Form CT W4P UAW Region 9A

What is the Form CT W4P?

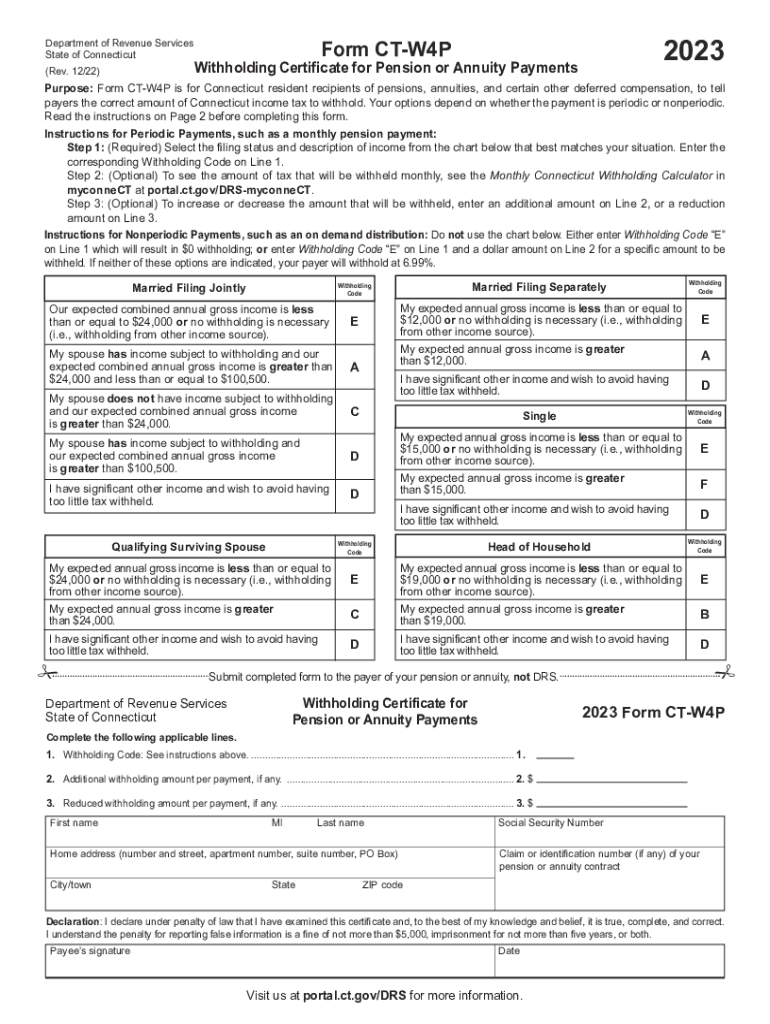

The CT W4P form, also known as the Connecticut Withholding Certificate for Pension and Annuity Payments, is a crucial document for individuals receiving pension or annuity payments in Connecticut. This form allows recipients to indicate their tax withholding preferences, ensuring that the correct amount of state income tax is withheld from their payments. It is specifically designed for pension and annuity recipients, making it essential for accurate tax reporting and compliance.

How to Obtain the Form CT W4P

The CT W4P form can be easily obtained through the Connecticut Department of Revenue Services (DRS) website. It is available in a downloadable PDF format, allowing users to print and fill it out at their convenience. Additionally, individuals may request a physical copy of the form from their pension or annuity provider, who should have the form readily available for their recipients.

Steps to Complete the Form CT W4P

Completing the CT W4P form involves several straightforward steps:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Indicate your filing status, which can be single, married, or head of household.

- Specify the amount you wish to have withheld from your pension or annuity payments.

- Review the form for accuracy, ensuring all information is complete and correct.

- Sign and date the form before submitting it to your pension or annuity provider.

Key Elements of the Form CT W4P

The CT W4P form includes several key elements that recipients should be aware of:

- Personal Information: Required details such as name, address, and Social Security number.

- Filing Status: Options for single, married, or head of household.

