A Completed Tax Return FP 7C is Required to Record Any Deed, Deed of Trust, Modification or Form

What is the A Completed Tax Return FP 7C Is Required To Record Any Deed, Deed Of Trust, Modification Or

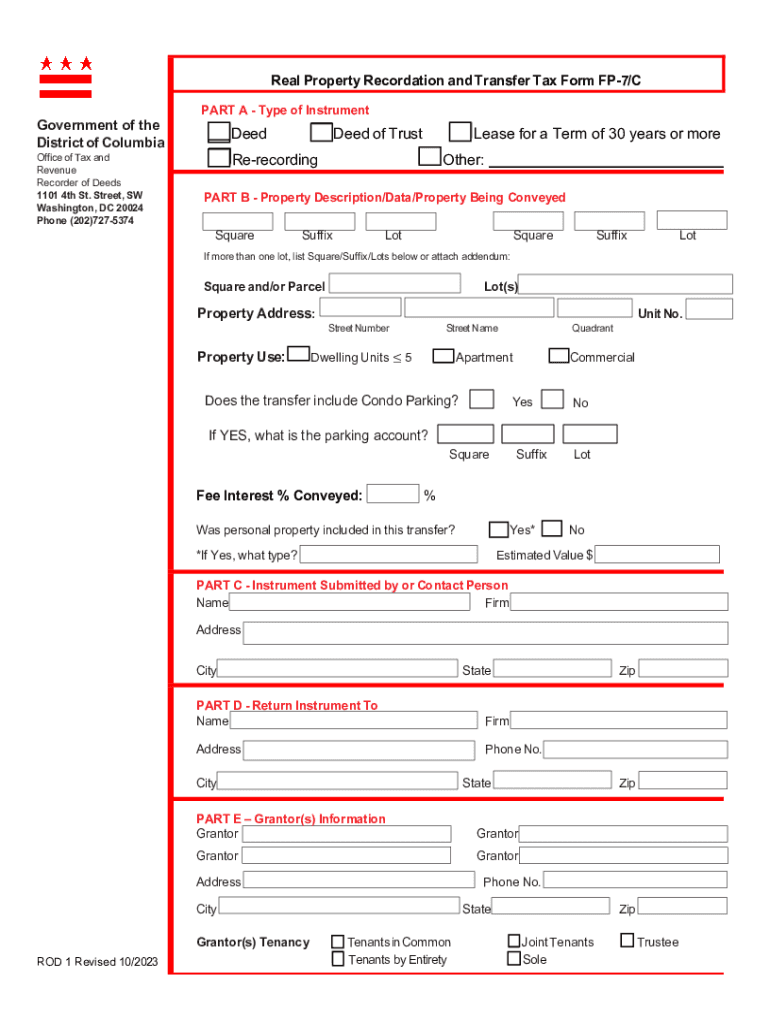

The A Completed Tax Return FP 7C is a specific form required in the United States for recording various legal documents, such as deeds, deeds of trust, and modifications. This form serves as a verification tool to ensure that the tax obligations associated with the property are met. It provides essential information to the relevant authorities regarding the financial status of the property owner, which is crucial for legal transactions involving real estate.

How to use the A Completed Tax Return FP 7C Is Required To Record Any Deed, Deed Of Trust, Modification Or

Using the A Completed Tax Return FP 7C involves several steps. First, ensure that you have accurately completed your tax return for the relevant year. This includes gathering all necessary financial documents and information. Once your tax return is finalized, you will need to fill out the FP 7C form, providing details about the deed or modification you wish to record. After completing the form, submit it along with your tax return to the appropriate local or state recording office, following their specific submission guidelines.

Steps to complete the A Completed Tax Return FP 7C Is Required To Record Any Deed, Deed Of Trust, Modification Or

To complete the A Completed Tax Return FP 7C, follow these steps:

- Gather all relevant financial documents, including your completed tax return.

- Obtain the FP 7C form from your local recording office or official resources.

- Fill out the form with accurate details about the deed or modification.

- Review the form for completeness and accuracy.

- Submit the completed FP 7C form along with your tax return to the appropriate office.

Legal use of the A Completed Tax Return FP 7C Is Required To Record Any Deed, Deed Of Trust, Modification Or

The legal use of the A Completed Tax Return FP 7C is primarily to ensure compliance with state and federal regulations regarding property transactions. This form acts as proof that the property owner has fulfilled their tax obligations, which is a prerequisite for recording any deeds or modifications. Failure to provide this documentation can lead to delays in the recording process or potential legal complications.

