DR 0205 Tax Year Ending Computation of Penalty Due Based on Underpayment of Colorado Corporate Estimated Tax and DR 0205 If You Form

Understanding the Colorado Penalty for Underpayment

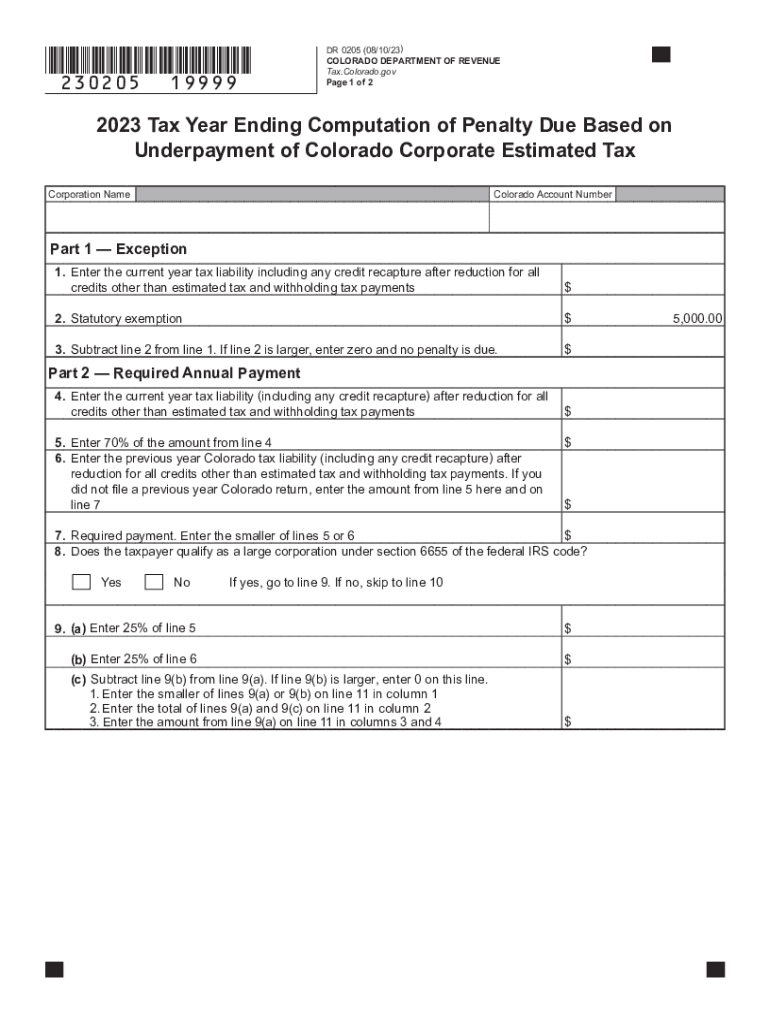

The Colorado penalty for underpayment primarily concerns businesses that fail to pay the correct amount of corporate estimated tax. This penalty is calculated based on the difference between what was paid and what should have been paid. The state uses Form DR 0205 to determine the tax year ending computation of the penalty due. Understanding this penalty is crucial for businesses to remain compliant and avoid additional fees.

Steps to Complete Form DR 0205

Completing Form DR 0205 involves several key steps. First, gather all necessary financial documents that reflect your estimated tax payments. Next, input your total income and calculate your estimated tax liability for the year. After this, compare your actual payments to the estimated liability. If there is a shortfall, the form will guide you through calculating the penalty based on the underpayment. Ensure all sections are filled out accurately to avoid delays in processing.

Key Elements of Form DR 0205

Form DR 0205 includes several important sections that must be completed. These sections typically cover your business information, total income, estimated tax payments made, and the resulting penalty calculation. Each part of the form is designed to ensure that the Colorado Department of Revenue can accurately assess your tax situation and any penalties due. Familiarizing yourself with these elements can streamline the completion process.

Filing Deadlines and Important Dates

It is essential to be aware of the filing deadlines associated with Form DR 0205. Generally, businesses must submit this form along with their corporate tax returns by the standard due date for corporate taxes in Colorado. Missing these deadlines can result in additional penalties and interest on the amount owed. Keeping a calendar of important dates can help ensure timely submissions.

Penalties for Non-Compliance

Failure to comply with Colorado's corporate estimated tax requirements can lead to significant penalties. These penalties are typically calculated based on the amount of underpayment and the duration of the underpayment period. Understanding the implications of non-compliance can motivate businesses to stay current with their tax obligations and avoid unnecessary financial burdens.

Eligibility Criteria for Using Form DR 0205

To use Form DR 0205, businesses must meet specific eligibility criteria. Generally, this form is intended for corporations that are required to make estimated tax payments in Colorado. Additionally, the business must have a tax liability that exceeds a certain threshold. Reviewing these criteria before attempting to file can help ensure that the form is applicable to your situation.

Quick guide on how to complete dr 0205 tax year ending computation of penalty due based on underpayment of colorado corporate estimated tax and dr 0205 if you

Complete DR 0205 Tax Year Ending Computation Of Penalty Due Based On Underpayment Of Colorado Corporate Estimated Tax And DR 0205 If You effortlessly on any device

Digital document management has gained immense popularity among businesses and individuals. It offers a perfect eco-friendly substitute for conventional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents swiftly without any hiccups. Manage DR 0205 Tax Year Ending Computation Of Penalty Due Based On Underpayment Of Colorado Corporate Estimated Tax And DR 0205 If You on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign DR 0205 Tax Year Ending Computation Of Penalty Due Based On Underpayment Of Colorado Corporate Estimated Tax And DR 0205 If You with ease

- Locate DR 0205 Tax Year Ending Computation Of Penalty Due Based On Underpayment Of Colorado Corporate Estimated Tax And DR 0205 If You and then click Get Form to begin.

- Employ the tools we provide to finalize your document.

- Emphasize pertinent sections of your documents or conceal sensitive information using tools specifically designed by airSlate SignNow for that use.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Choose how you want to deliver your form, via email, SMS, invitation link, or download it to the computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing additional document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign DR 0205 Tax Year Ending Computation Of Penalty Due Based On Underpayment Of Colorado Corporate Estimated Tax And DR 0205 If You and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dr 0205 tax year ending computation of penalty due based on underpayment of colorado corporate estimated tax and dr 0205 if you

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is dr 0205 in relation to airSlate SignNow?

dr 0205 refers to a specific feature or pricing tier in the airSlate SignNow platform. This designation helps users understand the various functionalities and benefits included in this package. Choosing dr 0205 can enhance your document management processes signNowly.

-

How much does dr 0205 cost?

The pricing for dr 0205 varies based on subscription levels and user needs. Typically, you can expect competitive rates that provide excellent value for document management and eSigning solutions. For detailed pricing information, visit our pricing page.

-

What features are included in the dr 0205 plan?

The dr 0205 plan includes advanced features such as in-person signing, document templates, and real-time tracking. These features are designed to streamline your workflows and enhance productivity. By opting for dr 0205, users can experience a comprehensive suite of tools tailored for efficient document handling.

-

What are the benefits of using airSlate SignNow with dr 0205?

Using airSlate SignNow with dr 0205 offers numerous benefits, including increased efficiency, cost savings, and improved collaboration. Users can easily send documents and collect signatures in one platform. Additionally, dr 0205 ensures that your documents are secure and compliant with industry standards.

-

Can I integrate other applications with dr 0205?

Yes, dr 0205 allows for seamless integrations with various applications and platforms. This flexibility ensures that you can connect airSlate SignNow with your existing tools, enhancing your overall productivity. Check our integrations page for a full list of compatible applications.

-

Is there a mobile app for dr 0205?

Absolutely! The airSlate SignNow platform offers a mobile application that supports the dr 0205 features. This means you can manage your documents and collect eSignatures on the go, ensuring you never miss an opportunity to close a deal.

-

How does dr 0205 ensure document security?

dr 0205 prioritizes document security with features such as encryption, secure access, and audit trails. This ensures that your sensitive information remains protected throughout the signing process. Users can confidently utilize airSlate SignNow knowing their documents are secure.

Get more for DR 0205 Tax Year Ending Computation Of Penalty Due Based On Underpayment Of Colorado Corporate Estimated Tax And DR 0205 If You

- Sample letter revoking hipaa authorization form

- Form rules

- Wtma patient portal login form

- Dental screening form new beginnings schools foundation newbeginningsnola

- Doctor sheet form

- Gulf coast occ med medical authorization form

- Www coursehero comfile43954397dispute form pdf dispute form please complete the form in

- Ohio child medical statement form

Find out other DR 0205 Tax Year Ending Computation Of Penalty Due Based On Underpayment Of Colorado Corporate Estimated Tax And DR 0205 If You

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA