How to Fill Out and File a Sched K 1 TAXES S2E44 YouTube Form

Understanding Schedule K-1 (Form N-20)

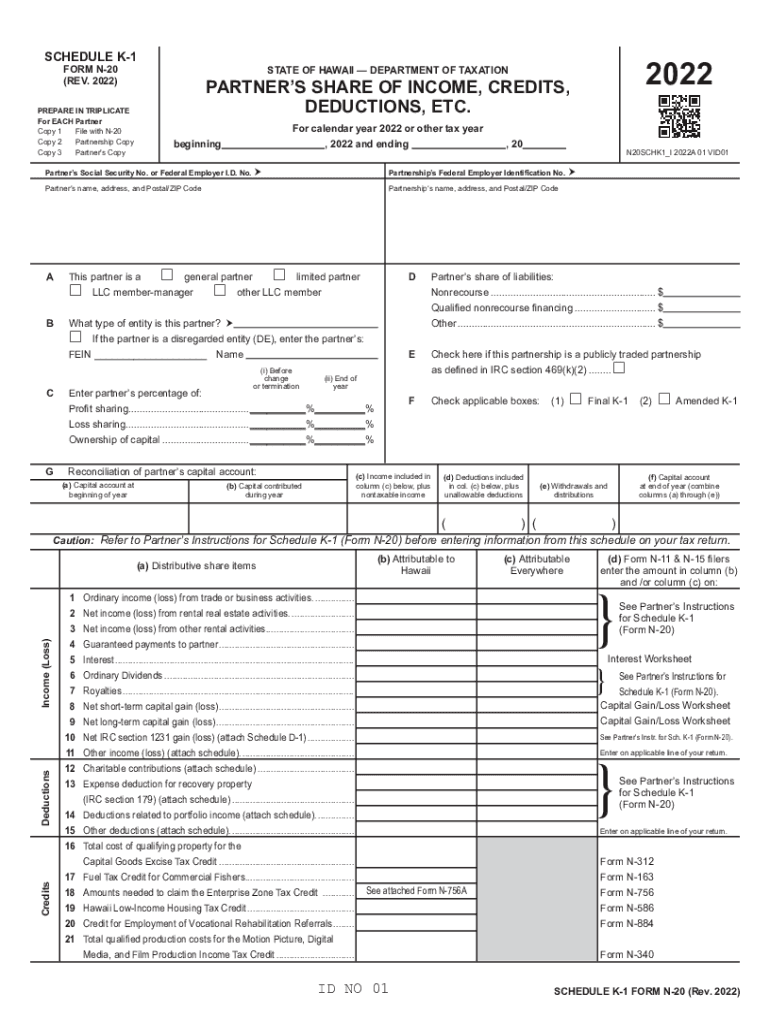

Schedule K-1 (Form N-20) is a tax document used in Hawaii to report income, deductions, and credits from partnerships, S corporations, estates, and trusts. This form is essential for individuals who receive income from these entities, as it details their share of the entity's income, losses, and other tax-related information. Each partner or shareholder receives a K-1, which they must include when filing their personal income tax returns.

Steps to Complete Schedule K-1 (Form N-20)

Filling out Schedule K-1 (Form N-20) requires careful attention to detail. Here are the steps to complete the form:

- Gather all necessary information from the partnership or entity, including your share of income, deductions, and credits.

- Begin by entering your name, address, and taxpayer identification number at the top of the form.

- Report your share of income in the appropriate sections, including ordinary income, capital gains, and other types of income.

- Fill in any deductions or credits allocated to you, ensuring you have supporting documentation.

- Review the completed form for accuracy before submission.

Filing Deadlines for Schedule K-1 (Form N-20)

It is crucial to be aware of the filing deadlines associated with Schedule K-1 (Form N-20). Typically, the entity must provide the K-1 to its partners or shareholders by the end of March. Individual taxpayers must then include the information from the K-1 when filing their personal income tax returns, usually due by April 20 in Hawaii. Late filing can result in penalties, so timely submission is important.

Common Mistakes When Filling Out Schedule K-1 (Form N-20)

When completing Schedule K-1 (Form N-20), taxpayers often make several common mistakes. These include:

- Failing to report all sources of income listed on the K-1.

- Incorrectly calculating deductions and credits.

- Omitting necessary identification information, such as taxpayer identification numbers.

- Not keeping copies of the K-1 for personal records.

