IMPORTANT INFORMATION on COUNTY of HAWAII

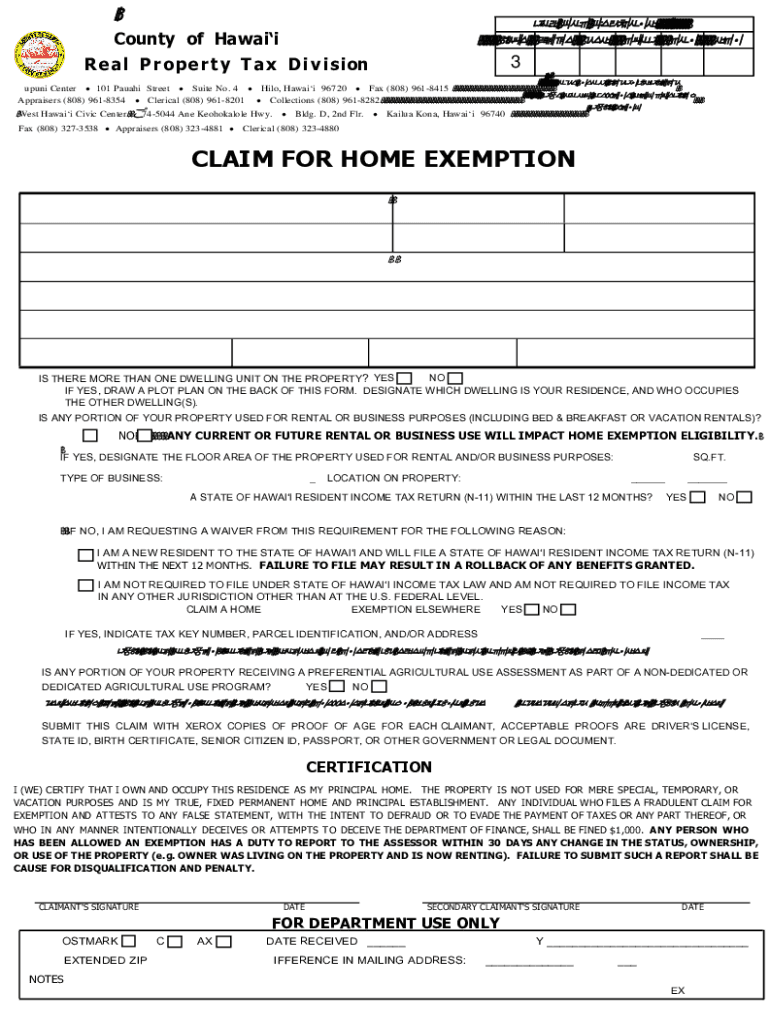

Overview of the Hawaii Form Property Claim

The Hawaii form property claim is a crucial document for residents seeking to establish or claim property exemptions within the state. This form is typically used to apply for various exemptions, including the home exemption, which can significantly reduce property tax liabilities for eligible homeowners. Understanding the nuances of this form is essential for ensuring compliance with local regulations and maximizing potential benefits.

Eligibility Criteria for the Hawaii Form Property Claim

To qualify for the Hawaii form property claim, applicants must meet specific eligibility requirements. Generally, the applicant must be the owner of the property and occupy it as their principal residence. Additional criteria may include age, disability status, or income limitations. It is important to review the detailed eligibility guidelines provided by the County of Hawaii to ensure compliance and avoid any delays in processing the claim.

Steps to Complete the Hawaii Form Property Claim

Filling out the Hawaii form property claim involves several key steps:

- Gather necessary documentation, including proof of ownership and residency.

- Obtain the appropriate form, typically available through the County of Hawaii's official website or local offices.

- Complete the form accurately, ensuring all required fields are filled in.

- Submit the completed form along with any supporting documents to the designated county office.

Taking care to follow these steps can help streamline the application process and improve the chances of approval.

Required Documents for the Hawaii Form Property Claim

When submitting the Hawaii form property claim, specific documents are required to support the application. These may include:

- Proof of identity, such as a driver's license or state ID.

- Documentation proving ownership of the property, such as a deed.

- Evidence of residency, which may include utility bills or tax returns.

- Any additional forms or documentation specified by the County of Hawaii.

Ensuring all required documents are included can help prevent delays in processing the claim.

Form Submission Methods for the Hawaii Form Property Claim

The Hawaii form property claim can typically be submitted through various methods, including:

- Online submission via the County of Hawaii's official website, if available.

- Mailing the completed form and documents to the appropriate county office.

- In-person submission at designated county offices during business hours.

Choosing the most convenient submission method can enhance the efficiency of the application process.

Important Filing Deadlines for the Hawaii Form Property Claim

Filing deadlines for the Hawaii form property claim can vary based on the type of exemption being sought. Generally, it is advisable to submit the claim by the end of the year to ensure consideration for the following tax year. Specific deadlines may be outlined by the County of Hawaii, so it is essential to verify these dates to avoid missing the opportunity to apply for exemptions.

Quick guide on how to complete important information on county of hawaii

Complete IMPORTANT INFORMATION ON COUNTY OF HAWAII effortlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as you can access the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents quickly without delays. Handle IMPORTANT INFORMATION ON COUNTY OF HAWAII on any platform using airSlate SignNow Android or iOS applications and enhance any document-based process today.

The easiest way to modify and eSign IMPORTANT INFORMATION ON COUNTY OF HAWAII without hassle

- Find IMPORTANT INFORMATION ON COUNTY OF HAWAII and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes only seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, cumbersome form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign IMPORTANT INFORMATION ON COUNTY OF HAWAII and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the important information on county of hawaii

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for submitting a Hawaii form property claim using airSlate SignNow?

Submitting a Hawaii form property claim using airSlate SignNow is straightforward. First, create your document using our intuitive platform. You can easily upload the Hawaii form property claim, fill in the required information, and invite others to eSign securely.

-

Are there any costs associated with using airSlate SignNow for Hawaii form property claims?

Yes, airSlate SignNow offers a variety of pricing plans to suit different needs. You can choose from monthly or annual subscriptions that provide unlimited access to features for managing Hawaii form property claims and other documents at a cost-effective rate.

-

What features does airSlate SignNow provide for managing Hawaii form property claims?

airSlate SignNow offers several powerful features for managing Hawaii form property claims, including easy document creation, customizable templates, and automated workflows. Additionally, our platform ensures all documents are securely stored and easily accessible.

-

Can I integrate airSlate SignNow with other platforms for my Hawaii form property claim processes?

Absolutely! airSlate SignNow integrates seamlessly with various platforms such as CRM systems, cloud storage solutions, and productivity tools. This allows you to streamline your workflow and efficiently manage Hawaii form property claims across different applications.

-

What benefits does airSlate SignNow offer for businesses handling Hawaii form property claims?

Using airSlate SignNow for Hawaii form property claims provides several benefits, including increased efficiency, reduced processing time, and improved accuracy. Our platform also enhances collaboration among team members, making it easier to track the status of claims in real-time.

-

Is airSlate SignNow user-friendly for submitting Hawaii form property claims?

Yes, airSlate SignNow is designed to be user-friendly, ensuring that anyone can easily submit Hawaii form property claims without extensive training. The intuitive interface and guided steps simplify the eSigning process for all users.

-

How secure is airSlate SignNow when dealing with Hawaii form property claims?

Security is a top priority at airSlate SignNow. We employ industry-standard encryption and security protocols to protect your data while handling Hawaii form property claims, ensuring that sensitive information remains confidential and secure.

Get more for IMPORTANT INFORMATION ON COUNTY OF HAWAII

Find out other IMPORTANT INFORMATION ON COUNTY OF HAWAII

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement