSign Massachusetts Simple rental agreement form Free

- eSign Nebraska Standard residential lease agreement Now

- eSign West Virginia Standard residential lease agreement Mobile

- Can I eSign New Hampshire Tenant lease agreement

- eSign Arkansas Commercial real estate contract Online

- eSign Hawaii Contract Easy

- How Do I eSign Texas Contract

- How To eSign Vermont Digital contracts

- eSign Vermont Digital contracts Now

- eSign Vermont Digital contracts Later

- How Can I eSign New Jersey Contract of employment

- eSignature Kansas Travel Agency Agreement Now

- How Can I eSign Texas Contract of employment

- eSignature Tennessee Travel Agency Agreement Mobile

- eSignature Oregon Amendment to an LLC Operating Agreement Free