Michigan Farmland Preservation Tax Credit Claim MI Form

Understanding the Michigan Farmland Preservation Tax Credit

The Michigan Farmland Preservation Tax Credit is designed to encourage the preservation of agricultural land. This credit allows eligible landowners to receive a tax reduction based on the value of their preserved farmland. The credit is available to those who have entered into a qualified farmland preservation agreement, which helps protect agricultural land from being developed for non-agricultural purposes. By participating, landowners can contribute to the sustainability of Michigan’s agricultural resources while benefiting financially.

Eligibility Criteria for the Tax Credit

To qualify for the Michigan Farmland Preservation Tax Credit, landowners must meet specific eligibility requirements. These include:

- The property must be located in a designated agricultural district.

- The land must be actively used for agricultural production.

- The landowner must have entered into a farmland preservation agreement with the Michigan Department of Agriculture and Rural Development.

It is essential for applicants to verify that their property meets these criteria to ensure successful credit claims.

Steps to Complete the Tax Credit Claim

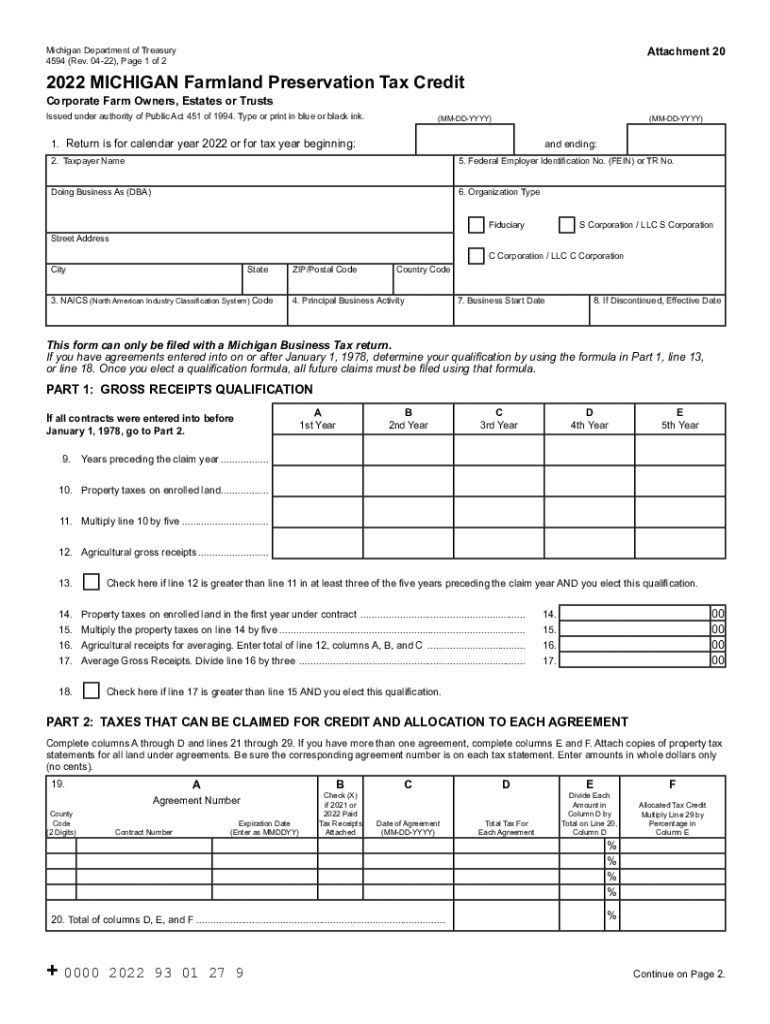

Completing the Michigan Farmland Preservation Tax Credit Claim involves several key steps:

- Gather necessary documentation, including proof of the farmland preservation agreement.

- Obtain and fill out the Michigan Form 4594, which is specifically designed for this credit.

- Calculate the amount of credit based on the assessed value of the preserved farmland.

- Submit the completed form along with any required attachments to the appropriate state department.

Following these steps carefully can help ensure a smooth application process.

Required Documents for Claim Submission

When filing for the Michigan Farmland Preservation Tax Credit, specific documents are required to support your claim. These typically include:

- A copy of the farmland preservation agreement.

- Proof of property ownership.

- Any additional documentation requested by the Michigan Department of Agriculture and Rural Development.

Ensuring that all documents are accurate and complete can facilitate the review process.

Filing Deadlines and Important Dates

It is crucial for applicants to be aware of filing deadlines for the Michigan Farmland Preservation Tax Credit. Generally, claims must be submitted by a specific date each year, typically aligned with the tax filing deadline. Staying informed about these dates can help landowners avoid missed opportunities for claiming their credits.

Form Submission Methods

Landowners can submit their Michigan Farmland Preservation Tax Credit Claim through various methods. These include:

- Online submission via the state’s official tax portal.

- Mailing the completed form to the appropriate department.

- In-person submission at designated state offices.

Choosing the right submission method can enhance the efficiency of the application process.

Quick guide on how to complete michigan farmland preservation tax credit claim mi

Effortlessly Prepare Michigan Farmland Preservation Tax Credit Claim MI on Any Device

Managing documents online has gained traction among both businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to easily access the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to swiftly create, modify, and electronically sign your documents without any delays. Handle Michigan Farmland Preservation Tax Credit Claim MI on any device with the airSlate SignNow applications for Android or iOS and enhance any document-centric process today.

The Easiest Way to Edit and Electronically Sign Michigan Farmland Preservation Tax Credit Claim MI

- Find Michigan Farmland Preservation Tax Credit Claim MI and click Get Form to begin.

- Utilize the tools provided to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information using the tools that airSlate SignNow offers specifically for that purpose.

- Generate your electronic signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Select your preferred method to share your form, whether through email, SMS, invite link, or downloading it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors requiring new document printouts. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Edit and electronically sign Michigan Farmland Preservation Tax Credit Claim MI to ensure outstanding communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the michigan farmland preservation tax credit claim mi

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Michigan farmland preservation tax?

The Michigan farmland preservation tax is a tax incentive designed to encourage landowners to maintain farmland and prevent urban sprawl. This program allows eligible farmers to receive tax breaks by actively preserving their agricultural land, thus contributing to sustainable farming in Michigan.

-

How can airSlate SignNow help with Michigan farmland preservation tax documentation?

airSlate SignNow streamlines the process of preparing and signing documents related to the Michigan farmland preservation tax. With our easy-to-use eSignature solution, you can quickly send necessary paperwork to the relevant authorities, ensuring compliance and timely submissions.

-

Are there any costs associated with applying for the Michigan farmland preservation tax?

While the Michigan farmland preservation tax itself provides financial benefits, there may be costs associated with applications or consulting services to ensure eligibility. Utilizing airSlate SignNow can help reduce costs by simplifying the documentation process, making it more efficient and saving you time.

-

What benefits does the Michigan farmland preservation tax offer to landowners?

The Michigan farmland preservation tax provides signNow benefits to landowners, including reduced property taxes and the opportunity to maintain agricultural operations. This tax incentive helps preserve the agriculture landscape of Michigan while offering financial relief to participating farmers.

-

Can airSlate SignNow integrate with other tools for managing farmland preservation tax documents?

Yes, airSlate SignNow offers integrations with various popular tools to enhance your workflow when managing Michigan farmland preservation tax documents. By integrating with your existing software, you can easily manage contracts, applications, and communication, all in one place.

-

Who qualifies for the Michigan farmland preservation tax?

To qualify for the Michigan farmland preservation tax, landowners must meet specific criteria, including active agricultural use and enrollment in the Farmland and Open Space Program. airSlate SignNow can assist in managing documentation to demonstrate eligibility more efficiently.

-

How can I start the application process for the Michigan farmland preservation tax?

Starting the application process for the Michigan farmland preservation tax involves gathering required documents to prove eligibility. Using airSlate SignNow, you can easily fill out and eSign these documents, streamlining your journey from application to approval.

Get more for Michigan Farmland Preservation Tax Credit Claim MI

- Selah community days home page selah waselah parks and recreationselah parks and recreation form

- Www chooseaesd orgcmslibsuperintendent assistant superintendent executive director of form

- Www azdhs govpreparednessstate laboratoryazdhsstate laboratory arizona department of health services form

- Date stamp form

- Republicanleader house gov wp content uploadsconservation with a purpose house republican leader form

- Religious educationst marys catholic primary school form

- Westchester county sports camp registration is open form

- Pittsburgh pa 15228 mt lebanon high school mtlsd form

Find out other Michigan Farmland Preservation Tax Credit Claim MI

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document