Grand Rapids Income Tax 2023-2026

What is the Grand Rapids Income Tax

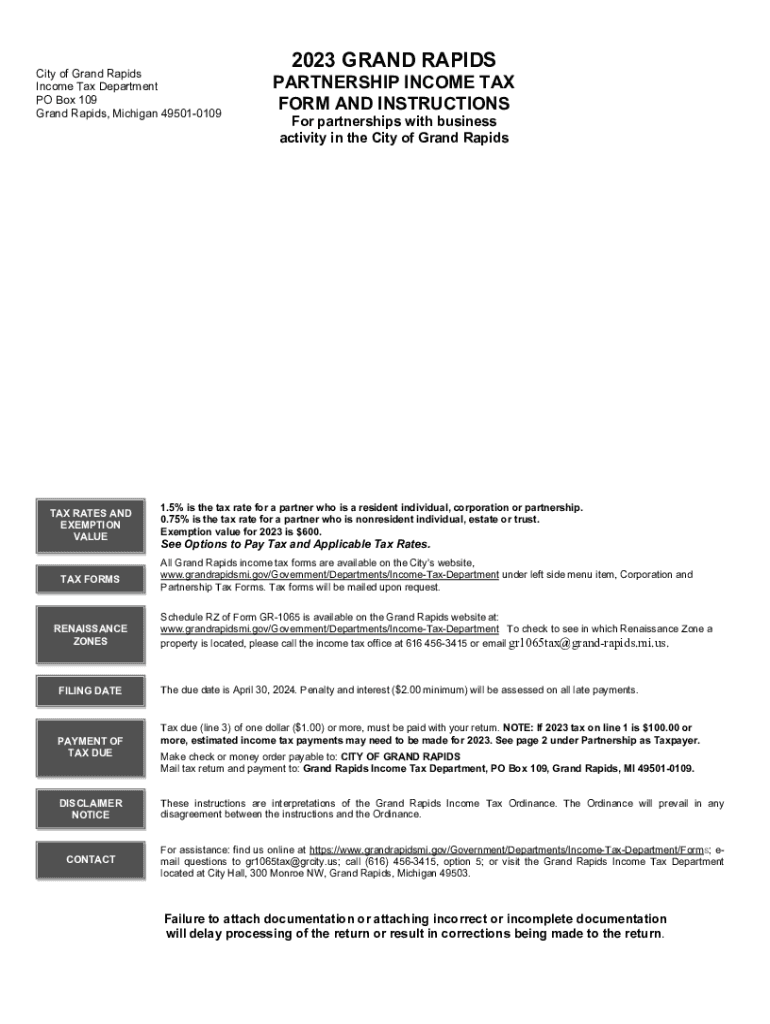

The Grand Rapids Income Tax is a municipal tax imposed on the income earned by residents and non-residents working within the city limits of Grand Rapids, Michigan. This tax is designed to fund local services and infrastructure. It applies to various types of income, including wages, salaries, and business profits. Understanding this tax is essential for compliance and effective financial planning for individuals and businesses operating in the area.

Steps to complete the Grand Rapids Income Tax

Completing the Grand Rapids Income Tax involves several key steps:

- Gather necessary documentation, including income statements, W-2 forms, and any relevant deductions.

- Determine your residency status, as tax rates differ for residents and non-residents.

- Calculate your taxable income by subtracting allowable deductions from your total income.

- Apply the appropriate tax rate to your taxable income to determine your tax liability.

- Complete the Grand Rapids Income Tax form accurately, ensuring all information is correct.

- Submit the completed form along with any payment due by the specified deadline.

Required Documents

To file the Grand Rapids Income Tax, you will need several important documents:

- W-2 forms from employers, detailing your annual earnings.

- 1099 forms for any additional income sources, such as freelance work or investments.

- Records of any deductions you plan to claim, such as business expenses or education costs.

- Proof of residency, if applicable, to determine the correct tax rate.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Grand Rapids Income Tax is crucial to avoid penalties:

- The annual tax return is typically due by April 15 of each year.

- If April 15 falls on a weekend or holiday, the deadline may be extended to the next business day.

- Estimated tax payments for the upcoming year may be required quarterly, with specific due dates.

Who Issues the Form

The Grand Rapids Income Tax form is issued by the City of Grand Rapids. The city's finance department is responsible for providing the necessary forms and instructions for filing. It is important to use the most current version of the form to ensure compliance with local tax laws.

Penalties for Non-Compliance

Failure to comply with the Grand Rapids Income Tax regulations can result in several penalties:

- Late filing penalties may be assessed if the tax return is not submitted by the deadline.

- Interest may accrue on any unpaid tax balances, increasing the total amount owed over time.

- In severe cases, legal action may be taken to collect outstanding taxes.

Quick guide on how to complete grand rapids income tax

Complete Grand Rapids Income Tax effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed paperwork, as you can access the correct format and safely store it online. airSlate SignNow provides all the resources you require to create, edit, and eSign your documents quickly and without delays. Handle Grand Rapids Income Tax on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to edit and eSign Grand Rapids Income Tax with ease

- Find Grand Rapids Income Tax and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Select pertinent sections of the documents or conceal sensitive details with tools provided specifically for that purpose by airSlate SignNow.

- Create your eSignature with the Sign feature, which takes just seconds and holds the same legal validation as a traditional handwritten signature.

- Verify the details and click on the Done button to save your modifications.

- Decide how you would like to send your document, via email, SMS, invitation link, or download it to your computer.

Say goodbye to missing or misplaced files, tedious form hunting, or errors that require printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from your selected device. Alter and eSign Grand Rapids Income Tax and ensure exceptional communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct grand rapids income tax

Create this form in 5 minutes!

How to create an eSignature for the grand rapids income tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Grand Rapids Income Tax and how does it affect my business?

Grand Rapids Income Tax is a tax levied on individuals and businesses operating within Grand Rapids. It is crucial for businesses to understand this tax, as it affects their financial obligations and compliance requirements. Staying informed about Grand Rapids Income Tax helps businesses maintain accurate records and avoid penalties.

-

How can airSlate SignNow assist with Grand Rapids Income Tax documentation?

airSlate SignNow simplifies the process of preparing and signing tax documents related to Grand Rapids Income Tax. Our platform allows businesses to eSign and send tax forms securely, ensuring compliance while saving time. With our easy-to-use solution, you can focus on your business rather than paperwork.

-

What are the pricing options for airSlate SignNow in relation to Grand Rapids Income Tax?

airSlate SignNow offers flexible pricing plans tailored to meet different business needs, including those dealing with Grand Rapids Income Tax. Our pricing is competitive and designed to be cost-effective, enabling companies to manage their eSigning and document workflows efficiently. Contact us for a detailed quote based on your specific requirements.

-

What features of airSlate SignNow are beneficial for handling Grand Rapids Income Tax?

airSlate SignNow includes features like customizable templates, bulk send options, and secure storage that are especially beneficial for managing Grand Rapids Income Tax documents. These tools streamline the eSigning process and ensure that all tax-related paperwork is organized and easily accessible. This helps businesses maintain compliance effortlessly.

-

Can airSlate SignNow integrate with accounting software for Grand Rapids Income Tax reporting?

Yes, airSlate SignNow seamlessly integrates with popular accounting software, making it easier to manage Grand Rapids Income Tax reporting. These integrations enable businesses to connect their eSignature capabilities directly with financial data, ensuring a smooth workflow from document signing to tax filing. This synergy helps maintain accuracy and compliance.

-

How does eSigning with airSlate SignNow help businesses meet Grand Rapids Income Tax obligations?

By using airSlate SignNow for eSigning, businesses can quickly and efficiently complete and submit their Grand Rapids Income Tax forms. Our platform ensures that all documents are signed securely and stored in one location, reducing the risk of errors and missed deadlines. This helps you stay organized and compliant with tax regulations.

-

Is airSlate SignNow suitable for small businesses handling Grand Rapids Income Tax?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, including small businesses navigating Grand Rapids Income Tax. Our user-friendly platform and affordable pricing make it an excellent choice for small businesses looking to manage their documentation efficiently without the burden of extensive paperwork.

Get more for Grand Rapids Income Tax

- Solo provider enrollment form

- Application for medicare supplement insurance plan application for medicare supplement insurance plan form

- Oregon mhacbo form

- Gobhi form

- Pdf care coordination request form oregon pacificsource

- Pa code 3270 form

- Adventure program information packet camp hebron

- Covid 19 a remote assessment in primary care the bmj form

Find out other Grand Rapids Income Tax

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT