Form Ct 706 709 Ext Fillable0624 Final PDF CT Gov 2024-2026

What is the Form CT 706 709 EXT Fillable0624 Final PDF?

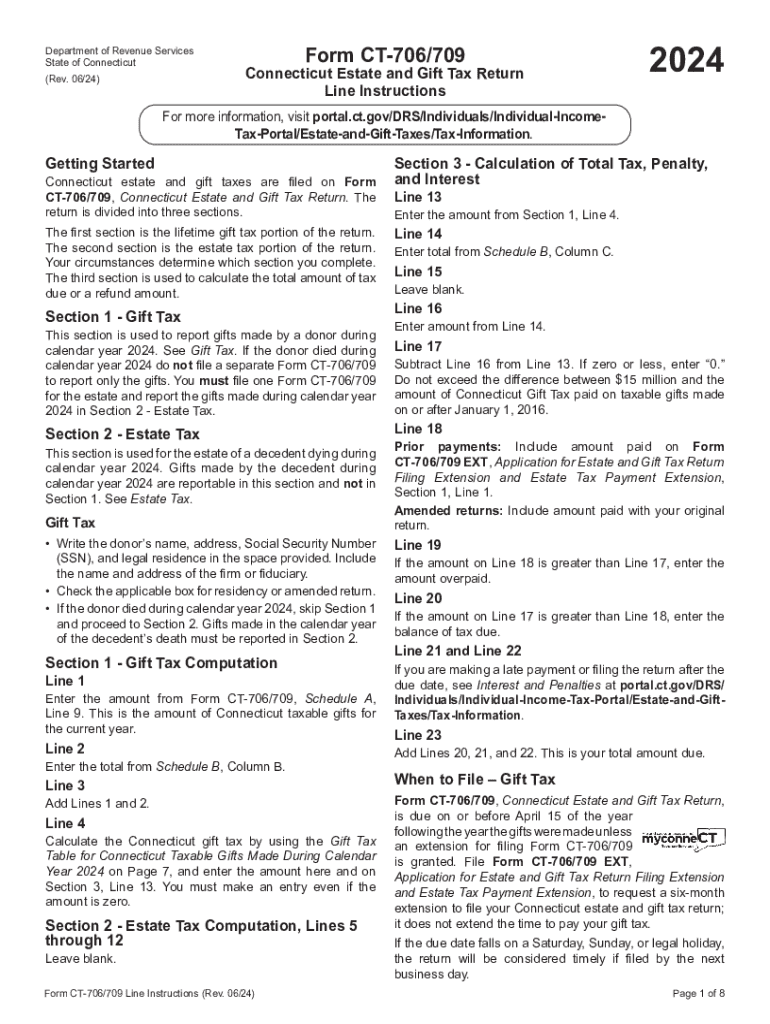

The Form CT 706 709 EXT Fillable0624 Final PDF is a state-specific tax form used in Connecticut for estate tax purposes. This form is essential for reporting the value of an estate and calculating any taxes owed to the state upon the death of an individual. It is designed to ensure compliance with Connecticut's estate tax laws and provides a structured method for taxpayers to disclose relevant financial information regarding the estate's assets and liabilities.

How to Use the Form CT 706 709 EXT Fillable0624 Final PDF

To effectively use the Form CT 706 709 EXT Fillable0624 Final PDF, individuals must first download the form from the official Connecticut government website. Once downloaded, users can fill out the form electronically, which simplifies the process of entering information. It is important to gather all necessary documentation related to the estate, including asset valuations, debts, and any prior tax filings, before starting the form. After completing the form, it should be reviewed for accuracy and submitted according to state guidelines.

Steps to Complete the Form CT 706 709 EXT Fillable0624 Final PDF

Completing the Form CT 706 709 EXT Fillable0624 Final PDF involves several key steps:

- Download the form from the Connecticut government website.

- Gather all necessary documentation, including asset valuations and debts.

- Fill out the form electronically, ensuring all required fields are completed.

- Review the form for accuracy and completeness.

- Submit the completed form by the designated deadline.

Key Elements of the Form CT 706 709 EXT Fillable0624 Final PDF

The Form CT 706 709 EXT Fillable0624 Final PDF includes several key elements that are critical for accurate reporting. These elements typically consist of:

- Identification of the decedent and their estate.

- Detailed listing of all assets, including real estate, bank accounts, and investments.

- Liabilities and debts associated with the estate.

- Calculations related to the estate tax owed.

- Signatures from the executor or administrator of the estate.

Filing Deadlines / Important Dates

Filing deadlines for the Form CT 706 709 EXT Fillable0624 Final PDF are crucial for compliance. Typically, the form must be filed within nine months of the decedent's date of death. Extensions may be available under certain circumstances, but it is important to check with the Connecticut Department of Revenue Services for specific guidelines and any changes to deadlines.

Form Submission Methods

The Form CT 706 709 EXT Fillable0624 Final PDF can be submitted through various methods. Taxpayers may choose to file the form electronically, which is often the most efficient option. Alternatively, the completed form can be printed and mailed to the appropriate state office. In-person submissions may also be possible, depending on local regulations and office availability. It is essential to verify the submission method that best suits your needs and complies with state requirements.

Create this form in 5 minutes or less

Find and fill out the correct form ct 706 709 ext fillable0624 final pdf ct gov

Create this form in 5 minutes!

How to create an eSignature for the form ct 706 709 ext fillable0624 final pdf ct gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form ct 706 709 ext fillable0624 final pdf CT gov?

The Form ct 706 709 ext fillable0624 final pdf CT gov is a tax form used in Connecticut for estate and gift tax purposes. It allows individuals to report and calculate their tax obligations efficiently. By using this fillable PDF, users can easily complete and submit their forms online.

-

How can I access the Form ct 706 709 ext fillable0624 final pdf CT gov?

You can access the Form ct 706 709 ext fillable0624 final pdf CT gov directly from the official Connecticut government website. This ensures that you are using the most up-to-date version of the form. Additionally, airSlate SignNow provides tools to help you fill out and eSign this document seamlessly.

-

Is there a cost associated with using the Form ct 706 709 ext fillable0624 final pdf CT gov?

Accessing the Form ct 706 709 ext fillable0624 final pdf CT gov is free through the Connecticut government website. However, if you choose to use airSlate SignNow for eSigning and document management, there may be subscription fees involved. Our pricing plans are designed to be cost-effective for businesses of all sizes.

-

What features does airSlate SignNow offer for the Form ct 706 709 ext fillable0624 final pdf CT gov?

airSlate SignNow offers a range of features for the Form ct 706 709 ext fillable0624 final pdf CT gov, including eSigning, document sharing, and secure storage. Our platform allows you to collaborate with others in real-time, ensuring that your forms are completed accurately and efficiently. Additionally, you can track the status of your documents easily.

-

Can I integrate airSlate SignNow with other applications for the Form ct 706 709 ext fillable0624 final pdf CT gov?

Yes, airSlate SignNow offers integrations with various applications, enhancing your workflow for the Form ct 706 709 ext fillable0624 final pdf CT gov. You can connect with popular tools like Google Drive, Dropbox, and more. This allows for seamless document management and storage.

-

What are the benefits of using airSlate SignNow for the Form ct 706 709 ext fillable0624 final pdf CT gov?

Using airSlate SignNow for the Form ct 706 709 ext fillable0624 final pdf CT gov streamlines the process of completing and signing your documents. It saves time and reduces errors, ensuring compliance with state regulations. Additionally, our platform enhances security and provides a user-friendly experience.

-

Is the Form ct 706 709 ext fillable0624 final pdf CT gov secure when using airSlate SignNow?

Absolutely! The Form ct 706 709 ext fillable0624 final pdf CT gov is secure when processed through airSlate SignNow. We implement advanced encryption and security measures to protect your sensitive information. You can trust that your documents are safe and compliant with industry standards.

Get more for Form ct 706 709 ext fillable0624 final pdf CT gov

- Az form 140 2020 2022 fill out tax template online us legal forms

- Azdorgovformsindividualform 140 resident personal income tax form non fillable

- Azdorgovformstax credits formscredit for contributions to qualifying charitable azdor

- Arizona form 348 credit for contributions to certified school tuition

- Arizona form 301 nonrefundable individual tax credits andarizona form 301 nonrefundable individual tax credits andindividual

- Do not use this form for contributions to private school tuition organizations

- Arizona a1 form

- Azdorgovformsindividualinnocent spouse reliefarizona department of revenue azdor

Find out other Form ct 706 709 ext fillable0624 final pdf CT gov

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure