Department of Revenue Services State of Connecticu 2021

What is the Department Of Revenue Services State Of Connecticut

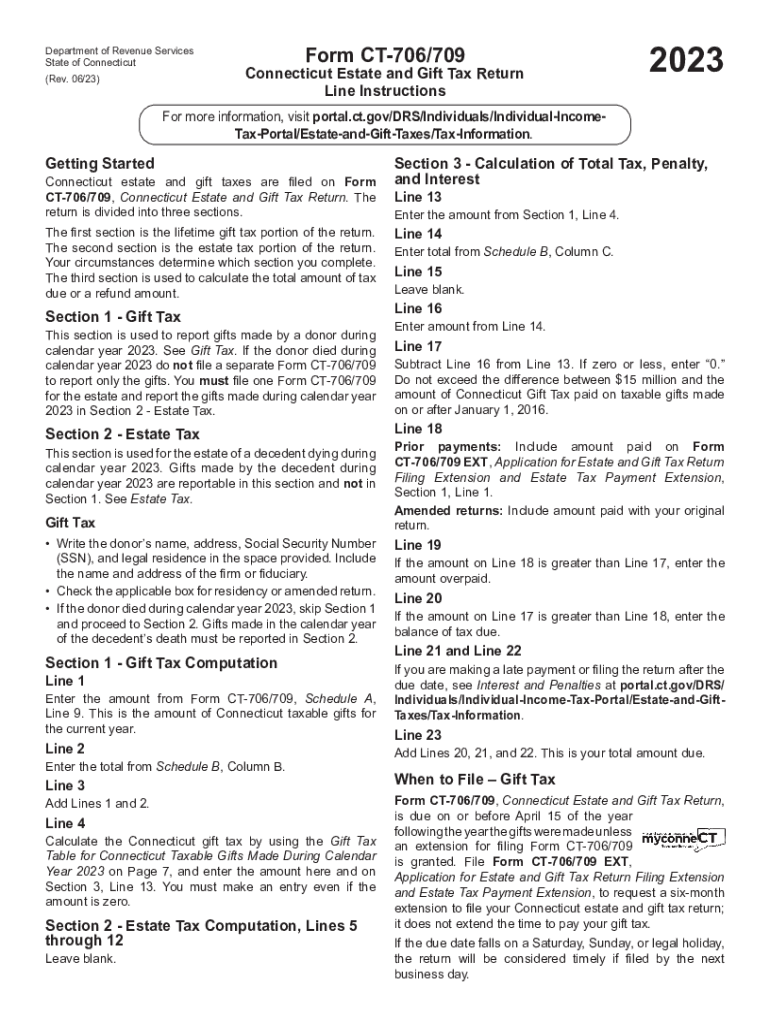

The Department Of Revenue Services (DRS) State Of Connecticut is the state agency responsible for the administration of tax laws and the collection of taxes in Connecticut. It oversees various tax programs, including income tax, sales and use tax, and corporate tax. The DRS ensures compliance with state tax regulations and provides resources to help taxpayers understand their obligations. Its mission is to promote voluntary compliance and enhance the efficiency of tax collection.

How to use the Department Of Revenue Services State Of Connecticut

Utilizing the Department Of Revenue Services State Of Connecticut involves accessing a variety of resources and services designed to assist taxpayers. Individuals can find information on tax rates, filing requirements, and available deductions on the DRS website. Additionally, the agency offers online services for filing returns, making payments, and checking the status of refunds. Taxpayers can also contact customer service for personalized assistance with specific questions or issues.

Steps to complete the Department Of Revenue Services State Of Connecticut

Completing the necessary forms for the Department Of Revenue Services State Of Connecticut typically follows a structured process. Here are the key steps:

- Gather all required financial documents, including income statements and previous tax returns.

- Select the appropriate form based on your tax situation, such as the CT-1040 for individual income tax.

- Carefully fill out the form, ensuring all information is accurate and complete.

- Review the form for any errors or omissions before submission.

- Submit the completed form online, by mail, or in person, depending on your preference.

Required Documents

To successfully complete forms for the Department Of Revenue Services State Of Connecticut, certain documents are essential. Taxpayers should prepare the following:

- W-2 forms from employers for income verification.

- 1099 forms for any additional income sources.

- Receipts for deductible expenses, such as medical bills or charitable contributions.

- Previous year’s tax return for reference.

Form Submission Methods

The Department Of Revenue Services State Of Connecticut offers multiple methods for submitting tax forms. Taxpayers can choose from the following options:

- Online submission through the DRS website for quick processing.

- Mailing completed forms to the designated address provided on the form.

- In-person submission at local DRS offices for those who prefer direct interaction.

Penalties for Non-Compliance

Failure to comply with the regulations set by the Department Of Revenue Services State Of Connecticut can result in various penalties. These may include:

- Fines for late filing or payment of taxes.

- Interest charges on unpaid tax amounts.

- Increased scrutiny or audits for repeated non-compliance.

Eligibility Criteria

Eligibility for certain tax programs and benefits administered by the Department Of Revenue Services State Of Connecticut may vary. Common criteria include:

- Residency in Connecticut for a specified duration.

- Income level, which may affect eligibility for tax credits or deductions.

- Filing status, such as single, married, or head of household, which can influence tax obligations.

Quick guide on how to complete department of revenue services state of connecticu

Easily Prepare Department Of Revenue Services State Of Connecticu on Any Device

The management of online documents has become increasingly favored by both companies and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your paperwork swiftly without delays. Handle Department Of Revenue Services State Of Connecticu on any device using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

How to Modify and Electronically Sign Department Of Revenue Services State Of Connecticu Effortlessly

- Find Department Of Revenue Services State Of Connecticu and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and has the same legal validity as a traditional handwritten signature.

- Verify the information and click on the Done button to save your changes.

- Select how you want to share your form, whether by email, SMS, or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign Department Of Revenue Services State Of Connecticu to ensure outstanding communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct department of revenue services state of connecticu

Create this form in 5 minutes!

How to create an eSignature for the department of revenue services state of connecticu

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow's pricing for businesses needing to comply with the Department Of Revenue Services State Of Connecticu?

airSlate SignNow offers competitive pricing plans designed to accommodate various business needs while ensuring compliance with the Department Of Revenue Services State Of Connecticu. Pricing is flexible and scales based on user count and features required, making it a cost-effective solution for document management.

-

How does airSlate SignNow help with document compliance for the Department Of Revenue Services State Of Connecticu?

airSlate SignNow provides tools that streamline the eSigning process, ensuring that all documents meet the necessary compliance standards set by the Department Of Revenue Services State Of Connecticu. This includes features like audit trails and secure storage to keep your documents safe and compliant.

-

What features does airSlate SignNow offer to assist with the Department Of Revenue Services State Of Connecticu requirements?

Some of the key features of airSlate SignNow include customizable templates, automated workflows, and robust eSignature capabilities that are essential for meeting the requirements of the Department Of Revenue Services State Of Connecticu. These features help simplify document processing and enhance productivity.

-

Can airSlate SignNow integrate with other software to support the Department Of Revenue Services State Of Connecticu?

Yes, airSlate SignNow seamlessly integrates with various software applications, which is beneficial for businesses managing documents related to the Department Of Revenue Services State Of Connecticu. This enables improved workflow efficiency and ensures that all necessary data is synchronized across platforms.

-

What are the benefits of using airSlate SignNow for transactions requiring the Department Of Revenue Services State Of Connecticu?

Using airSlate SignNow provides numerous benefits when handling transactions under the Department Of Revenue Services State Of Connecticu, including improved turnaround times, reduced paperwork, and enhanced security. This results in a more efficient workflow for businesses in any sector.

-

Is airSlate SignNow suitable for small businesses dealing with the Department Of Revenue Services State Of Connecticu?

Absolutely! airSlate SignNow's pricing plans and features are crafted to suit small businesses interacting with the Department Of Revenue Services State Of Connecticu, making it an accessible and effective solution. The platform’s user-friendly interface ensures that even non-technical users can easily manage their documents.

-

How does airSlate SignNow ensure the security of documents related to the Department Of Revenue Services State Of Connecticu?

airSlate SignNow employs top-notch security measures, including encryption and multi-factor authentication, to protect documents relevant to the Department Of Revenue Services State Of Connecticu. This rigorous security framework is crucial for maintaining the confidentiality and integrity of sensitive information.

Get more for Department Of Revenue Services State Of Connecticu

- Frontier communications permit extension form

- Des 102 program completion data form state of michigan mi

- Michigan boiler rules form

- Fillable online www2 illinois certified assessor form

- Qathet regional district receives tourism funding request form

- Peer form

- Www today comnewstoday s 23rd annual toy drivetodays 23rd annual toy drive make holidays sparkle for kids form

- Weekly travel card sprague high school form

Find out other Department Of Revenue Services State Of Connecticu

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online