- Withholding Amount: The specific amount or percentage to be withheld from payments.

- Signature: A declaration that the information provided is accurate and complete.

Legal Use of the Form CT W4P

The CT W4P form is legally binding once completed and submitted. It is essential for ensuring compliance with state tax laws regarding pension and annuity payments. By accurately filling out this form, recipients can avoid potential issues with under-withholding or over-withholding of state taxes, which can lead to penalties or unexpected tax liabilities.

Filing Deadlines / Important Dates

It is important for recipients to be aware of specific deadlines associated with the CT W4P form. Generally, the form should be submitted to the pension or annuity provider before the first payment is made to ensure correct withholding. Additionally, recipients should review their withholding preferences annually or whenever there is a significant change in their financial situation to avoid complications during tax season.

Quick guide on how to complete form ct w4p uaw region 9a

Finalize Form CT W4P UAW Region 9A seamlessly on any device

Managing documents online has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents swiftly without any hold-ups. Handle Form CT W4P UAW Region 9A on any device using the airSlate SignNow apps for Android or iOS and simplify any document-related task today.

The easiest method to modify and eSign Form CT W4P UAW Region 9A with ease

- Find Form CT W4P UAW Region 9A and click Get Form to begin.

- Use the tools we provide to fill out your document.

- Emphasize key sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which only takes seconds and bears the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to save your changes.

- Select how you wish to send your form, whether through email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Adjust and eSign Form CT W4P UAW Region 9A and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form ct w4p uaw region 9a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ct w4p form and why is it important?

The ct w4p form is used for withholding allowances in Connecticut. It is crucial for ensuring that employers withhold the correct amount of state income tax from their employees' paychecks. Using airSlate SignNow to electronically sign this form can streamline the process and improve accuracy.

-

How does airSlate SignNow help with the ct w4p process?

airSlate SignNow simplifies the ct w4p process by allowing users to fill out, sign, and send the form digitally. This eliminates the need for paper forms and manual submissions, making it faster and more efficient. Additionally, it ensures that all signatures are legally binding and secure.

-

What are the pricing options for using airSlate SignNow for ct w4p forms?

airSlate SignNow offers various pricing plans to accommodate different business needs when handling ct w4p forms. These plans include features like unlimited signing, templates, and integrations at competitive rates. You can choose a plan that fits your budget and requirements for efficient document management.

-

What features does airSlate SignNow offer for managing the ct w4p?

With airSlate SignNow, you can access features like customizable templates, real-time tracking, and automated reminders for the ct w4p. These tools help ensure that forms are completed on time and are easily accessible. The platform also provides a user-friendly interface for a seamless experience.

-

Can I integrate airSlate SignNow with other software for the ct w4p?

Yes, airSlate SignNow can be easily integrated with various software applications, enhancing your workflow for the ct w4p form. You can connect it with CRM systems, cloud storage, and productivity tools. This flexibility allows for a more efficient process in handling your documents.

-

What benefits does airSlate SignNow provide for businesses using the ct w4p?

Using airSlate SignNow for the ct w4p offers numerous benefits, such as reduced turnaround time and decreased paper waste. The ability to track the signing process in real-time provides transparency and enhances accountability. Overall, it supports a more environmentally friendly and efficient approach to document management.

-

Is airSlate SignNow secure for submitting ct w4p documents?

Absolutely, airSlate SignNow employs advanced encryption and security protocols to protect your ct w4p documents. This ensures that sensitive information remains confidential and secure during the signing process. You can have peace of mind knowing that your documents are safe.

Get more for Form CT W4P UAW Region 9A

- New mexico state board of social work examiners form

- Cheer sponsorship form 315057180

- Federal student aid authorization form mcphs university my mcphs

- Mcps emergency information

- Job club worksheets form

- Gap addendum 49646102 form

- Handout 3 abc checklist form

- Id card designs washington state department of licensing form

Find out other Form CT W4P UAW Region 9A

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple