Other Helpful Information CT Gov 2016

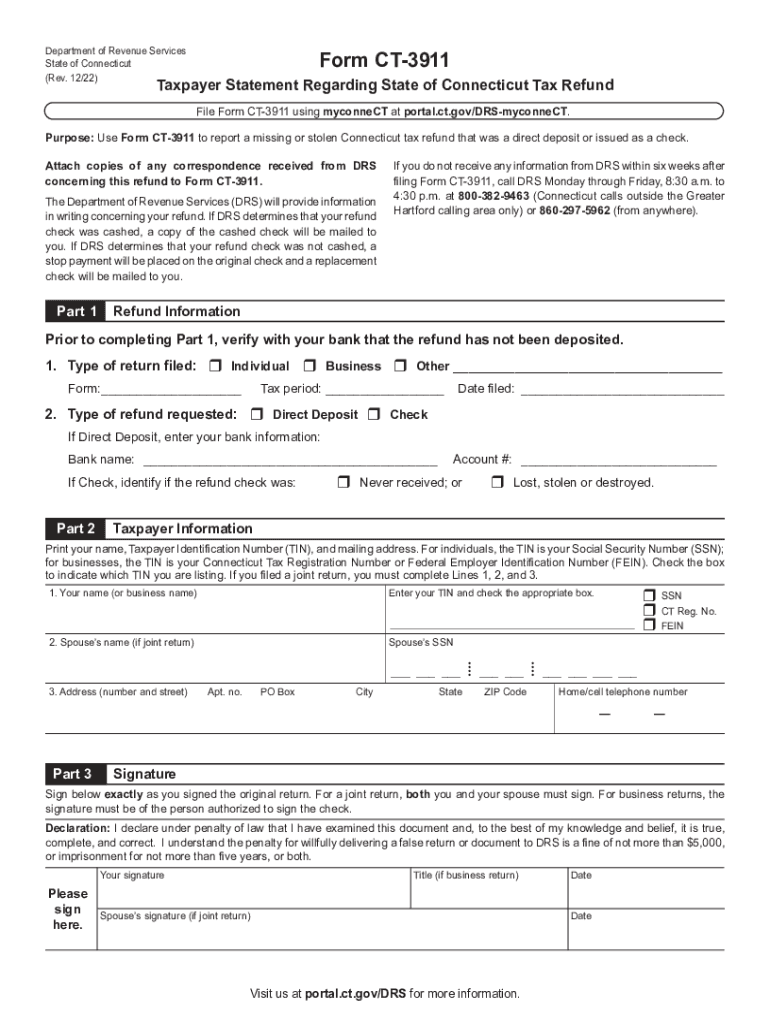

What is Connecticut Form 3911?

Connecticut Form 3911, also known as the CT 3911 tax form, is a crucial document used by taxpayers in Connecticut to request a refund of their state income tax. This form is particularly important for individuals who believe they are entitled to a refund due to overpayment or other qualifying circumstances. Understanding the purpose of this form is essential for ensuring that taxpayers can effectively manage their tax obligations and receive any refunds owed to them.

Steps to Complete Connecticut Form 3911

Filling out Connecticut Form 3911 requires careful attention to detail. Here are the steps to complete the form:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Provide details about your tax year and the amount you believe you are owed as a refund.

- Include any relevant documentation that supports your request for a refund, such as previous tax returns or payment receipts.

- Review the form for accuracy before submitting it to ensure all information is correct.

Required Documents for Form 3911

When submitting Connecticut Form 3911, it is important to include certain documents to support your refund request. Required documents may include:

- A copy of your most recent tax return.

- Proof of payment for any taxes previously submitted.

- Any correspondence from the Connecticut Department of Revenue Services related to your tax account.

Gathering these documents in advance can help streamline the process and reduce the likelihood of delays in receiving your refund.

Form Submission Methods for Connecticut Form 3911

Connecticut Form 3911 can be submitted through various methods to accommodate taxpayer preferences:

- Online Submission: Taxpayers can submit the form electronically through the Connecticut Department of Revenue Services website.

- Mail Submission: You can print the completed form and mail it to the address specified on the form.

- In-Person Submission: For those who prefer face-to-face interactions, submitting the form in person at a local Department of Revenue Services office is an option.

Filing Deadlines for Connecticut Form 3911

Timeliness is crucial when submitting Connecticut Form 3911. Generally, the form should be filed within three years from the due date of the original tax return for the year in question. Missing this deadline may result in the forfeiture of your right to claim a refund. It is advisable to keep track of these dates to ensure compliance and avoid any complications.

IRS Guidelines Related to Connecticut Form 3911

While Connecticut Form 3911 is a state-specific form, it is essential to be aware of how it interacts with federal tax regulations. The IRS provides guidelines on how state refunds are treated for federal tax purposes. Taxpayers should consult IRS publications or a tax professional to understand the implications of receiving a state refund on their federal tax filings.

Quick guide on how to complete other helpful information ct gov

Complete Other Helpful Information CT gov effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly alternative to conventional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage Other Helpful Information CT gov on any device using the airSlate SignNow Android or iOS applications and simplify any document-centric task today.

The easiest way to modify and eSign Other Helpful Information CT gov without hassle

- Obtain Other Helpful Information CT gov and then click Get Form to begin.

- Utilize the tools we provide to finish your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically supplies for that purpose.

- Generate your signature using the Sign tool, which takes seconds and has the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign Other Helpful Information CT gov and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct other helpful information ct gov

Create this form in 5 minutes!

How to create an eSignature for the other helpful information ct gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the connectiuct form 3911 and how is it used?

The connectiuct form 3911 is a crucial document used in Connecticut for various tax-related purposes. It helps taxpayers to rectify tax filing issues or inquiries. Using airSlate SignNow, you can easily fill out and eSign the connectiuct form 3911, streamlining your submission process.

-

How much does it cost to use airSlate SignNow for the connectiuct form 3911?

AirSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. The cost-effective solution ensures that you can easily send and eSign the connectiuct form 3911 without breaking the bank. Check our pricing page for detailed information on subscription options.

-

What features does airSlate SignNow offer for the connectiuct form 3911?

AirSlate SignNow provides a variety of features that simplify the process of managing the connectiuct form 3911. These include secure eSigning, templates for quick form filling, and document tracking to ensure your submissions are handled efficiently. Enjoy a user-friendly interface designed for ease of use.

-

What are the benefits of using airSlate SignNow for the connectiuct form 3911?

Using airSlate SignNow for the connectiuct form 3911 offers numerous benefits, including streamlined workflows and enhanced document security. You'll save time with automated eSigning processes and reduce paper clutter. This efficient solution allows you to focus more on your core business activities.

-

Can I integrate airSlate SignNow with other software to manage the connectiuct form 3911?

Yes, airSlate SignNow offers numerous integrations with popular applications, making it easier to manage the connectiuct form 3911 alongside other essential tools. This interoperability enhances your workflow, allowing automatic data transfer between systems. Check our integration list for specifics on compatible software.

-

Is airSlate SignNow compliant with legal regulations for the connectiuct form 3911?

Absolutely! AirSlate SignNow is designed with compliance in mind, ensuring that all eSignatures for the connectiuct form 3911 adhere to legal standards. Our platform safeguards your data while ensuring that your documents are securely stored and easily accessible.

-

How secure is airSlate SignNow when handling the connectiuct form 3911?

Security is a top priority for airSlate SignNow, especially when dealing with sensitive documents like the connectiuct form 3911. We utilize advanced encryption protocols, secure cloud storage, and multi-factor authentication to protect your information. You can trust us with your eSigning needs.

Get more for Other Helpful Information CT gov

- Noaa diving program diving incident report form ndc noaa

- Pharmacy address form

- Direct care staff appsstateorus form

- Sex history assessment form

- Dental insurance verification doc form

- Crisis plan template fill online printable fillable blank form

- How to lift your email conversions to 500 with form

- Emergency contact and medical information for a child m childs name date of birth parentsguardians name f parentsguardians name

Find out other Other Helpful Information CT gov

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online