Legal Use of Schedule K-1 (Form N-20)

Schedule K-1 (Form N-20) must be used in compliance with IRS guidelines and state regulations. It is important to ensure that the information reported on the K-1 is accurate and reflects your share of the income and expenses from the partnership or entity. Misreporting can lead to audits or penalties, so understanding the legal implications of the K-1 is essential for all taxpayers involved.

Who Issues Schedule K-1 (Form N-20)

Schedule K-1 (Form N-20) is issued by partnerships, S corporations, estates, and trusts. The entity is responsible for preparing the K-1 for each partner or shareholder, detailing their respective shares of income, deductions, and credits. It is important for the issuing entity to ensure accuracy and timeliness in providing these forms to their partners or shareholders.

Quick guide on how to complete how to fill out and file a sched k 1 taxes s2e44 youtube

Handle How To Fill Out And File A Sched K 1 TAXES S2E44 YouTube seamlessly on any device

Digital document management has gained traction among businesses and users. It offers an excellent environmentally friendly substitute for traditional printed and signed documents, as you can access the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly without holdups. Manage How To Fill Out And File A Sched K 1 TAXES S2E44 YouTube on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign How To Fill Out And File A Sched K 1 TAXES S2E44 YouTube effortlessly

- Locate How To Fill Out And File A Sched K 1 TAXES S2E44 YouTube and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tiring form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign How To Fill Out And File A Sched K 1 TAXES S2E44 YouTube and ensure exceptional communication throughout each stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the how to fill out and file a sched k 1 taxes s2e44 youtube

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Schedule K-1 N-20?

A Schedule K-1 N-20 is a tax document used in Hawaii for partnerships to report each partner's share of income, deductions, and credits. Understanding how to fill out the Schedule K-1 N-20 is crucial for accurate tax filing and compliance. airSlate SignNow can help streamline the process of generating and signing this important document.

-

How can airSlate SignNow assist with Schedule K-1 N-20 forms?

AirSlate SignNow provides an easy-to-use platform for creating, sending, and eSigning Schedule K-1 N-20 forms efficiently. With its intuitive interface, you can quickly modify templates and ensure seamless collaboration among partners. This ensures that all necessary information is accurately captured and securely shared.

-

Is there a cost associated with using airSlate SignNow for Schedule K-1 N-20?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. By investing in this platform, you gain access to powerful eSigning features, unlimited document storage, and round-the-clock customer support. The cost is often offset by the time saved in document management and signing efficiency.

-

What features does airSlate SignNow provide for handling Schedule K-1 N-20 forms?

Key features of airSlate SignNow for Schedule K-1 N-20 forms include customizable templates, workflow automation, and secure cloud storage. Additionally, the platform allows for real-time tracking and reminders for document signing, ensuring that all partners stay on top of their tax obligations quickly and easily.

-

Can I integrate airSlate SignNow with other software for Schedule K-1 N-20 processing?

Absolutely! AirSlate SignNow offers integrations with popular finance and accounting software, which makes it easier to manage Schedule K-1 N-20 forms alongside your existing tools. This capability enhances efficiency and reduces the likelihood of errors when transferring data across platforms.

-

What are the benefits of using airSlate SignNow for my Schedule K-1 N-20 documents?

Using airSlate SignNow for your Schedule K-1 N-20 documents streamlines your workflow, reduces paperwork, and enhances productivity. The platform's user-friendly design ensures all partners can easily sign documents, while its security measures protect sensitive financial information. This results in faster turnaround times and improved compliance.

-

Is airSlate SignNow secure for sending Schedule K-1 N-20 forms?

Yes, airSlate SignNow prioritizes security with features like encryption and secure access controls, making it safe to send Schedule K-1 N-20 forms. The platform adheres to industry standards for data protection, providing peace of mind while handling sensitive information. Your documents are safe from unauthorized access throughout the signing process.

Get more for How To Fill Out And File A Sched K 1 TAXES S2E44 YouTube

- Asset manager property inspection report 4 property address form

- Consignment form 495565864

- Contact us at pods for moving options ampamp storage services form

- Florida landlord deposit 495570068 form

- Resident referral bonus agreement westmore apartments form

- Notice landlord vacate premises sample form

- Examples of 30 day notice to vacate in tn form

- Sample letter to remove property from premises form

Find out other How To Fill Out And File A Sched K 1 TAXES S2E44 YouTube

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile