Collection & Compliance Notices SC Department of Revenue Form

Understanding the South Carolina Resale Certificate

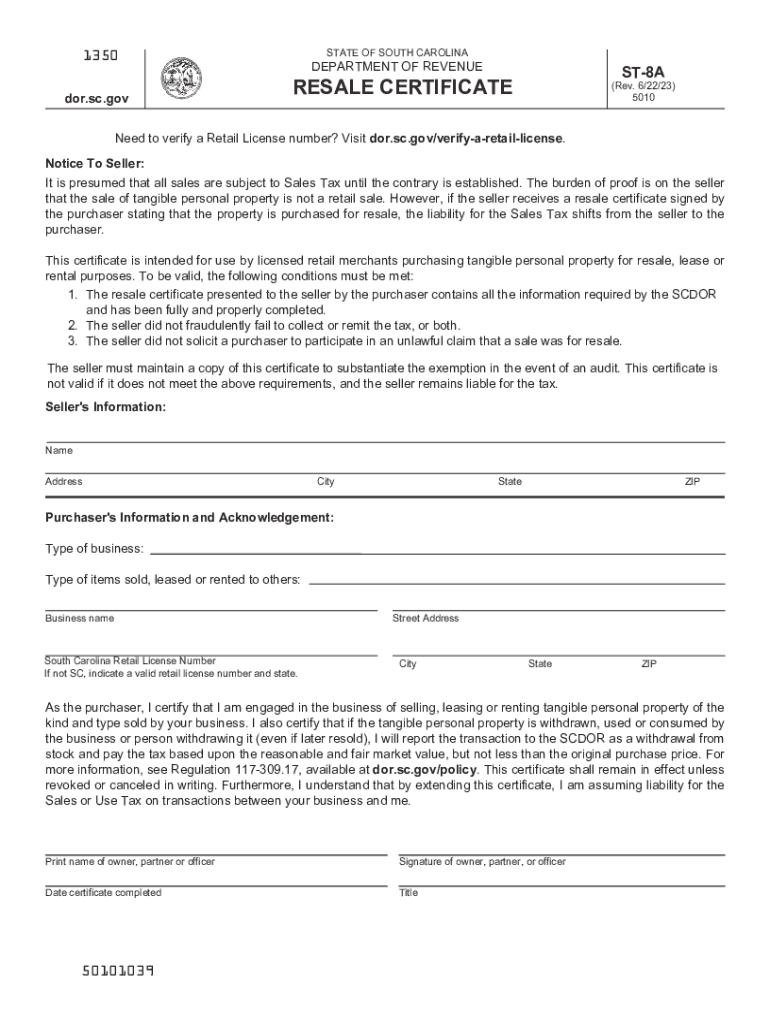

The South Carolina resale certificate, also known as the SC resale certificate, is a crucial document for businesses that purchase goods for resale. It allows retailers to buy items without paying sales tax, provided those items are intended for resale rather than personal use. This certificate is essential for maintaining compliance with South Carolina tax regulations and is used to substantiate tax-exempt purchases.

Steps to Complete the SC Resale Certificate

Filling out the SC resale certificate involves several straightforward steps:

- Obtain the form: The SC resale certificate can be found on the South Carolina Department of Revenue's website or through authorized tax professionals.

- Provide your business information: Include the name, address, and sales tax number of your business.

- Detail the items for resale: Clearly specify the types of goods you intend to purchase tax-exempt.

- Sign and date the certificate: Ensure that the document is signed by an authorized representative of your business.

Legal Use of the SC Resale Certificate

The SC resale certificate must be used in accordance with state law. It is intended solely for transactions involving items purchased for resale. Misuse of the certificate, such as using it for personal purchases or non-resale items, can result in penalties, including fines and back taxes owed. Businesses should keep accurate records of all transactions involving the resale certificate to ensure compliance.

Eligibility Criteria for the SC Resale Certificate

To qualify for the SC resale certificate, businesses must meet specific criteria:

- Be registered with the South Carolina Department of Revenue and possess a valid sales tax number.

- Engage in the sale of tangible personal property that is subject to sales tax.

- Use the certificate exclusively for purchases intended for resale.

Required Documents for the SC Resale Certificate

When applying for or using the SC resale certificate, businesses must be prepared to provide certain documents:

- A copy of the business's sales tax registration certificate.

- Documentation that verifies the nature of the business and the types of goods sold.

- Any additional forms or information requested by the South Carolina Department of Revenue.

Form Submission Methods for the SC Resale Certificate

The SC resale certificate can be submitted in various ways, depending on the preferences of the seller and the buyer:

- Online: Many businesses opt to complete and submit the form electronically through compatible accounting software.

- Mail: The completed form can be printed and sent via postal service to the seller.

- In-person: Businesses may also deliver the form directly to the seller during a transaction.

Quick guide on how to complete collection ampamp compliance notices sc department of revenue

Complete Collection & Compliance Notices SC Department Of Revenue effortlessly on any device

Online document management has gained traction among businesses and individuals. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to easily locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents swiftly without any holdups. Manage Collection & Compliance Notices SC Department Of Revenue on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign Collection & Compliance Notices SC Department Of Revenue with ease

- Locate Collection & Compliance Notices SC Department Of Revenue and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors requiring new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Edit and eSign Collection & Compliance Notices SC Department Of Revenue and ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the collection ampamp compliance notices sc department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an SC resale certificate?

An SC resale certificate is a document used by sellers in South Carolina to purchase goods tax-free when those goods are intended for resale. This certificate allows businesses to avoid paying sales tax on items they will sell to consumers. Having an SC resale certificate can signNowly lower operational costs for retailers and wholesalers.

-

How do I obtain an SC resale certificate?

To obtain an SC resale certificate, you must complete the specific application form provided by the South Carolina Department of Revenue. Make sure to provide accurate business information and be prepared to include your sales tax number. Once your application is approved, you'll be able to use the SC resale certificate for qualifying purchases.

-

Can airSlate SignNow help me manage my SC resale certificate documents?

Yes, airSlate SignNow offers features to simplify document management, including the storage and sharing of your SC resale certificate. The platform allows you to easily access and eSign essential documents, ensuring that your business remains compliant with resale certificate requirements. Streamlining this process can save you time and increase efficiency.

-

Are there any costs associated with obtaining an SC resale certificate through airSlate SignNow?

There are no fees specifically for obtaining an SC resale certificate through airSlate SignNow, as the certificate itself does not cost anything from the state. However, using airSlate SignNow may involve a subscription or usage fees, depending on the features you choose. Consider the value of streamlined document management as a beneficial investment.

-

What are the benefits of using airSlate SignNow for SC resale certificates?

Using airSlate SignNow for your SC resale certificates offers various benefits, including efficiency, security, and compliance. The platform enables you to send, eSign, and store documents securely in one place, minimizing the risk of loss. Additionally, you can easily track document status and maintain compliance with state reselling laws.

-

Does airSlate SignNow integrate with other business tools for managing SC resale certificates?

Yes, airSlate SignNow integrates seamlessly with various business tools, enhancing your ability to manage SC resale certificates. Integrations with popular software like Google Drive, Salesforce, and more allow for efficient workflows. This connectivity helps streamline your operations and keeps all necessary documents organized and accessible.

-

What documents do I need to provide when using an SC resale certificate?

When using an SC resale certificate, businesses typically need to provide documentation that verifies their status as a reseller. This may include your business license, your sales tax number, and any previous sales records relevant to the goods sold. It's important to keep this documentation on hand for audits and compliance checks.

Get more for Collection & Compliance Notices SC Department Of Revenue

- Aura grande golden retrievers form

- Affidavit regarding baptism and dom to marry form

- Gas 1274 registration application for motor carrier license and decals form

- Lunch order form crossroads christian school ccscolts

- Online credit card authorization form

- Adam ampamp eve founder phil harvey honored with washington post obituary form

- Wellness activity liability acknowledgement form informed

- Alarmapp doc form

Find out other Collection & Compliance Notices SC Department Of Revenue

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template