Tax Information Retirees

What is the IA 8453 PE Partnership Declaration?

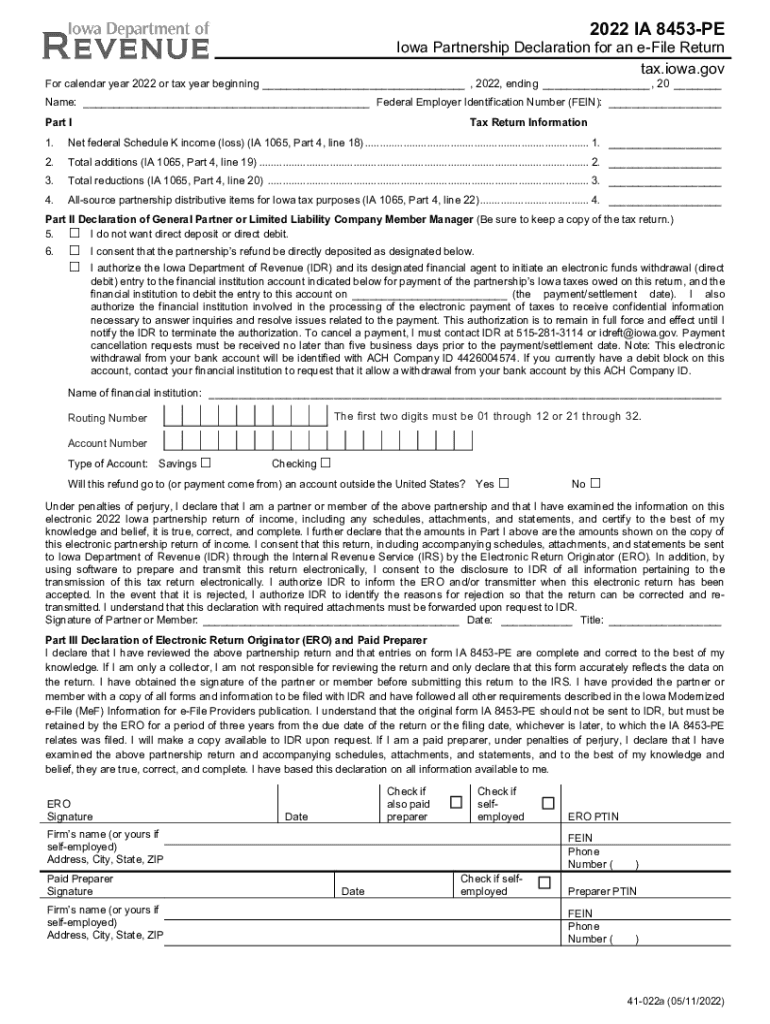

The IA 8453 PE is a crucial form used by partnerships in the United States to declare their tax information. This form serves as a declaration of the partnership’s income, deductions, and credits, ensuring compliance with federal tax regulations. It is specifically designed for partnerships that are filing electronically and need to authenticate their electronic return. By submitting this form, partnerships confirm that the information provided in their electronic tax return is accurate and complete.

Steps to Complete the IA 8453 PE Partnership Declaration

Completing the IA 8453 PE involves several important steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements, expense reports, and any relevant tax documents. Next, fill out the form with the partnership's identifying information, including the name, address, and Employer Identification Number (EIN). Ensure that all income and deductions are accurately reported. After completing the form, it must be signed by an authorized partner, confirming the accuracy of the information provided. Finally, submit the IA 8453 PE along with the electronic tax return to the IRS.

IRS Guidelines for the IA 8453 PE

The IRS provides specific guidelines for the completion and submission of the IA 8453 PE. It is essential to follow these guidelines to avoid penalties or delays in processing. According to IRS regulations, the form must be signed electronically by an authorized partner. Additionally, the form should be submitted within the same timeframe as the electronic return. Partnerships must retain a copy of the IA 8453 PE for their records, as it may be required for future reference or audits.

Filing Deadlines for the IA 8453 PE

Partnerships must adhere to specific filing deadlines when submitting the IA 8453 PE. Generally, the deadline for filing the electronic return, along with the IA 8453 PE, is March 15 of the year following the tax year. If the partnership requires an extension, it may file Form 7004 to obtain an additional six months. However, the IA 8453 PE must still be submitted by the original deadline to avoid penalties.

Required Documents for the IA 8453 PE

When completing the IA 8453 PE, partnerships must have several documents on hand. These include the partnership's financial statements, prior year tax returns, and any supporting documents that validate income and deductions. Additionally, partners should have their Social Security numbers or EINs readily available for accurate reporting. Ensuring all required documents are complete and accurate will facilitate a smooth filing process.

Legal Use of the IA 8453 PE

The IA 8453 PE is legally binding and serves as a declaration of the partnership’s tax obligations. By signing the form, partners affirm that the information provided is true and complete to the best of their knowledge. Misrepresentation or failure to file the IA 8453 PE can result in penalties, including fines and increased scrutiny from the IRS. Therefore, it is critical for partnerships to understand the legal implications of submitting this form.

Quick guide on how to complete tax information retirees

Effortlessly Prepare Tax Information Retirees on Any Device

The management of documents online has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed papers, as you can easily find the correct form and securely keep it online. airSlate SignNow provides all the tools necessary for you to create, modify, and electronically sign your documents swiftly without delays. Handle Tax Information Retirees on any device with airSlate SignNow's Android or iOS applications and enhance any document-based process today.

How to Edit and eSign Tax Information Retirees with Ease

- Obtain Tax Information Retirees and click Get Form to commence.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign tool, which takes only moments and carries the same legal authority as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Modify and eSign Tax Information Retirees and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax information retirees

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ia 8453 pe form, and how does airSlate SignNow help with it?

The ia 8453 pe is a form used for electronic filing of certain Iowa tax returns. By using airSlate SignNow, businesses can easily eSign and manage the ia 8453 pe, ensuring a seamless filing process that saves time and effort.

-

What features does airSlate SignNow offer for managing the ia 8453 pe?

airSlate SignNow offers a variety of features for managing the ia 8453 pe form, including customizable templates, secure document storage, and real-time tracking. These features help streamline the eSigning process, making it more efficient for users.

-

How much does airSlate SignNow cost for handling the ia 8453 pe?

airSlate SignNow provides flexible pricing options suitable for businesses of all sizes. Costs can vary based on the features chosen, but using SignNow for your ia 8453 pe forms proves to be a cost-effective solution for electronic document management.

-

Can airSlate SignNow integrate with other software for processing the ia 8453 pe?

Yes, airSlate SignNow seamlessly integrates with various software applications, including CRM systems and document management platforms. This means you can easily incorporate the ia 8453 pe processes into your existing workflow.

-

What are the benefits of using airSlate SignNow for the ia 8453 pe form?

Using airSlate SignNow for the ia 8453 pe form offers numerous benefits, such as enhanced security, ease of access, and faster turnaround times for document signing. These advantages ensure a more efficient process for handling important tax forms.

-

Is airSlate SignNow user-friendly for someone new to the ia 8453 pe?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it accessible even for those unfamiliar with the ia 8453 pe form. Its intuitive interface ensures users can navigate the signing and management processes without difficulty.

-

What types of documents can I send and eSign besides the ia 8453 pe using airSlate SignNow?

Aside from the ia 8453 pe, airSlate SignNow supports a wide range of documents, including contracts, agreements, and other essential forms. This versatility allows businesses to handle all their eSigning needs in one platform.

Get more for Tax Information Retirees

- Health statement form 210588255

- Commitment to general review form

- Prp consent form 444063488

- Odeaacardsouthernctedu form

- Employment application form pdf arena pharmaceuticals inc

- Verbal warning form hrserve complyability com

- Active employee life insurance beneficiary designation form

- Employment reference check form pdf university of pennsylvania

Find out other Tax Information Retirees

- eSign Utah Outsourcing Services Contract Computer

- How Do I eSign Maryland Interview Non-Disclosure (NDA)

- Help Me With eSign North Dakota Leave of Absence Agreement

- How To eSign Hawaii Acknowledgement of Resignation

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure

- eSign Alaska Worksheet Strengths and Weaknesses Myself

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter