Grand Rapids Income Tax Resident EZ Form 2022

What is the Grand Rapids Income Tax Resident EZ Form

The Grand Rapids Income Tax Resident EZ Form is a simplified tax form specifically designed for residents of Grand Rapids, Michigan. This form allows individuals to report their income and calculate their local income tax obligations efficiently. It is intended for taxpayers who meet specific criteria, such as having straightforward income sources and not claiming complex deductions. By using this form, residents can fulfill their tax responsibilities while minimizing the time and effort required for preparation.

How to use the Grand Rapids Income Tax Resident EZ Form

Using the Grand Rapids Income Tax Resident EZ Form involves several straightforward steps. First, ensure that you have all necessary information, including your income details and any applicable deductions. Next, download or obtain a copy of the form from the appropriate local tax authority. Carefully fill out the form, following the provided instructions to ensure accuracy. Once completed, review your entries for any errors before submitting the form to the designated tax office. It is essential to keep a copy of the submitted form for your records.

Steps to complete the Grand Rapids Income Tax Resident EZ Form

Completing the Grand Rapids Income Tax Resident EZ Form can be broken down into a series of clear steps:

- Gather your financial documents, including W-2s, 1099s, and any other income statements.

- Download the EZ Form from the Grand Rapids tax authority website or obtain a paper copy.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your total income from all sources as instructed on the form.

- Calculate your tax liability based on the provided tax rates.

- Sign and date the form to certify that the information provided is accurate.

- Submit the completed form by the filing deadline, either online, by mail, or in person.

Required Documents

To complete the Grand Rapids Income Tax Resident EZ Form, you will need several important documents. These include:

- Your W-2 forms from employers, which report your annual wages and withheld taxes.

- Any 1099 forms for additional income, such as freelance work or interest earned.

- Records of any other income sources, including rental income or investments.

- Identification documents, such as your driver's license or state ID, for verification purposes.

Filing Deadlines / Important Dates

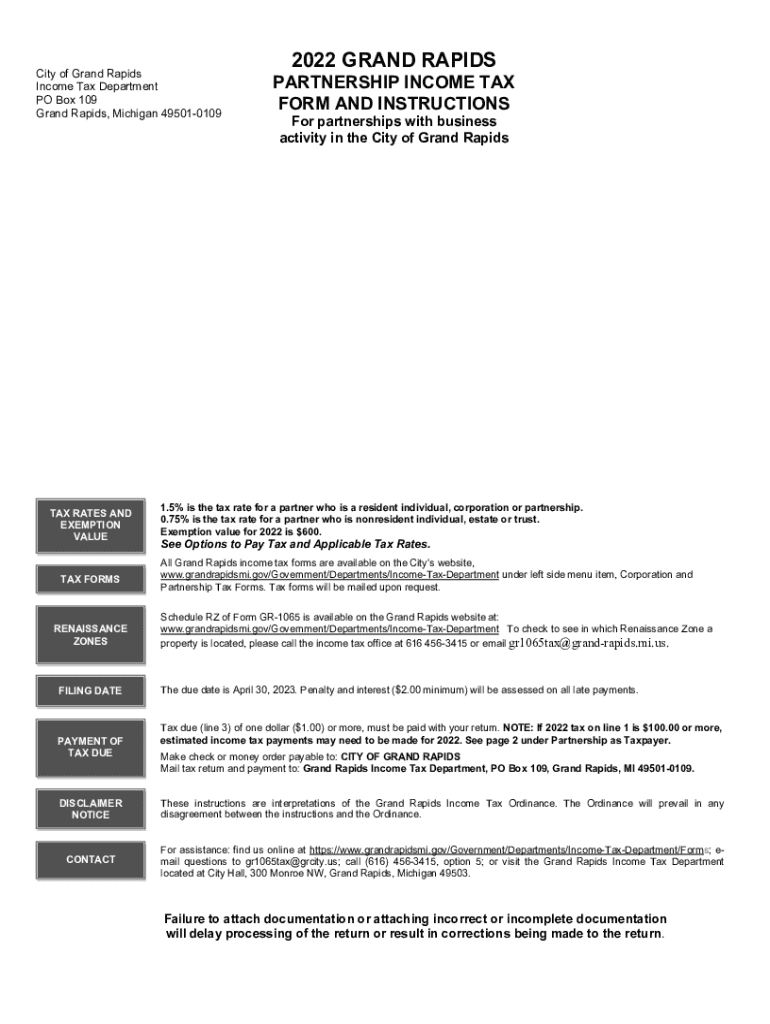

Awareness of filing deadlines is crucial when submitting the Grand Rapids Income Tax Resident EZ Form. Typically, the deadline for filing local income tax returns is the same as the federal tax deadline, which falls on April fifteenth each year. However, if the deadline falls on a weekend or holiday, it is extended to the next business day. Residents should also be aware of any specific local extensions or changes that may apply in a given tax year.

Who Issues the Form

The Grand Rapids Income Tax Resident EZ Form is issued by the City of Grand Rapids Finance Department. This department is responsible for collecting local income taxes and providing residents with the necessary forms and resources to comply with tax regulations. Residents can contact the Finance Department for assistance with the form or for any questions regarding local tax obligations.

Quick guide on how to complete grand rapids income tax resident ez form

Effortlessly Prepare Grand Rapids Income Tax Resident EZ Form on Any Device

Digital document management has become increasingly favored by companies and individuals alike. It offers a convenient eco-friendly substitute to conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides all the resources required to create, amend, and eSign your documents quickly without complications. Manage Grand Rapids Income Tax Resident EZ Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to amend and eSign Grand Rapids Income Tax Resident EZ Form without hassle

- Find Grand Rapids Income Tax Resident EZ Form and then click Get Form to begin.

- Use the tools we supply to finalize your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Put an end to lost or misplaced files, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Grand Rapids Income Tax Resident EZ Form to ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct grand rapids income tax resident ez form

Create this form in 5 minutes!

How to create an eSignature for the grand rapids income tax resident ez form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Grand Rapids Income Tax Resident EZ Form?

The Grand Rapids Income Tax Resident EZ Form is a streamlined tax document designed for residents of Grand Rapids. This form simplifies the filing process, allowing users to easily report their income, deductions, and tax liabilities. Whether you’re a new filer or a seasoned taxpayer, this form makes compliance straightforward and efficient.

-

How much does the Grand Rapids Income Tax Resident EZ Form cost?

The cost of filing the Grand Rapids Income Tax Resident EZ Form may vary depending on the platform you choose to file through. Generally, fees can range from free options for basic filers to minimal charges if additional services or features are requested. It's advisable to check directly on the provided services for the most current pricing.

-

What features does the Grand Rapids Income Tax Resident EZ Form offer?

The Grand Rapids Income Tax Resident EZ Form offers features like simple income reporting, direct eFiling capabilities, and automatic calculations to prevent errors. Additionally, users can manage their document submissions easily through an intuitive interface. This ensures that taxpayers can focus more on accuracy rather than paperwork.

-

How can the Grand Rapids Income Tax Resident EZ Form benefit me?

Using the Grand Rapids Income Tax Resident EZ Form can save you time and reduce stress during tax season. Its straightforward design allows for quick completion without the confusion of more complex financial forms. This user-friendly approach can lead to maximized refunds and help you comply with local tax regulations efficiently.

-

Is the Grand Rapids Income Tax Resident EZ Form compatible with other software?

Yes, the Grand Rapids Income Tax Resident EZ Form can often integrate with various tax preparation platforms and accounting software. This compatibility allows for seamless data transfer and enhances your overall filing experience. Be sure to check the specific integrations available on your chosen platform.

-

How do I eFile the Grand Rapids Income Tax Resident EZ Form?

eFiling the Grand Rapids Income Tax Resident EZ Form is straightforward; simply fill out the necessary information through your chosen eFiling platform, review for accuracy, and submit your form electronically. Most platforms provide guidance throughout the process, ensuring you don’t miss any steps. This method is not only convenient but also allows for quicker processing by tax authorities.

-

Can I amend my Grand Rapids Income Tax Resident EZ Form after submission?

Yes, if you realize that you need to make changes to your Grand Rapids Income Tax Resident EZ Form after submission, you can file an amendment. This typically involves completing an amendment form and following specific state guidelines on how to submit. It’s essential to correct any inaccuracies promptly to avoid potential penalties.

Get more for Grand Rapids Income Tax Resident EZ Form

- Connecticut educator certification system form

- To download the baking contest entry form atchison chamber of atchisonkansas

- Bring completed order form to pe class to receive

- Backflow installation otc application doc form

- State of arizona disability search state of arizona disability form

- Download form navajo epa navajonationepa

- Rule 5150 form baltimore county public schoolsof

- Hardship exemption application form

Find out other Grand Rapids Income Tax Resident EZ Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors