Check the Status of Your Income Tax Refund 2023-2026

Understanding the CT 3911 Form

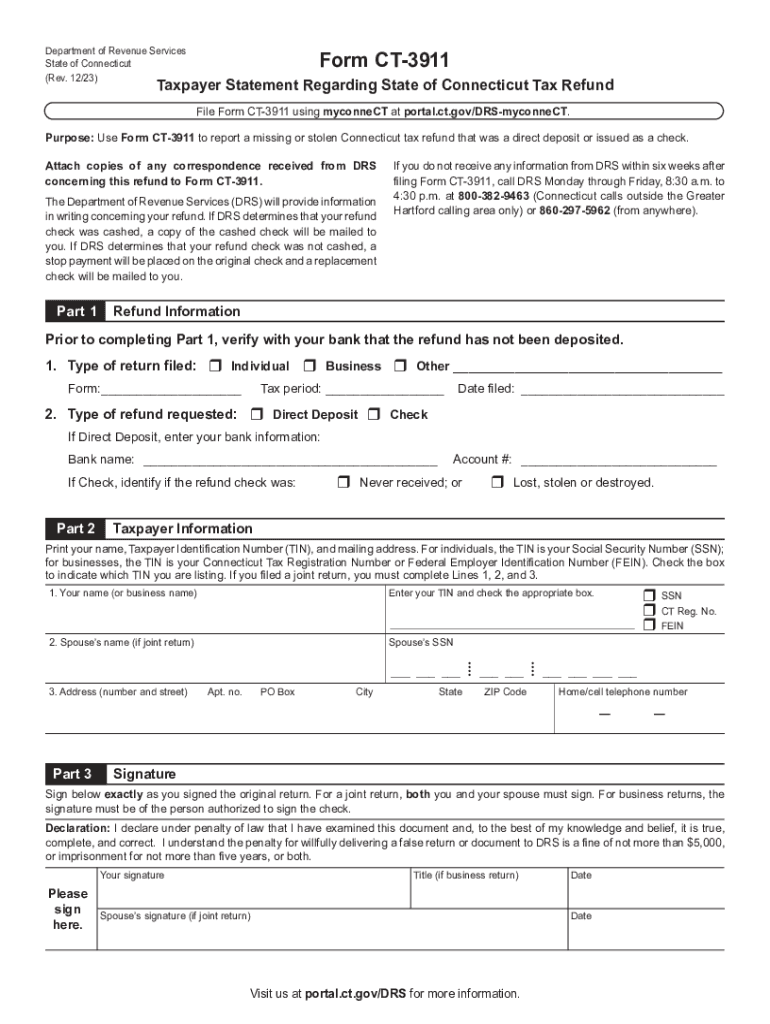

The CT 3911 form, also known as the "Request for Refund of Income Tax," is a crucial document used by taxpayers in Connecticut. It allows individuals to request a refund for overpaid state income taxes. This form is particularly relevant for those who have filed their tax returns and believe they are entitled to a refund due to various reasons, such as an overpayment or an error on their original return. Understanding the purpose and requirements of the CT 3911 form is essential for ensuring that taxpayers can successfully reclaim their funds.

Steps to Complete the CT 3911 Form

Completing the CT 3911 form involves several key steps:

- Gather necessary information, including your Social Security number, tax year, and details of the overpayment.

- Fill out the form accurately, ensuring all sections are completed. Pay special attention to the refund amount you are requesting.

- Review the form for any errors or omissions before submission.

- Sign and date the form to validate your request.

Taking the time to complete the form correctly can help expedite the refund process.

Required Documents for Submission

When submitting the CT 3911 form, certain documents may be required to support your request. These typically include:

- A copy of your tax return for the year in question.

- Any relevant documentation that verifies the overpayment, such as W-2 forms or 1099s.

- Proof of identity, which may include a government-issued ID.

Having these documents ready can facilitate a smoother processing of your refund request.

Filing Methods for the CT 3911 Form

Taxpayers can submit the CT 3911 form through various methods:

- Online Submission: Some taxpayers may have the option to submit the form electronically through the Connecticut Department of Revenue Services website.

- Mail: The form can be printed, completed, and mailed to the appropriate address specified on the form.

- In-Person: Taxpayers may also choose to deliver the form in person at designated state offices.

Choosing the right submission method can depend on your preferences and the urgency of your refund request.

Eligibility Criteria for the CT 3911 Form

To be eligible to file the CT 3911 form, taxpayers must meet specific criteria:

- You must have filed a Connecticut income tax return for the year you are requesting a refund.

- There must be a documented overpayment of taxes for the specified tax year.

- The request for a refund must be made within the statutory time limits set by Connecticut tax law.

Understanding these criteria helps ensure that your refund request is valid and can be processed without delays.

Potential Penalties for Non-Compliance

Failing to comply with the requirements related to the CT 3911 form can lead to penalties. These may include:

- Delays in processing your refund request.

- Possible denial of your refund if the form is not submitted correctly or within the required time frame.

- Additional fees or interest on any unpaid taxes if the overpayment is not addressed properly.

Being aware of these potential penalties can motivate taxpayers to complete and submit the CT 3911 form accurately and on time.

Quick guide on how to complete check the status of your income tax refund

Complete Check The Status Of Your Income Tax Refund effortlessly on any device

Web-based document management has become increasingly favored by both organizations and individuals. It offers an ideal eco-conscious alternative to traditional printed and signed documents, enabling you to access the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without any hold-ups. Manage Check The Status Of Your Income Tax Refund on any device using airSlate SignNow's Android or iOS applications and simplify any document-related operation today.

How to amend and eSign Check The Status Of Your Income Tax Refund with ease

- Locate Check The Status Of Your Income Tax Refund and click Get Form to commence.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or conceal sensitive details with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your updates.

- Select how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign Check The Status Of Your Income Tax Refund and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct check the status of your income tax refund

Create this form in 5 minutes!

How to create an eSignature for the check the status of your income tax refund

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ct ct 3911 in relation to airSlate SignNow?

The term 'ct ct 3911' refers to a specific functionality within the airSlate SignNow platform that facilitates efficient document management and eSignature processes. This feature allows users to streamline their workflows by providing secure and legally binding electronic signatures, making it easier to manage approvals and contracts.

-

How much does airSlate SignNow cost?

Pricing for airSlate SignNow varies based on the plan you choose, with options that cater to different business needs. Each plan includes access to core features, including the 'ct ct 3911' functionality, providing exceptional value for users looking to optimize their document signing process.

-

What are the key features of airSlate SignNow?

AirSlate SignNow offers a wealth of features, including template creation, real-time tracking, and custom branding. Notably, the 'ct ct 3911' integration enhances the eSigning experience by ensuring compliance and security, making it ideal for businesses that require a reliable electronic signature solution.

-

What benefits does airSlate SignNow provide for businesses?

Using airSlate SignNow helps businesses save time and reduce costs associated with traditional paper-based processes. The 'ct ct 3911' feature furthers this by offering a seamless way to manage documentation and approvals, ultimately improving operational efficiency and enhancing customer satisfaction.

-

Can airSlate SignNow integrate with other software?

Yes, airSlate SignNow offers various integrations with popular software applications and platforms, enhancing its functionality. The 'ct ct 3911' feature works well with these integrations, allowing users to embed eSigning capabilities directly into their existing workflows and applications.

-

Is airSlate SignNow secure for sensitive documents?

Absolutely, airSlate SignNow prioritizes security with features like encryption and authentication processes. The 'ct ct 3911' functionality is designed to ensure that all signed documents are secure and compliant, making it a trusted choice for businesses handling sensitive information.

-

How does airSlate SignNow improve the workflow process?

AirSlate SignNow streamlines the workflow process by allowing users to send and sign documents electronically in a matter of minutes. Through the 'ct ct 3911' feature, organizations can automate repetitive tasks and reduce delays, thus enabling quicker decision-making.

Get more for Check The Status Of Your Income Tax Refund

Find out other Check The Status Of Your Income Tax Refund

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure