IA 1040ESIowa Department of RevenueIndividual Inco Form

What is the IA 1040ES?

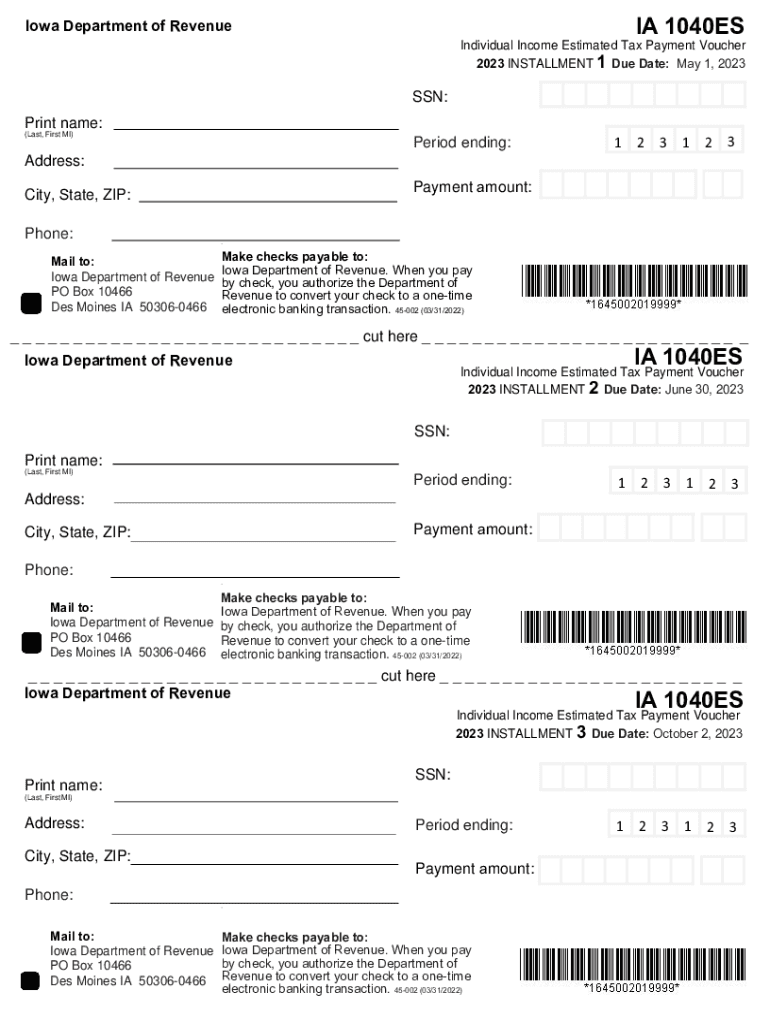

The IA 1040ES is an estimated tax payment voucher used by individuals in Iowa to report and pay their estimated income tax. This form is essential for taxpayers who expect to owe at least one thousand dollars in tax for the year. It allows individuals to make quarterly payments to avoid penalties and interest charges associated with underpayment of taxes. The IA 1040ES is specifically designed for residents of Iowa, ensuring compliance with state tax regulations.

How to use the IA 1040ES

To use the IA 1040ES, taxpayers should first determine their estimated tax liability for the year. This involves calculating expected income, deductions, and credits. Once the estimated tax is determined, individuals can fill out the IA 1040ES form, indicating the amount they plan to pay for each quarter. Payments can be made online, by mail, or in person at designated locations. It is crucial to adhere to the payment schedule to avoid penalties.

Steps to complete the IA 1040ES

Completing the IA 1040ES involves several key steps:

- Estimate your total income for the year, including wages, self-employment income, and other sources.

- Calculate deductions and credits to determine your taxable income.

- Use the Iowa tax tables to find your estimated tax liability.

- Divide your estimated tax into four equal payments, or adjust based on expected income fluctuations.

- Fill out the IA 1040ES form with your personal information and payment amounts.

- Submit the form and payment by the due dates to avoid penalties.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines for the IA 1040ES to ensure timely payments. The due dates for estimated tax payments are typically:

- First payment: April 30

- Second payment: June 30

- Third payment: September 30

- Fourth payment: January 31 of the following year

It is important to check for any updates or changes to these dates each tax year.

