DR 0204 Tax Year Ending Computation of Penalty Due Based on Underpayment of Colorado Individual Estimated Tax If You Are Using a Form

Understanding the DR 0204 Tax Form

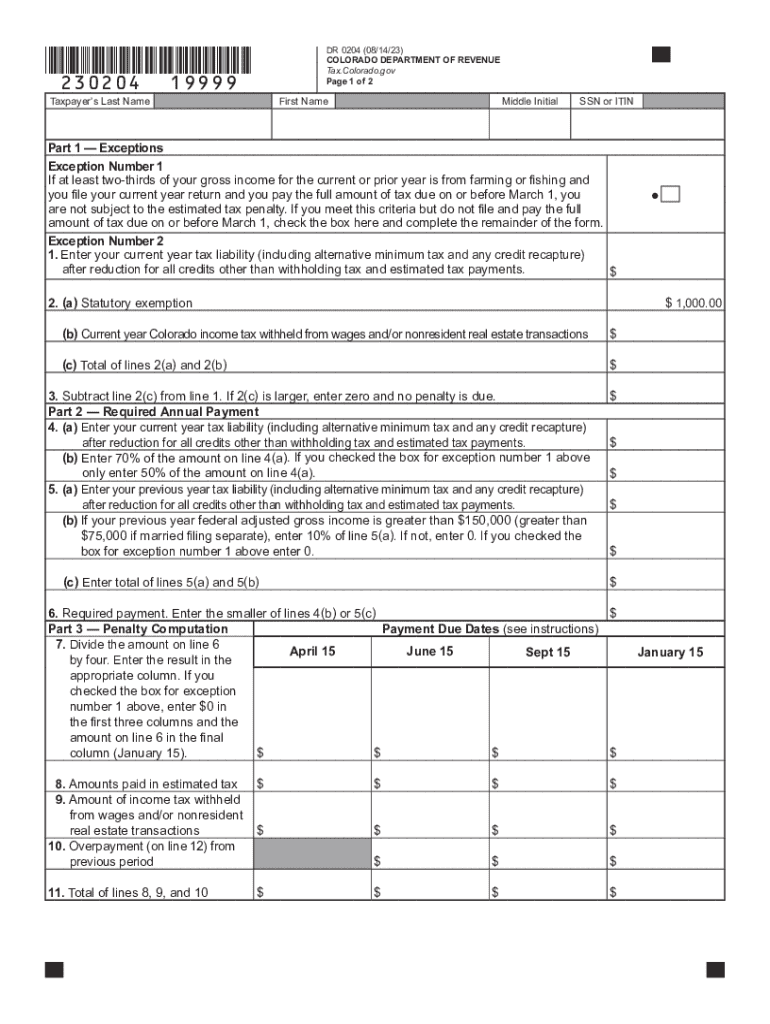

The DR 0204 form, officially known as the Computation of Penalty Due Based on Underpayment of Colorado Individual Estimated Tax, is essential for individuals in Colorado who may have underpaid their estimated taxes. This form helps calculate any penalties that may arise due to insufficient tax payments throughout the year. Understanding the nuances of this form is crucial for compliance with Colorado tax regulations.

Steps to Complete the DR 0204 Form

Completing the DR 0204 form involves several key steps to ensure accuracy and compliance. Begin by gathering your financial documents, including income statements and previous tax returns. Next, follow these steps:

- Determine your total estimated tax liability for the year.

- Calculate the amount you have already paid in estimated taxes.

- Assess whether you have underpaid your estimated taxes.

- Use the provided calculations on the form to determine the penalty amount.

- Complete the form with your findings and ensure all figures are accurate.

Key Elements of the DR 0204 Form

Several key elements must be included when filling out the DR 0204 form. These include:

- Your personal identification information, including name and Social Security number.

- The total amount of estimated tax due for the year.

- The total amount of estimated tax paid to date.

- The calculated penalty amount for underpayment, if applicable.

Ensuring all these elements are accurately reported is vital for a smooth filing process.

Penalties for Non-Compliance

Failure to accurately complete and submit the DR 0204 form can lead to significant penalties. If you underreport your estimated tax payments, the Colorado Department of Revenue may impose fines. These penalties can accumulate quickly, making it essential to file the form correctly and on time to avoid unnecessary financial burdens.

Filing Deadlines and Important Dates

Timely submission of the DR 0204 form is critical. The filing deadlines typically align with the annual tax deadlines in Colorado. Keeping track of these dates helps ensure that you submit your form on time, thereby avoiding penalties. It is advisable to check the Colorado Department of Revenue's official calendar for specific due dates each tax year.

Eligibility Criteria for Using the DR 0204 Form

To use the DR 0204 form, individuals must meet specific eligibility criteria. Primarily, this form is intended for Colorado residents who have underpaid their estimated individual income taxes. Additionally, it applies to those who have a tax liability exceeding a certain threshold, which can vary from year to year. Understanding these criteria can help determine whether you need to file this form.

Quick guide on how to complete dr 0204 tax year ending computation of penalty due based on underpayment of colorado individual estimated tax if you are using

Complete DR 0204 Tax Year Ending Computation Of Penalty Due Based On Underpayment Of Colorado Individual Estimated Tax If You Are Using A effortlessly on any device

Online document administration has become increasingly favored by businesses and individuals. It presents an excellent eco-friendly substitute for conventional printed and signed materials, as you can easily find the necessary form and securely store it online. airSlate SignNow equips you with all the features required to create, modify, and eSign your documents swiftly without interruptions. Manage DR 0204 Tax Year Ending Computation Of Penalty Due Based On Underpayment Of Colorado Individual Estimated Tax If You Are Using A on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The easiest way to modify and eSign DR 0204 Tax Year Ending Computation Of Penalty Due Based On Underpayment Of Colorado Individual Estimated Tax If You Are Using A without hassle

- Find DR 0204 Tax Year Ending Computation Of Penalty Due Based On Underpayment Of Colorado Individual Estimated Tax If You Are Using A and click Obtain Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important portions of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Finish button to secure your modifications.

- Choose how you want to send your form, via email, SMS, invitation link, or download it to your computer.

No more concerns about lost or mislaid documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow manages all your document management requirements in just a few clicks from a device of your choice. Modify and eSign DR 0204 Tax Year Ending Computation Of Penalty Due Based On Underpayment Of Colorado Individual Estimated Tax If You Are Using A and ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dr 0204 tax year ending computation of penalty due based on underpayment of colorado individual estimated tax if you are using

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is dr0204 in relation to airSlate SignNow?

The term dr0204 refers to a specific functionality or feature within the airSlate SignNow platform. It allows users to easily manage and eSign documents securely and efficiently. Through dr0204, businesses can streamline their workflow and enhance productivity.

-

How does airSlate SignNow utilize dr0204 for document management?

airSlate SignNow incorporates dr0204 as a key feature in its document management solution. With dr0204, users can quickly send, receive, and sign documents, reducing turnaround times. This automation saves time and improves the overall efficiency of document handling.

-

What pricing plans does airSlate SignNow offer for dr0204?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including those utilizing dr0204. Prices vary based on features and the number of users. You can choose a plan that best fits your organization’s size and document management needs.

-

What are the key benefits of using dr0204 in airSlate SignNow?

Using dr0204 within airSlate SignNow provides numerous benefits, including enhanced workflow efficiency, improved document security, and cost savings. Businesses can reduce manual processes and minimize errors, leading to faster project completion and higher accuracy in document execution.

-

Can I integrate dr0204 with other software applications?

Yes, airSlate SignNow allows for seamless integration of dr0204 with various software applications. This capability enables businesses to connect their existing tools and enhance functionality further. Popular integrations may include CRM platforms, accounting software, and more.

-

How secure is the use of dr0204 for eSigning documents?

The airSlate SignNow platform, including the dr0204 feature, employs robust security measures to ensure secure eSigning of documents. With encryption and compliance with major regulations, users can trust that their sensitive information will be kept safe throughout the signing process.

-

What types of documents can I send using dr0204?

With dr0204 in airSlate SignNow, you can send various types of documents for eSigning, including contracts, agreements, and consent forms. The platform supports multiple file formats, ensuring you can handle all your document types efficiently. It’s designed to make document workflows simpler for businesses.

Get more for DR 0204 Tax Year Ending Computation Of Penalty Due Based On Underpayment Of Colorado Individual Estimated Tax If You Are Using A

- Pacenet pace enrollment application form

- National sex offender registry department of human servicesnational sex offender registry department of human servicesunited form

- Construction work zone claim incident report form

- Dem ri govnatural resources bureaumarine fisheriesmarine fisheriesrhode island department of environmental form

- Request for exception to ride a school bus form

- Policycertificate holder information

- Form n 301 rev application for automatic extension of time to file hawaii corporation income tax return forms fillable

- Cooperative education agreement total points form

Find out other DR 0204 Tax Year Ending Computation Of Penalty Due Based On Underpayment Of Colorado Individual Estimated Tax If You Are Using A

- How To eSign Arizona Course Evaluation Form

- How To eSign California Course Evaluation Form

- How To eSign Florida Course Evaluation Form

- How To eSign Hawaii Course Evaluation Form

- How To eSign Illinois Course Evaluation Form

- eSign Hawaii Application for University Free

- eSign Hawaii Application for University Secure

- eSign Hawaii Medical Power of Attorney Template Free

- eSign Washington Nanny Contract Template Free

- eSignature Ohio Guaranty Agreement Myself

- eSignature California Bank Loan Proposal Template Now

- Can I eSign Indiana Medical History

- eSign Idaho Emergency Contract Form Myself

- eSign Hawaii General Patient Information Fast

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure