What is Alternative Minimum Tax AMT Video Form

Understanding the Colorado Minimum Tax

The Colorado minimum tax, often referred to as the Alternative Minimum Tax (AMT), is a tax system designed to ensure that individuals and businesses pay a minimum amount of tax, regardless of deductions or credits. This tax applies to certain taxpayers who may otherwise pay little to no tax due to various deductions. Understanding this tax is crucial for accurate filing and compliance with state tax laws.

Eligibility Criteria for Colorado Minimum Tax

To determine if you are subject to the Colorado minimum tax, you must first assess your income level and the deductions you claim. Generally, higher-income earners or those with significant deductions may trigger the AMT. Specific criteria include:

- Filing status (single, married, etc.)

- Income thresholds established by the state

- Types of deductions claimed, such as state tax deductions

Steps to Complete the Colorado Minimum Tax Form

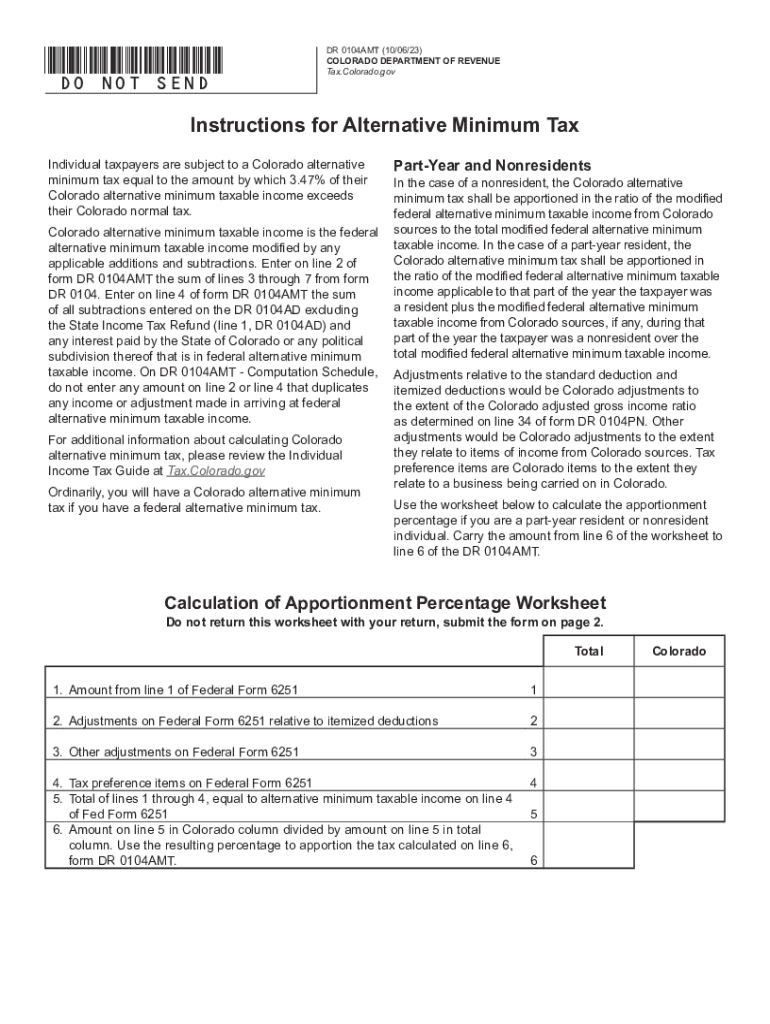

Completing the Colorado minimum tax form, known as the DR 0104AMT, involves several steps. Follow these guidelines to ensure accurate submission:

- Gather necessary documentation, including income statements and deduction records.

- Calculate your adjusted gross income (AGI) and determine if you exceed the income threshold.

- Complete the DR 0104AMT form, following the instructions provided.

- Review your calculations for accuracy.

- Submit the form by the state’s filing deadline.

Required Documents for Filing

When filing for the Colorado minimum tax, it is essential to have the right documents on hand. These typically include:

- W-2 forms from employers

- 1099 forms for other income

- Records of deductions claimed

- Previous year’s tax return for reference

Filing Deadlines for the Colorado Minimum Tax

Filing deadlines for the Colorado minimum tax align with the general state tax deadlines. Typically, individual tax returns are due on April 15. If this date falls on a weekend or holiday, the deadline may be extended. It is important to stay updated on any changes to filing dates to avoid penalties.

Penalties for Non-Compliance

Failure to comply with Colorado minimum tax regulations can result in significant penalties. These may include:

- Late filing penalties

- Interest on unpaid taxes

- Potential audits by the state tax authority

Ensuring timely and accurate filing can help avoid these consequences.

Quick guide on how to complete what is alternative minimum tax amt video

Complete What Is Alternative Minimum Tax AMT Video effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-conscious alternative to conventional printed and signed paperwork, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the tools needed to create, edit, and electronically sign your documents swiftly without delays. Manage What Is Alternative Minimum Tax AMT Video on any device using airSlate SignNow Android or iOS applications and streamline any document-related procedure today.

The easiest way to edit and eSign What Is Alternative Minimum Tax AMT Video without stress

- Find What Is Alternative Minimum Tax AMT Video and click on Get Form to begin.

- Use the tools we offer to finalize your document.

- Emphasize important sections of your documents or obscure sensitive data with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign feature, which takes just seconds and carries the same legal authority as a conventional ink signature.

- Review all details and click on the Done button to save your modifications.

- Choose how you wish to submit your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious searches for forms, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Edit and eSign What Is Alternative Minimum Tax AMT Video and ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the what is alternative minimum tax amt video

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Colorado minimum requirement for electronic signatures?

The Colorado minimum requirement for electronic signatures ensures that eSignatures are legally binding under the Uniform Electronic Transactions Act. Using airSlate SignNow, businesses can easily comply with these requirements while streamlining their document processes.

-

How does airSlate SignNow help meet Colorado minimum compliance standards?

airSlate SignNow is designed to help businesses meet Colorado minimum compliance standards by providing secure and legally binding electronic signatures. Our platform ensures that all transactions are encrypted and traceable, giving you peace of mind regarding the legal standing of your documents.

-

What are the pricing options for airSlate SignNow with regard to Colorado minimum requirements?

airSlate SignNow offers flexible pricing options that cater to various business sizes and needs while adhering to Colorado minimum requirements. Depending on your chosen plan, you can access advanced features that enhance your eSignature experience without breaking the bank.

-

Can I integrate airSlate SignNow with my existing business tools while ensuring Colorado minimum compliance?

Yes, airSlate SignNow seamlessly integrates with a variety of business tools, ensuring you can maintain productivity while adhering to Colorado minimum compliance standards. Integration options include popular platforms like Salesforce, Google Drive, and more, making it easy to manage your documents in one place.

-

What are the benefits of using airSlate SignNow for Colorado minimum documentation?

Using airSlate SignNow for your Colorado minimum documentation brings multiple benefits, such as increased efficiency and reduced turnaround times. With an intuitive interface, you can easily create, send, and manage documents, all while ensuring compliance with Colorado’s electronic signature laws.

-

Is airSlate SignNow suitable for small businesses in Colorado regarding minimum requirements?

Absolutely! airSlate SignNow is an ideal solution for small businesses in Colorado looking to meet minimum requirements without incurring heavy costs. Our user-friendly platform empowers small organizations to leverage the power of electronic signatures and streamline their operations effectively.

-

What features does airSlate SignNow offer to ensure adherence to Colorado minimum standards?

airSlate SignNow offers a range of features to ensure adherence to Colorado minimum standards, including customizable templates, audit trails, and multi-factor authentication. These tools provide added security and compliance assurance for your eSigning processes, so you can focus on your business.

Get more for What Is Alternative Minimum Tax AMT Video

- Georgia noi form

- Agent appointment package aegon group pdf form

- Eesd 3900 form

- 3206 0136 designation of beneficiary federal employees group life insurance federal employees group life insurance fegli form

- Standard work order form minnesota state university mankato mnsu

- Git rep 3 form

- Date good citizenship award school express form

- Lead leads to busy days at vancouver lab columbian com form

Find out other What Is Alternative Minimum Tax AMT Video

- Sign Arkansas Nanny Contract Template Fast

- How To Sign California Nanny Contract Template

- How Do I Sign Colorado Medical Power of Attorney Template

- How To Sign Louisiana Medical Power of Attorney Template

- How Do I Sign Louisiana Medical Power of Attorney Template

- Can I Sign Florida Memorandum of Agreement Template

- How Do I Sign Hawaii Memorandum of Agreement Template

- Sign Kentucky Accident Medical Claim Form Fast

- Sign Texas Memorandum of Agreement Template Computer

- How Do I Sign Utah Deed of Trust Template

- Sign Minnesota Declaration of Trust Template Simple

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy

- Sign Nevada Strategic Alliance Agreement Online

- How To Sign Alabama Home Repair Contract

- Sign Delaware Equipment Rental Agreement Template Fast

- Sign Nevada Home Repair Contract Easy

- Sign Oregon Construction Contract Template Online

- Sign Wisconsin Construction Contract Template Simple