Required Documents

To complete the IA 1040ES, taxpayers should have several documents on hand:

- Previous year’s tax return for reference

- Income statements (W-2s, 1099s, etc.)

- Records of any deductions or credits

- Current year’s income projections

Having these documents ready will facilitate accurate calculations and timely submission of the estimated tax payment voucher.

Penalties for Non-Compliance

Failure to submit the IA 1040ES payments on time can result in penalties and interest charges. If a taxpayer underpays their estimated tax, they may incur a penalty of up to ten percent of the unpaid amount. Additionally, interest may accrue on any overdue payments. It is essential for taxpayers to stay informed about their payment obligations to avoid these financial consequences.

Quick guide on how to complete ia 1040esiowa department of revenueindividual inco

Prepare IA 1040ESIowa Department Of RevenueIndividual Inco effortlessly on any device

Online document management has gained popularity among companies and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to find the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents rapidly without delays. Manage IA 1040ESIowa Department Of RevenueIndividual Inco on any platform with airSlate SignNow Android or iOS applications and enhance any document-based operation today.

How to edit and eSign IA 1040ESIowa Department Of RevenueIndividual Inco with ease

- Obtain IA 1040ESIowa Department Of RevenueIndividual Inco and click Get Form to initiate.

- Use the tools we offer to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to deliver your form, via email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Edit and eSign IA 1040ESIowa Department Of RevenueIndividual Inco and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ia 1040esiowa department of revenueindividual inco

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an Iowa tax payment voucher?

An Iowa tax payment voucher is a document that taxpayers in Iowa use to submit payments for their tax obligations. It provides all necessary information including taxpayer details and payment amount, ensuring that your payment is credited properly to your account. Using this voucher simplifies the process of managing your tax payments.

-

How do I obtain an Iowa tax payment voucher?

You can easily obtain an Iowa tax payment voucher through the official Iowa Department of Revenue website. Additionally, airSlate SignNow offers templates that you can customize to create an Iowa tax payment voucher quickly and efficiently. This feature saves you time and helps streamline the payment process.

-

Is there a cost associated with using airSlate SignNow for submitting an Iowa tax payment voucher?

Using airSlate SignNow is a cost-effective solution to manage your documents, including the Iowa tax payment voucher. While there is a subscription fee, the platform offers various pricing plans to fit your budget. Compared to traditional methods, the savings and efficiencies can be signNow.

-

Can I track my Iowa tax payment voucher submissions?

Yes, airSlate SignNow provides tracking features that allow you to monitor all your submissions, including the Iowa tax payment voucher. You will receive notifications when your document is viewed, signed, or finalized. This level of transparency helps you ensure that your payments are processed in a timely manner.

-

What features does airSlate SignNow offer for creating an Iowa tax payment voucher?

airSlate SignNow offers a user-friendly interface for creating Iowa tax payment vouchers, including customizable templates and eSignature capabilities. You can easily fill out the necessary information and send it for eSignature, streamlining the process. Additionally, it integrates with various platforms to simplify workflows.

-

How can airSlate SignNow help me save time on managing Iowa tax payment vouchers?

By using airSlate SignNow, you can create, send, and manage your Iowa tax payment voucher quickly and easily. The automation of document workflows saves you from manual processes, allowing you to focus on more important tasks. This efficiency is especially beneficial during tax season.

-

What security measures does airSlate SignNow implement for Iowa tax payment vouchers?

Security is a top priority for airSlate SignNow, especially when handling sensitive documents like the Iowa tax payment voucher. The platform uses advanced encryption protocols and complies with industry standards to protect your data. This ensures that your financial information remains safe during the submission process.

Get more for IA 1040ESIowa Department Of RevenueIndividual Inco

- Handicap parking placard form hawaii

- Guarantors indemnity to the form

- Corporation income tax return form

- Application or revocation of the authorization to file separate form

- Edms cover sheet instructions ohio department of medicaid form

- Standard contract template form

- Standard consult contract template form

- Standard employee contract template form

Find out other IA 1040ESIowa Department Of RevenueIndividual Inco

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History