Required Documents

When preparing to submit the A Completed Tax Return FP 7C, it is essential to have the following documents ready:

- Your completed tax return for the relevant year.

- Any supporting financial documents that verify your income and tax status.

- The FP 7C form itself, accurately filled out.

- Identification documents, if required by the recording office.

Filing Deadlines / Important Dates

Filing deadlines for the A Completed Tax Return FP 7C may vary by state and the specific type of transaction. It is crucial to check with your local recording office for the exact deadlines. Generally, it is advisable to submit the form as soon as your tax return is completed to avoid any delays in recording your deed or modification.

Quick guide on how to complete a completed tax return fp 7c is required to record any deed deed of trust modification or

Effortlessly Prepare A Completed Tax Return FP 7C Is Required To Record Any Deed, Deed Of Trust, Modification Or on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to access the correct version and securely store it online. airSlate SignNow provides all the resources necessary to quickly create, modify, and eSign your documents without delays. Manage A Completed Tax Return FP 7C Is Required To Record Any Deed, Deed Of Trust, Modification Or on any device using airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

The Easiest Way to Modify and eSign A Completed Tax Return FP 7C Is Required To Record Any Deed, Deed Of Trust, Modification Or Seamlessly

- Find A Completed Tax Return FP 7C Is Required To Record Any Deed, Deed Of Trust, Modification Or and click on Get Form to begin.

- Utilize the provided tools to complete your document.

- Emphasize important sections of your documents or redact sensitive data using the tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign function, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to preserve your changes.

- Choose your preferred method for sending your form, whether by email, text message (SMS), sharing a link, or downloading it to your computer.

Eliminate concerns about lost or misplaced documents, frustrating searches for forms, or mistakes that require reprinting. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign A Completed Tax Return FP 7C Is Required To Record Any Deed, Deed Of Trust, Modification Or to ensure effective communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the a completed tax return fp 7c is required to record any deed deed of trust modification or

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is required to record a deed?

A Completed Tax Return FP 7C Is Required To Record Any Deed, Deed Of Trust, Modification Or. This document verifies your tax status and ensures compliance with regulatory requirements when filing important property transactions.

-

How does airSlate SignNow assist with tax documents?

With airSlate SignNow, you can easily eSign and manage documents, ensuring that a Completed Tax Return FP 7C Is Required To Record Any Deed, Deed Of Trust, Modification Or is obtained and processed efficiently. Our intuitive platform simplifies document handling and keeps you organized.

-

What is the pricing structure for airSlate SignNow?

Our pricing plans are designed to be cost-effective and scalable for businesses of any size. Subscriptions include access to essential features like eSigning and document tracking, which are crucial when ensuring a Completed Tax Return FP 7C Is Required To Record Any Deed, Deed Of Trust, Modification Or.

-

Can I integrate airSlate SignNow with other software?

Yes, airSlate SignNow offers various integrations with popular business applications, enhancing your workflows. This ensures that processes requiring a Completed Tax Return FP 7C Is Required To Record Any Deed, Deed Of Trust, Modification Or can be streamlined across platforms.

-

What are the key features of airSlate SignNow?

Key features include document templates, real-time tracking, and secure eSigning capabilities. These tools are critical for managing documentation accurately where a Completed Tax Return FP 7C Is Required To Record Any Deed, Deed Of Trust, Modification Or is concerned.

-

Is airSlate SignNow secure for sensitive documents?

Absolutely! airSlate SignNow employs advanced security measures, including encryption and secure data storage, to protect sensitive information. This is especially important when handling a Completed Tax Return FP 7C Is Required To Record Any Deed, Deed Of Trust, Modification Or, ensuring your data is safe.

-

How can airSlate SignNow improve my document workflow?

By automating the eSigning process and facilitating document management, airSlate SignNow signNowly speeds up workflows. This is particularly helpful for transactions where a Completed Tax Return FP 7C Is Required To Record Any Deed, Deed Of Trust, Modification Or, allowing you to focus on your core business activities.

Get more for A Completed Tax Return FP 7C Is Required To Record Any Deed, Deed Of Trust, Modification Or

- Washington state department of revenue audit divis form

- Pactregistration pact act registration form

- Cq077 podiatry referral bform v1b2 queensland health health qld gov

- Statement of personal health and circumstances docx form

- Form to enrol in a victorian government school

- Rlrp application form

- Smile line dental form

- Tax registration certificate form

Find out other A Completed Tax Return FP 7C Is Required To Record Any Deed, Deed Of Trust, Modification Or

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document